This put up might include affiliate hyperlinks that pay us while you click on on them.

International Entry and TSA PreCheck memberships are one in all my favourite journey instruments. These Trusted Traveler packages allow vacationers to hurry by way of safety with devoted lanes and minimal inconvenience. Though the yearly value of membership is low, there’s no must pay for them when your journey bank card has you lined. Listed below are the 12 bank cards that reimburse International Entry or TSA PreCheck software charges.

What’s International Entry and TSA PreCheck?

International Entry and TSA PreCheck are membership packages that permit authorised vacationers to make use of devoted lanes at safety whereas touring. As a result of the federal government has carried out a background verify on you, the safety screening is much less invasive and, due to this fact, takes much less time.

TSA PreCheck is for flights originating throughout the U.S. and prices $85 for a 5-year membership. It offers members with devoted lanes at airport safety. You’ll be able to hold your footwear, belts, and light-weight jackets on. Plus, your laptop computer and 3-1-1 liquids can keep in your baggage.

International Entry is for worldwide vacationers and prices $100 for a 5-year membership. It speeds you thru U.S. Customs when coming back from a overseas nation. You utilize automated kiosks to reply the essential questions of the place you’ve been and what you’ve introduced dwelling with you. Members additionally obtain the advantages of TSA PreCheck for flights within the U.S.

I really like having International Entry and TSA PreCheck advantages that save time whereas going by way of safety as a result of that permits me to spend extra time within the airport lounge. Or, after I’m operating behind, I’m much less more likely to miss my flight.

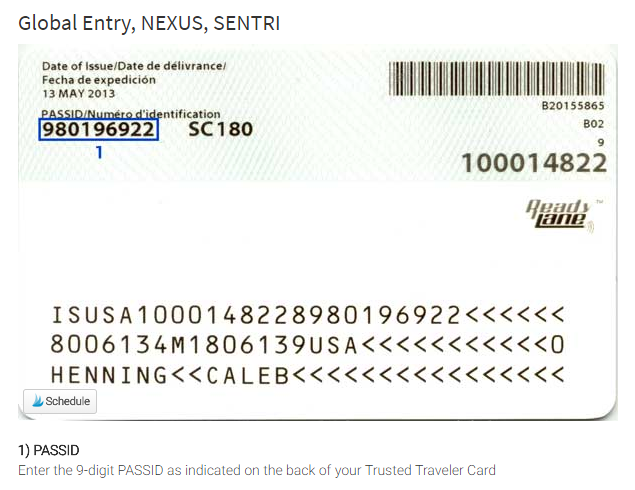

Learn: New Passport? How to Update Global Entry

Which bank cards reimburse International Entry or TSA PreCheck software charges?

Journey bank cards provide a ton of advantages to justify their annual charges. Considered one of these advantages is reimbursing you for software charges for International Entry or TSA PreCheck. Listed below are the 12 bank cards that reimburse International Entry or TSA PreCheck software charges.

After you’re carried out studying, check out the newest travel credit card offers.

The Platinum Card® from American Specific

The Platinum Card® from American Specific affords 5x on flights and pre-paid lodges (by way of Amex Journey), $200 annual airline price credit score, and airport lounge entry. Plus, you obtain automated Gold standing with Hilton and Marriott. American Specific additionally affords a enterprise model of this card, which affords advantages geared towards enterprise homeowners.

The Amex Platinum Card affords reimbursement of as much as $100 for software charges for International Entry or TSA PreCheck. The International Entry credit score can be utilized each 4 years, whereas the TSA PreCheck credit score is sweet each 4.5 years. As an added plus, all licensed customers additionally obtain reimbursement, so each cardholder may also get International Entry or TSA PreCheck membership.

Learn: Hidden Benefits of the American Express Platinum

Financial institution of America Premium Rewards bank card

The Financial institution of America Premium Rewards bank card earns a vast 2x factors on all journey and eating purchases and 1.5 factors on all the things else. Purchasers with bigger relationships can get a bonus of 25% to 75% extra factors, based mostly on the scale of their balances.

This card offers an announcement credit score of as much as $100 for International Entry or TSA PreCheck each 4 years. Plus, you’ll additionally obtain assertion credit protecting as much as $100 airline charges for seat upgrades, baggage charges, in-flight providers, and airport lounge charges.

Capital One Enterprise Rewards Credit score Card

The Capital One Enterprise Rewards Credit score Card earns limitless 2x factors on each buy that you just make. These factors might be redeemed for 1 cent every in direction of journey. Now, they can be transferred to fifteen airline and lodge companions for probably much more worth.

Cardholders obtain reimbursement as much as $100 each 4 years for International Entry or TSA PreCheck software charges. That is one in all my favourite bank cards that reimburse for International Entry as a result of the annual price is low and the miles are so versatile.

Learn: Finally Approved for the Capital One Venture Card

Chase Sapphire Reserve

Skilled vacationers love the Chase Sapphire Reserve. It earns 3x factors on journey and eating, and the factors are value 50% extra when reserving journey by way of Chase. Plus, you obtain airport lounge entry and a $300 journey credit score every year that covers any journey bills, together with flights, lodges, and different journey purchases.

You’re reimbursed as much as $100 each 4 years for the appliance charges for International Entry or TSA PreCheck.

Citi AAdvantage Government World Elite Mastercard

Frequent fliers with American Airways love this card as a result of it contains Admirals Membership entry for the first cardholder and all licensed customers. It earns 2x miles on American Airways purchases and 1x miles all over the place else. Cardholders earn 10,000 Loyalty Factors yearly you spend $40,000 on the cardboard. Plus, cardholders obtain precedence boarding, free checked luggage, and 25% financial savings on inflight meals and drinks.

Each 5 years, you’ll be reimbursed as much as $100 for International Entry or TSA PreCheck software charges.

Learn: Is the Citi AAdvantage Executive World Elite Mastercard Worth $450?

Citi Status Credit score Card

The Citi Status affords quite a lot of journey advantages. It earns 5x on eating and air journey and 3x on lodges and cruises, whereas all the things else is 1x. Citi affords a $250 journey credit score yearly that’s routinely utilized to any journey expense you cost to the cardboard. Cardholders obtain the 4th evening free twice a yr when reserving by way of ThankYou.com. And while you fly, you’ll take pleasure in airport lounge entry with Priority Pass.

The appliance charges for International Entry or TSA PreCheck are reimbursed as much as $100 each 5 years.

IHG Rewards Membership Premier Credit score Card

Should you love IHG lodges, you want this lodge bank card. You’ll earn 10x per greenback at IHG (for a complete of 25x together with elite standing) and 2x factors on gasoline, groceries, and eating. It offers automated IHG Rewards Membership Platinum Elite standing and one free lodge evening (as much as 40,000 factors) yearly. Plus, while you redeem factors for lodge stays, you’ll obtain the 4th evening free.

While you use the cardboard to pay for International Entry or TSA PreCheck, you’ll be reimbursed as much as $100 each 4 years. I’m a giant fan of IHG due to Kimpton, and I really like that this is among the bank cards that reimburse for International Entry. We get large worth from this card that has the bottom annual price of any on this checklist.

Marriott Bonvoy Good™ American Specific® Card

The Marriott Bonvoy Good™ American Specific® Card is ideal for vacationers that choose Marriott lodges and resorts. It earns 6x factors at Marriott, 3x at U.S. eating places (together with takeout and supply) and flights booked with the airways, and 2x on all different purchases. You’ll obtain a $300 annual assertion credit score for rooms, resort expenses, and extra made at Marriott lodges. It contains an annual free evening value as much as 50,000 factors, automated Gold standing, and a Precedence Cross™ Choose membership.

International Entry software charges as much as $100 are reimbursed each 4 years, whereas TSA PreCheck charges are reimbursed each 4.5 years.

Mastercard Black Card

The Barclays Mastercard Black Card isn’t affiliated with a lodge or airline, however affords some helpful journey advantages. It earns 1x per greenback and factors are value 2% for airfare and 1.5% for money again. Cardholders obtain a $100 credit score per yr in direction of airline tickets and costs and a Precedence Cross airport lounge membership.

You’ll obtain as much as $100 for International Entry or $85 for TSA PreCheck each 5 years.

Southwest Speedy Rewards Efficiency Enterprise Credit score Card

Enterprise homeowners have a second (cheaper) journey bank card choice that reimburses your software charges. The Southwest Speedy Rewards Efficiency Enterprise Credit score Card earns 3x factors on Southwest flights and with its lodge & automotive rental companions, plus 2x factors on web promoting and web, cable, and cellphone providers. You’ll obtain 4 Upgraded Boardings yearly and 9,000 bonus factors while you renew the cardboard. It additionally comes with 365 inflight WiFi credit every year.

You’ll be reimbursed for as much as $100 in International Entry or TSA PreCheck charges as soon as each 4 years.

United Explorer Card

The United Explorer Card earns 2x miles with United and on eating, lodges, and eating purchases. Your first checked bag is free and also you’ll get precedence boarding, two United Membership passes every year, and a 25% assertion credit score for in-flight meals, drinks, and WiFi. You’ll additionally obtain expanded award availability when reserving United flights along with your miles. The annual price is waived the primary yr.

Software charges as much as $100 for International Entry or TSA PreCheck are reimbursed as soon as each 4 years.

U.S. Financial institution Altitude Reserve Visa Infinite Card

The U.S. Financial institution Altitude Reserve Visa Infinite Card has a $325 annual journey credit score that covers most of its annual price. It earns 5x factors on pay as you go lodges and automotive leases booked by way of U.S. Financial institution and 3x on journey and cellular pockets purchases. You’ll additionally obtain a Precedence Cross membership and 12 complimentary Gogo in-flight WiFi passes every year.

You’ll be reimbursed as much as $100 each 4 years for International Entry or TSA PreCheck software charges.

Evaluating the insurance policies for bank cards that reimburse for International Entry or TSA PreCheck

Though the bank cards above every present reimbursement for International Entry or TSA PreCheck software charges, the main points differ by card. It’s best to think about these guidelines when selecting which travel credit card to use for.

| Credit score Card | Annual Price | International Entry | TSA PreCheck |

| American Specific Platinum | $550 private $595 enterprise |

$100 each 4 yrs | |

| Financial institution of America Premium Rewards | $95 | $100 each 4 yrs | |

| Capital One Enterprise Rewards | $95 | $100 each 4 yrs | |

| Chase Sapphire Reserve | $550 | $100 each 4 yrs | |

| Citi AAdvantage Government World Elite Mastercard | $450 | $100 each 5 yrs | |

| Citi Status | $450 | $100 each 5 yrs | |

| IHG Rewards Membership Premier | $89 | $100 each 4 yrs | |

| Marriott Bonvoy Good American Specific Card | $450 | $100 each 4 yrs | |

| Mastercard Black Card | $495 | $100 each 5 yrs | |

| Southwest Speedy Rewards Efficiency Enterprise | $199 | $100 each 4 yrs | |

| United Explorer Card | $0 intro, the $95 per yr | $100 each 4 yrs | |

| U.S. Financial institution Altitude Reserve Visa Infinite | $400 | $100 each 4 yrs |

Do my youngsters want to join International Entry or TSA PreCheck?

Kids ages 12 and underneath don’t have to join TSA PreCheck. They’ll use the safety lanes so long as they’re touring with somebody who’s a member.

International Entry pairs along with your passport and requires everybody to have a membership. We discovered this out the laborious approach after we traveled with our children to Cancun when Scarlett was solely six months. We needed to signal her up after we returned, however that’s okay as a result of I’ve a number of bank cards that provide reimbursement for International Entry or TSA PreCheck software charges. Plus, signing up a baby for Global Entry is tremendous straightforward and fast.

Ought to I join CLEAR?

CLEAR is one other journey membership program that I really like. Whereas International Entry and TSA PreCheck streamline safety procedures, CLEAR truly brings you to the entrance of the road utilizing biometrics and a touchless expertise.

CLEAR works with each TSA PreCheck lanes and regular airport safety strains. Plus, CLEAR works with venues and stadiums across the nation, so you possibly can take pleasure in the advantages even while you’re not touring.

Should you can match it in your journey finances, the mixture of CLEAR and both International Entry or TSA PreCheck is the best setup. You’ll transfer to the entrance of the strains with CLEAR. Then, you’ll pace by way of safety with International Entry or TSA PreCheck.

CLEAR membership is $179 per yr. Use our referral hyperlink to join a free 2-month trial of CLEAR or use this hyperlink to save $30 your first year.

Sadly, all the bank cards above don’t reimburse for CLEAR software charges. The one bank card that may cowl among the worth is the American Specific Inexperienced Card. It has an annual price of $150 however features a $100 credit score in direction of CLEAR membership and $100 in credit for airport lounge entry. Simply these two advantages alone cowl the annual price. Plus, you’ll nonetheless take pleasure in the remainder of its advantages, like 3x factors on journey, eating, and transit, no overseas transaction charges, and journey & buy safety.

Learn: TSA PreCheck vs. Global Entry vs. CLEAR: Which Is Right For You?

The Bald Ideas

International Entry and TSA PreCheck make the touring expertise so a lot better. You should utilize devoted safety lanes, hold your footwear on, and go away your laptop computer and liquids in your bag. These memberships value as much as $100 to use, however you don’t must pay money for it. As a substitute, use one in all these 12 journey bank cards that reimburse for International Entry or TSA PreCheck software charges.

This text was initially printed on BaldThoughts.com on September 29, 2020.