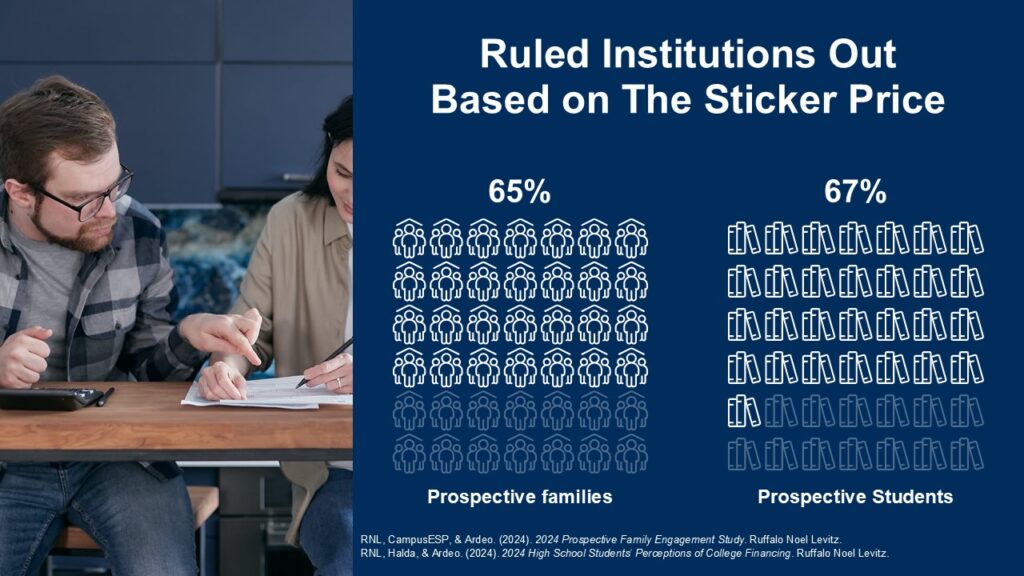

In relation to selecting a university, the sticker worth could be a main turnoff. A big 65% of potential college students and 67% of their households report ruling out establishments primarily based solely on the marketed “sticker worth”.

However what does this imply for schools and universities, and the way can they assist households look past the sticker shock to grasp the true affordability of a level?

The rising tide of sticker shock

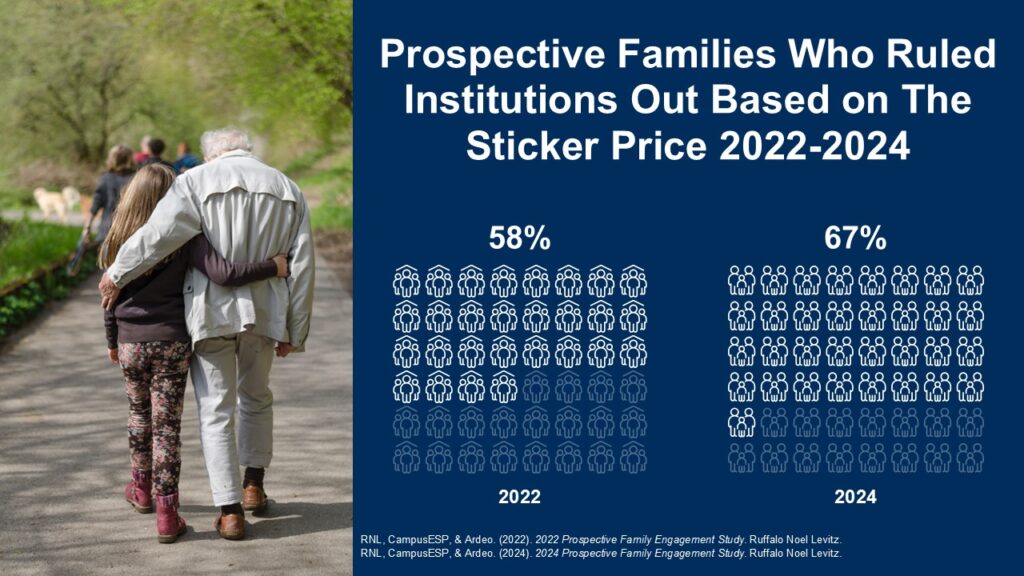

Ruling out schools primarily based on the sticker worth is on the rise – and it’s taking place quick. In simply three years, the proportion of households eliminating colleges from consideration on account of excessive upfront prices has jumped from 58% in 2022 to 67% in 2024.

This implies that considerations about affordability are more and more driving the faculty planning course of, with households taking a tough take a look at the underside line earlier than even exploring different elements. However is that this sticker shock response at all times a rational response, or may schools be shedding out on candidates who may afford to attend with the assistance of economic help?

The generational divide

A notable divide emerges when evaluating the sticker shock responses of first-generation faculty college students to their continuing-generation friends. A full 69% of first-generation college students reported ruling out colleges primarily based on sticker worth, in comparison with 64% of continuing-generation college students.

This disparity can also be mirrored in households’ perceptions, with 68% of first-generation households eliminating colleges on account of value versus 62% of continuing-generation households. This might recommend that first-generation college students and households are much less accustomed to the intricacies of school financing and the essential distinction between sticker and internet worth.

Consequently, they might be extra prone to give attention to the daunting upfront value with out totally exploring the out there help choices. How can schools higher attain, educate, and assist these first-generation college students about affordability to stop them from ruling out establishments that may very well be a fantastic match financially and academically?

The function of household involvement

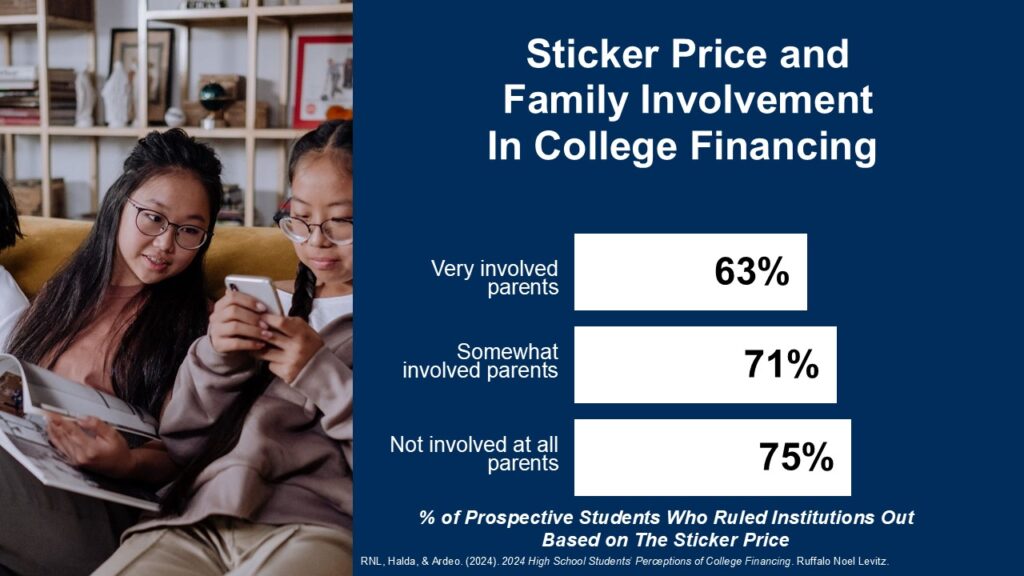

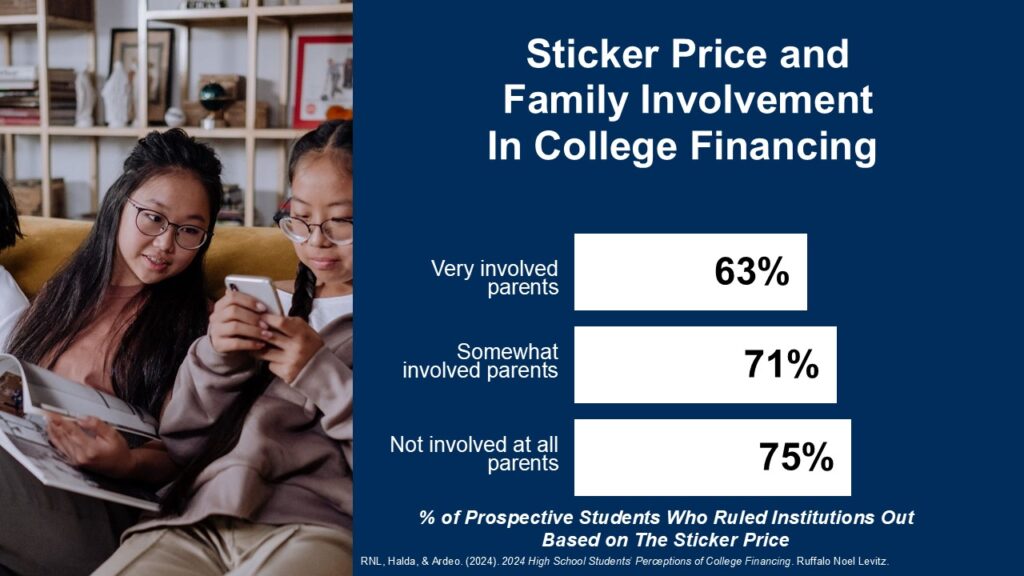

The extent of household involvement within the faculty search course of additionally performs a job in sticker shock choices. College students with very concerned dad and mom had been much less prone to rule out schools primarily based on sticker worth (63%), suggesting that parental steerage might assist candidates look past the preliminary value to think about the larger monetary image.

However what about college students with much less concerned dad and mom? A placing 75% of scholars with uninvolved dad and mom dominated out schools primarily based on sticker worth. How can schools step in to offer the required counseling and training about affordability for these candidates?

Mortgage nervousness and sticker shock: A shared concern for college students and households

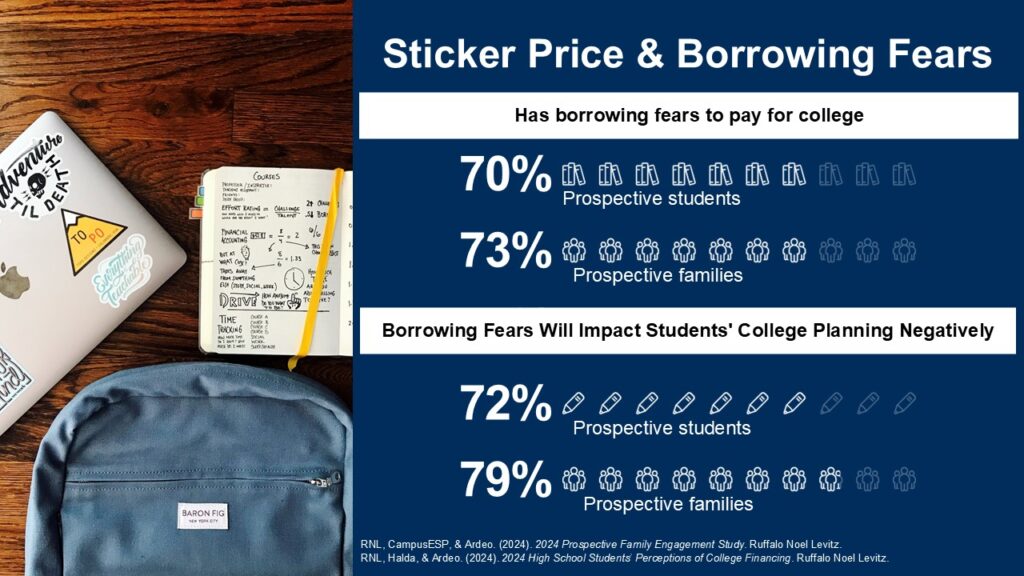

For each college students and their households, considerations about mortgage debt play a big function within the sticker shock equation. A placing 70% of scholars who expressed considerations about borrowing to finance their training had been extra prone to rule out schools primarily based on excessive costs. Households share this mortgage nervousness – 73% of households with mortgage considerations reported ruling out establishments primarily based on sticker worth. This underscores the necessity for schools to deal with mortgage considerations head-on by means of clear communication about financing choices, debt administration methods, and a level’s long-term return on funding.

By offering reassurance and sources, establishments may help candidates really feel extra comfy with the monetary dedication and fewer prone to rule out colleges on account of preliminary sticker shock. Importantly, 72% of scholars and 79% of households reported that their borrowing considerations had been negatively impacting their faculty planning, suggesting that proactive assist from establishments is essential in mitigating mortgage nervousness and selling a extra holistic view of affordability.

The web worth crucial

Whereas sticker worth could be a main deterrent, the precise internet worth of attendance paints a really completely different image. Establishments should do a greater job of clearly speaking internet worth data to potential college students and households.

This implies highlighting out there help, scholarships, and financing choices to exhibit affordability. Instruments like internet worth calculators might be highly effective in serving to candidates perceive the true value of attendance. However are these sources being successfully utilized and communicated to offset the sticker shock response?

To assist households and college students look past sticker shock, establishments can take the next steps:

- Clearly talk internet worth data: Spotlight the distinction between sticker worth and internet worth in your web site and in recruitment supplies.

- Present clear financing data: Break down the prices of attendance and clarify financing choices in clear, easy-to-understand language.

- Provide user-friendly internet worth calculators: Assist households estimate their precise out-of-pocket prices with interactive internet worth calculators.

- Proactively counsel about help: Don’t look forward to households to ask – supply customized monetary help counseling to potential college students.

- Tackle mortgage nervousness: Present sources and steerage to assist college students and households perceive accountable borrowing and debt administration.

- Spotlight worth past worth: Showcase the long-term worth and outcomes of a level out of your establishment to exhibit the return on funding.

- Accomplice with excessive colleges: Collaborate with highschool counselors to offer early training about faculty financing and affordability.

- Goal outreach to first-gen college students and their households: Acknowledge that first-generation college students might have further assist and training concerning the faculty financing course of.

- Comply with up with sticker-shocked candidates: If a pupil expresses curiosity however appears deterred by the sticker worth, proactively attain out with details about help and affordability choices.

- Leverage video and AI to personalize the method: Use video content material and synthetic intelligence instruments to offer customized, interactive explanations of economic help and affordability. AI-powered chatbots can supply 24/7 assist to reply households’ financing questions, whereas customized video messages can break down advanced help packages in an easy-to-digest format. By embracing these applied sciences, establishments can create a extra partaking, self-service-oriented expertise that empowers households to confidently navigate the affordability panorama.

The underside line and extra findings from our Perceptions report

The sticker shock phenomenon is an actual and rising concern in faculty admissions. Nonetheless, by understanding the elements that drive these choices and taking proactive steps to coach households, schools may help potential college students see past the marketed tuition charge to think about the true affordability of a level. This requires a nuanced understanding of the faculty financing panorama and a dedication to clear, clear communication. With the proper approaches, establishments can appeal to various candidates who might have in any other case been deterred by sticker shock.

You possibly can learn extra insights and findings within the 2024 High School Students’ Perceptions of College Financing report, co-sponsored by our companions Ardeo and Halda. This report captures information from a survey of greater than 2,100 Eleventh- and Twelfth-grade college students. Read it now.