The HDFC Financial institution Tata Neu Infinity Credit score Card is a semi-premium, co‑branded bank card designed to maximise rewards by NeuCoins, a cashback‑equal rewards forex that works seamlessly throughout the Tata ecosystem.

HDFC Financial institution points two variants: Tata Neu Plus & Tata Neu Infinity

The Infinity variant is clearly the higher one, thanks to raised rewards and lounge entry. Choosing the RuPay model unlocks UPI transactions with rewards, which is arguably the core worth proposition of this card.

Right here’s every little thing it’s essential to know in regards to the HDFC Tata Neu Infinity Credit score Card in it’s present kind,

Overview

| Kind | Semi-Premium Credit score Card |

| Reward Price | 1.5% – 5% |

| Greatest for | UPI & Invoice Funds |

| USP | Rewards on UPI Spends |

At this charge level, HDFC Financial institution’s Tata Neu Infinity Credit score Card is kind of loaded with advantages and rewards that’s very near Premium Credit score Playing cards.

Do observe that Tata Neu even have give you comparable playing cards with SBICard however I might say HDFC variant remains to be higher.

Becoming a member of Charges

| Becoming a member of Charge | Nil (Issued as FYF/LTF) |

| Welcome Profit | 1,499 NeuCoins (on paid playing cards) |

| Renewal / Annual Charge | 1,499 INR + GST |

| Renewal Profit | Nil |

| Renewal Charge waiver | On spending >3 Lakhs |

Whereas it’s straightforward to seize First 12 months Free (FYF) supply on HDFC Financial institution’s Tata Neu Infinity Credit score Card, getting Lifetime Free (LTF) supply is turning into tougher in 2025, in comparison with the way it was once prior to now.

*** Greatest UPI Credit score Card in 2025 ***

Rewards

| SPEND TYPE | REWARD RATE | Max Cap |

|---|---|---|

| Common Spends | 1.5% | Nil |

| UPI Spends (by way of TataNeu App) |

1.5% | 500 NeuCoins (per 30 days, mixed) |

| UPI Spends (on different Apps) |

0.5% | 500 NeuCoins (per 30 days, mixed) |

| Spends on TataNeu App (Invoice Pay & Tata manufacturers) |

5% | as per class |

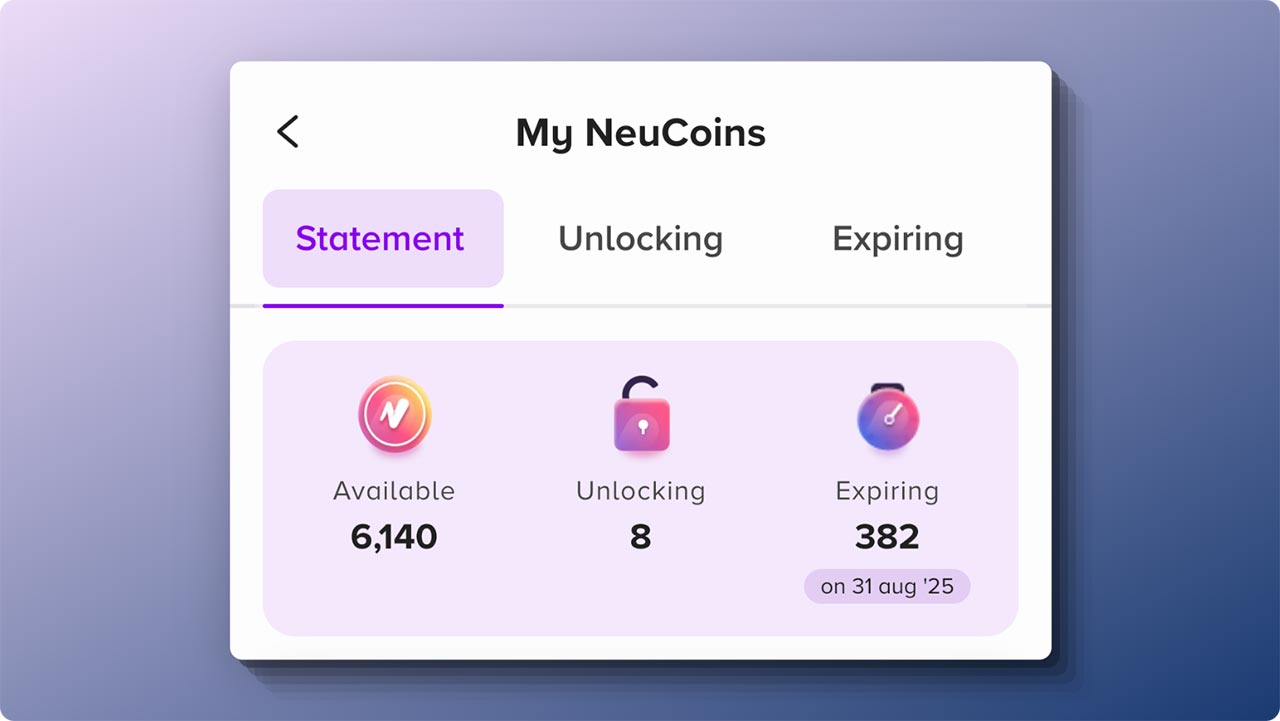

- NeuCoins Validity: 1 12 months

- No rewards on gas, pockets, lease, gaming and Gov spends.

- Capping is as per “calendar” month.

Whereas the common rewards on the cardboard shouldn’t be thrilling, the 5% return with Tata Brands and even on Invoice funds is kind of a very good factor.

Limitation on Rewards:

- Insurance coverage, Groceries, utility, Telecom & Cable all capped at 2,000 NeuCoins / month for every class as above.

- Training funds made by third-party apps like CRED, MobiKwik, and many others is not going to earn NeuCoins.

- Some retailers could not supply further 5% rewards by way of NeuPass.

- 5% rewards relevant for transactions executed solely by way of Main Card Holder Cellular Quantity Account (as per bank card software) on Tata Neu

- At present, Invoice Fee (Tata Pay), Tanishq, Cult.match, Air India, Tata Play spends are usually not eligible for added 5% NeuCoins by way of NeuPass Membership

The bounds are ideally adequate for a daily person and 5% rewards on these classes are uncommon to see within the phase.

NeuPass

With NeuPass Membership, you get:

- Extra 5% NeuCoins on eligible Tata Neu spends

This stacks with the cardboard’s 5% rewards (on choose classes), providing you with as much as 10% efficient return.

On prime of that, you additionally get good reductions by reserving on the app with manufacturers like BigBasket & Taj Lodges.

Redemption

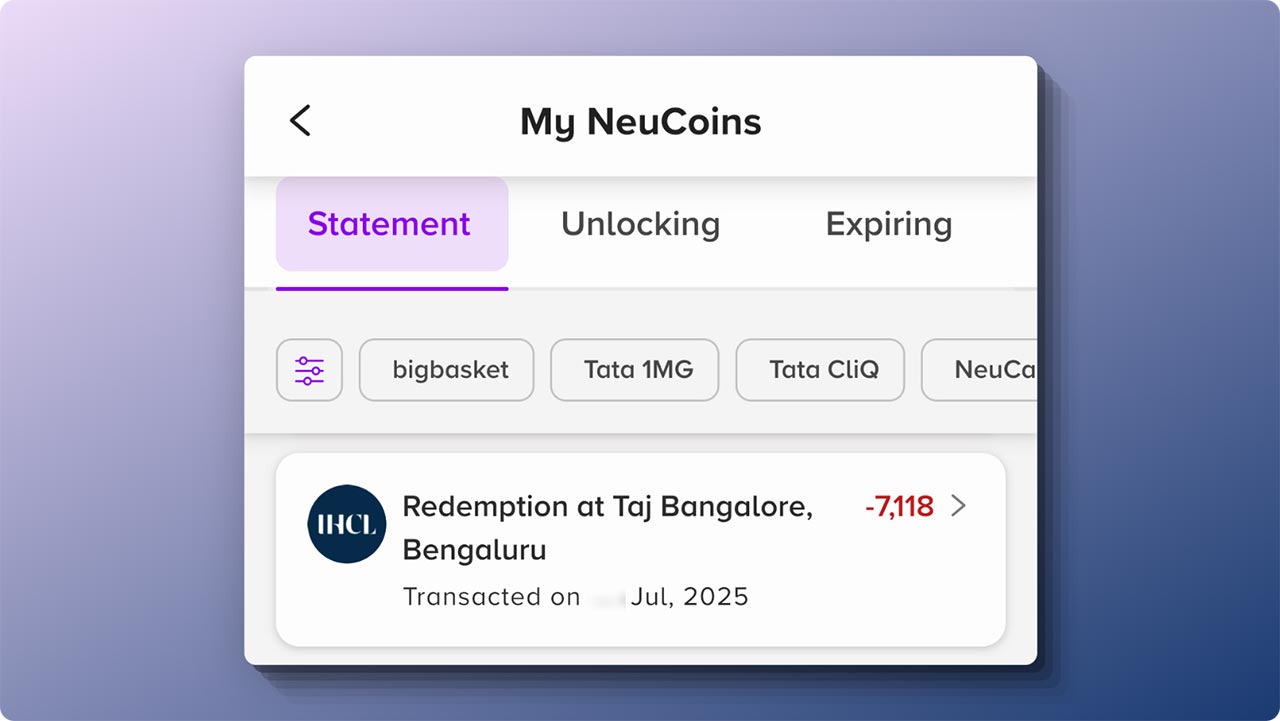

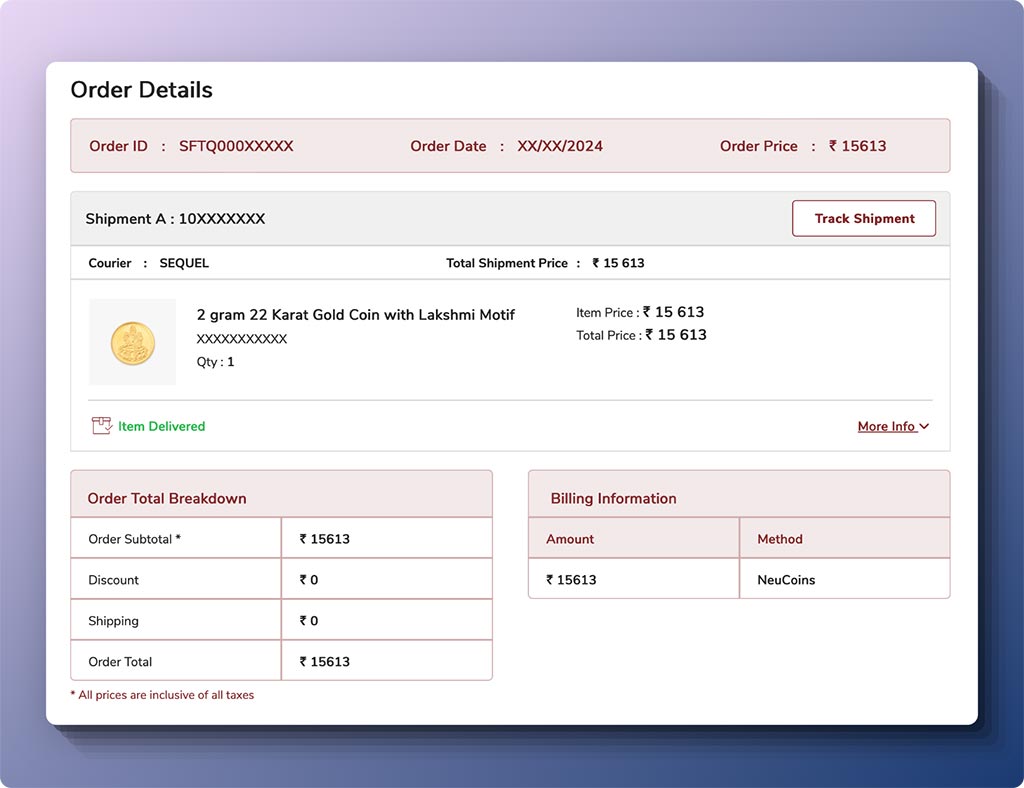

NeuCoins are cash-equivalent and simple to redeem throughout Tata accomplice manufacturers. Whereas there are various choices, redeeming for Tanishq gold cash is the favored alternative.

For those who’re into journey, you too can redeem NeuCoins at Taj Lodges which is ideal for settling any remaining stability after making use of Taj vouchers.

Some similar redemptions beneath:

Lounge Entry

| ACCESS TYPE | ACCESS VIA | ACCESS LIMIT |

|---|---|---|

| Home | Visa / Rupay | 2/Qtr |

| Worldwide | Rupay/ Precedence Move | 1/Qtr (shared) |

For home entry, lounge vouchers will probably be issued. Obtain SMS/e mail to declare voucher inside 120 days, then lounge utilization legitimate inside 180 days. Link to particulars.

For worldwide entry, on Visa, Precedence Move is issued on request.

Whereas earlier the cardboard supplied direct swipe-based entry, the voucher mannequin with spend requirement provides friction.

That apart, in case your life includes frequent journey, you might maybe get the HDFC Regalia Gold credit card together with a Tata Neu card to make your life simpler.

Different Advantages

- Foreign exchange markup: 2% on international forex spends

- Fuel surcharge waiver: 1% on petrol transactions between ₹400–₹5,000, max waiver ₹500 per billing cycle

The lower forex markup fee on the HDFC Bank Tata Neu Infinity Credit Card is a nice perk, especially in this segment.

*** Greatest UPI Credit score Card in India ***

Bottomline

The HDFC Tata Neu Infinity Credit score Card is without doubt one of the most rewarding UPI bank cards within the nation, notably useful for many who are within the Tata ecosystem.

On this phase, you would possibly as effectively have an interest within the SBI Cashback Credit card (no UPI benefit although) that provides 5% direct cashback on most on-line spends.

For those who’re in search of extra choices, there are very many best credit cards in India to select from.

Are you holding HDFC Financial institution’s TataNeu Infinity Credit score Card? Be happy to share your ideas within the feedback beneath.