In recent times, new applied sciences have been rolled out to extend effectivity, decrease prices, and enhance the borrower expertise throughout the residence mortgage course of.

For instance, there’s now digital verification, which permits debtors to electronically share their monetary info with lenders, together with checking account and payroll knowledge.

This in flip permits banks/lenders to confirm revenue, employment, and belongings with out bugging the borrower and asking for mountains of paperwork.

On the identical time, it improves accuracy and reduces errors because the info is coming direct from the supply.

Nonetheless, many really feel that getting a mortgage is a significant ache and caught within the stone age. Whereas I agree, I’d be mendacity if I stated it hasn’t gotten simpler.

Nonetheless, it still takes a month or more to get a mortgage, which in as we speak’s day and age simply doesn’t appear ok.

Private-Contact Has Considerably Declined

That brings me to a brand new examine that was performed by Fannie Mae to higher perceive adoption charges of stated applied sciences.

Fannie surveyed current residence patrons who bought a property with a mortgage acquired by the corporate between January 2023 and November 2023.

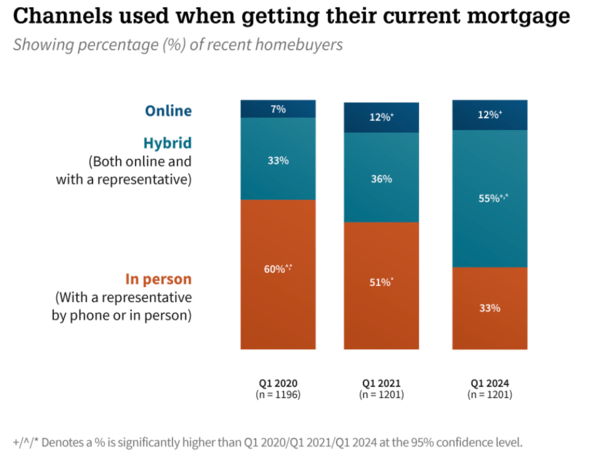

One of many survey’s key findings was that the usage of personal-touch-only channels when acquiring a mortgage (for instance in-person or by-phone) have “considerably declined.”

In different phrases, fewer mortgage candidates are selecting up the telephone to talk to a mortgage officer. And possibly rather a lot much less are driving right down to the native financial institution department.

They merely don’t need to because of as we speak’s digital mortgage functions, digital disclosures, eSigning, and that digital verification course of talked about above.

There’s additionally been a shift in primary human conduct. How typically do you name somebody versus textual content them?

Even my very own dad has caught on, and now usually sends a textual content message versus making an old-timey telephone name.

With the youthful generations, a telephone name appears ghastly. Who would do this?!

And whereas I’m not in complete disagreement, I do admire the odd name each now and again. Name me nostalgic.

Anyway, as you possibly can see within the illustration above, in-person channels have gotten rather a lot much less frequent, whereas a hybrid method is taking middle stage.

As not too long ago as 2020, in-person was the main channel to get a mortgage. Right now, it’s simply 33%, with hybrid coming in at 55%.

There’s additionally online-only, which accounts for simply 12% (thoughts you it has almost doubled from 2020).

And likelihood is it might most likely triple within the subsequent 5 years from present ranges, regardless of seeming to carry regular the previous few years.

Fannie famous that “homebuyers’ curiosity in a extra or absolutely digital mortgage course of (the place homebuyers might full extra or all steps on-line) could be very excessive.”

It has jumped from 63% in 2021 to 90% as of 2024.

When it comes to why debtors are gravitating to the digital choices, 75% stated it “accelerates the method” and 71% stated it “makes the method simpler”

Merely put, no likes getting a mortgage. It’s not enjoyable. So making it simpler and sooner is a no brainer.

I Solely Used Electronic mail to Get My Final Mortgage

That brings me to my story, which I solely thought to inform after stumbling upon the Fannie Mae examine.

After I utilized for a rate and term refinance again in 2021 to get out of my 5/1 ARM and right into a boring outdated 30-year fastened, I used a mortgage broker.

Full disclosure, it was an outdated colleague of mine. However right here’s what sort of nuts. I didn’t name him as soon as. Not a single time.

We didn’t converse on the telephone in any respect throughout the course of, and I’m not even certain if I despatched him a textual content to be sincere.

As an alternative, we simply emailed backwards and forwards to get via the method. And it wasn’t as a result of I’m savvier or one thing.

It simply wasn’t essential to chit chat or get on a telephone name. If I had a query (or he had one), an e-mail could be fired off.

Apart from being handy for each events, the whole lot was additionally documented. Everybody is aware of it’s good to get stuff in writing, particularly when coping with a house mortgage.

As well as, I might return to a earlier e-mail if I neglect what he stated, or what he wanted.

For me, it’s merely extra environment friendly and there’s accountability. And since we’re just about all plugged in anyway, emails are learn quick and responses come rapidly as effectively.

There’s Nothing Mistaken with Making Telephone Calls

Whereas this labored out nice for me, regardless of being unintentional, I absolutely perceive that some people like face-to-face interplay.

And a few a minimum of need to make a telephone name and listen to the opposite individual’s voice. Or focus on issues extra in-depth.

That’s all good. You’ll be able to proceed to do this if it fits you, or like many others, take a hybrid method.

Generally a telephone name simply is sensible. It’s simpler to verbally clarify one thing, particularly if you happen to’re new to the entire mortgage factor.

Sooner or later, I wouldn’t be stunned if issues go a step additional, and also you solely talk with a chatbot or one thing.

Granted, that’ll be bittersweet if it results in attrition and layoffs. And there’s nonetheless one thing particular about human contact, particularly with emotional decisions like home buying.

However I don’t suppose anybody could be upset if the refinance process is whittled right down to days as a substitute of weeks.

Lastly, there’s the query of compensation if the lending course of turns into as simple as ordering pet food on Amazon.

On the one hand, you would argue that loan origination fees ought to come down if the work concerned doesn’t match the price.

On the opposite, a superb dealer or LO could make the method pain-free for the borrower, the place it looks like they don’t need to do a lot of something (as a result of it’s dealt with behind the scenes).

In fact, if machines and software program can ultimately accomplish that and ship such an expertise, charges ought to come down.