Following the current pattern within the trade, the ICICI Financial institution has provide you with a model new purchasing portal within the title of iShop, a purchasing/journey reserving portal that provides accelerated rewards on spends, much like HDFC Financial institution’s SmartBuy.

ICICI Financial institution’s iShop portal affords up-to 12X rewards on spends performed on the portal that offers a reward charge of up-to candy 36%. Right here’s the whole lot you could know:

Accelerated Rewards

| Credit score Card | Common Rewards | iShop Flights / Vouchers (6X) | iShop Lodges (12X) |

|---|---|---|---|

| Emeralde Personal Metallic | 3% | 18% | 36% |

| Instances Black | 2% | 12% | 24% |

| Emeralde PVC | 1% | 6% | 12% |

| Different Playing cards | 0.75% | 3% | 6% |

| Co-brand Playing cards (Cashback) |

~ | 4% | 4% |

Other than that, even debit playing cards and NetBanking transactions would earn accelerated rewards, however they’re not thrilling per se, so it’s protected to disregard.

That’s excellent 36% return on accommodations and upto 18% financial savings even on vouchers, particularly on Amazon Pay Vouchers too. We’ll look again after every week or two to see if it continues to exist. 😉

Max Cap

| Card | Max. Cap (on Bonus) |

|---|---|

| Emeralde Personal Metallic | 18,000 Factors |

| Instances Black | 12,000 Factors |

| Emeralde PVC | 12,000 Factors |

| Different Playing cards (Coral, CSK, HPCL, ManU, Parakram, Rubyx, Sapphiro) |

9,000 Factors |

| Co-Branded Playing cards (Amazon, Adani, Emirates, MMT, and so forth.) |

₹1,100 Cashback |

It’s evident from above that ICICI Emeralde Private Metal and ICICI Times Black Credit score Playing cards are the very best ones to carry to make the most of the iShop accelerated rewards system, as each reward charge and max cap are adequate to discover these playing cards.

That’s about 1L INR spend equal on Emeralde Personal Metallic or Instances Black for Flights/Vouchers or 50K INR spend on Lodges, which is sort of good.

That stated, I’m unsure if the cap is on calendar month or assertion cycle.

Redemption

- Flights: 95% factors (1 Level = 1 INR)

- Lodges: 90% factors (1 Level = 1 INR)

- eVouchers: 50% factors (1 Level = 0.60 INR)

So there are 2 portals now in the event you want to redeem rewards earned on ICICI Financial institution Credit score Playing cards.

One, the common rewards portal which ICICI Financial institution just lately launched by changing Payback factors system. The opposite is the brand new iShop portal.

One can redeem their present rewards on their ICICI Financial institution bank cards for something on iShop portal, partially or absolutely, with above restriction in place.

The ICICI Financial institution’s iShop portal is a lot better in comparison with HDFC (Smartbuy), Axis (Traveledge) or most different platforms for typical journey redemption.

The portal seems to be neat and easy and lists all playing cards linked to your profile superbly, together with the factors accessible on every.

Nevertheless, it’s to be famous that ICICI is but to convey up their factors switch companions into the system, which I’m hoping would go reside anytime.

As of now, one can switch factors to Air India at 1:1 on common rewards portal.

Is it Stay?

I contacted ICICI Wealth Banking assist relating to this, however they lacked readability and easily suggested me to belief the data so long as its on the financial institution’s portal.

I additionally reached out to ICICI Financial institution’s PR staff, who confirmed that there was no formal launch of iShop to this point.

At this level, there isn’t any official communication. Nevertheless, even Axis Financial institution by no means explicitly communicated in regards to the Journey Edge portal for a very long time after its launch.

So it appears that is focused at maximizers – permitting the financial institution to generate some good income whereas factors maximizers get what they need – rewards, a number of rewards!

iShop Portal

- Open the hyperlink: icicibank.com/ishoplogin

- Login utilizing your ICICI Financial institution credentials and it’ll take you to the iShop portal.

- Select the class from the menu

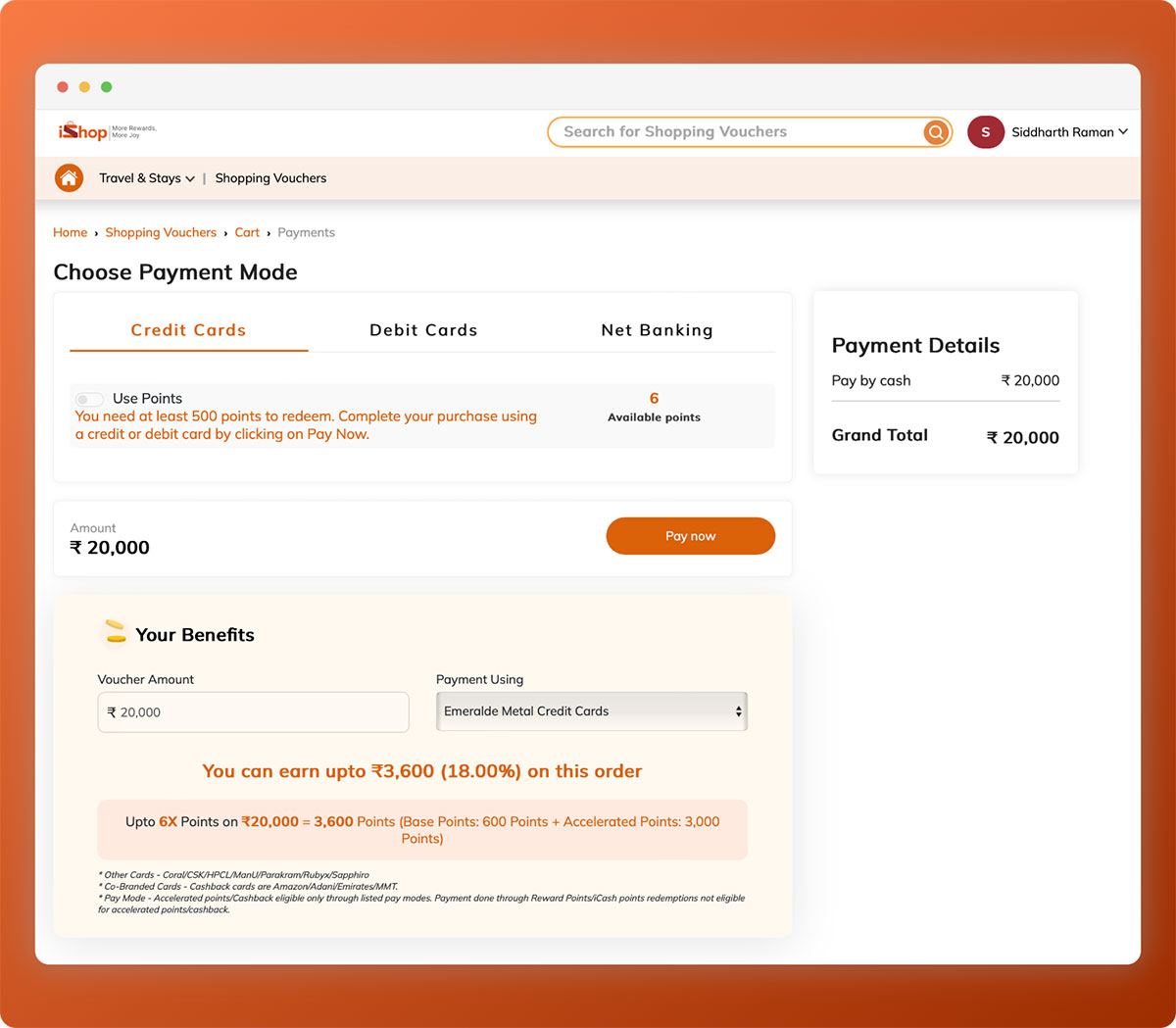

- Confirm the bonus factors in your card earlier than putting the order & proceed with fee.

Arms-on expertise

I tried to purchase eVouchers utilizing my Emeralde Private metal, however the transaction was initially declined for “safety causes”.

Since I’ve confronted comparable points earlier than, I knew the repair – calling assist to whitelist the service provider/transaction on my account.

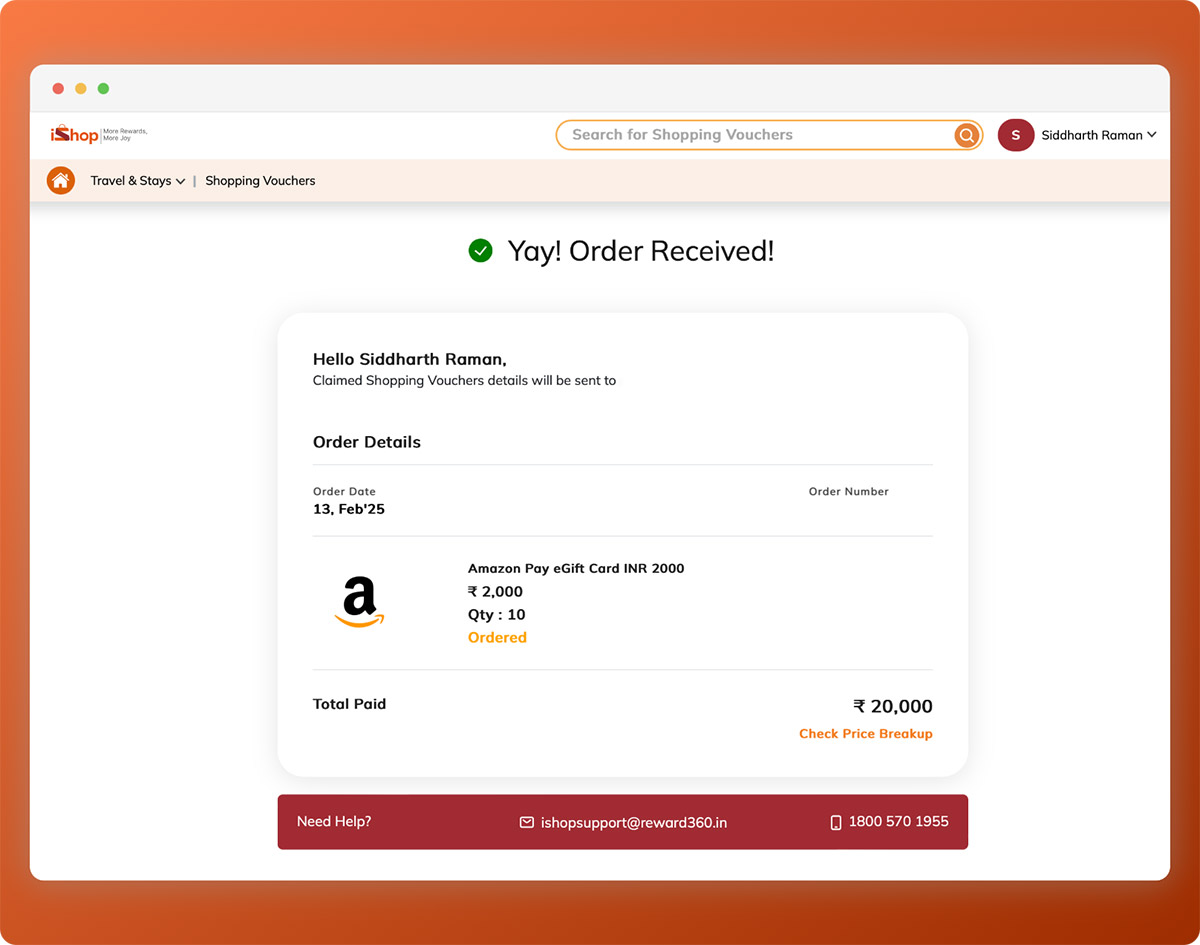

I attempted once more after 5 minutes, and this time the transaction was profitable. The vouchers are working with none points.

That apart, I did discover that the system is selecting the rewards on my ICICI Sapphiro bank card (changed from Intermiles Sapphiro) however not the rewards on Emeralde Personal metallic’s.

That appears bizarre, so I’ve dropped an e-mail to assist to see if they’ll repair, or I’ll higher shut the Sapphiro to see if that fixes the difficulty.

Now, it’s a ready recreation to see if the rewards kick in as anticipated – and the way will or not it’s given? as common rewards or as iCash!

In a nutshell

ICICI Financial institution Credit score Playing cards had been by no means thought-about as a mainstream bank card for reward seekers, due to their not so good reward charge.

However with the launch of the accelerated rewards on iShop portal, their tremendous premium bank cards like ICICI Emeralde Personal Metallic & ICICI Instances Black seems to be profitable unexpectedly and now it competes splendidly nicely with Axis and HDFC Financial institution within the phase.

Provided that ICICI Emeralde Personal Metallic shouldn’t be straightforward to get, I’m anticipating lot of purposes going in direction of ICICI Times Black Credit Card, which is smart for many who can’t get fingers on with Axis Magnus Burgundy or HDFC Infinia.

Whereas the preliminary impressions of iShop are promising, time will inform if it reshapes the notion of rewards on ICICI Financial institution Credit score Playing cards – till then get pleasure from extra rewards & extra pleasure with iShop.