The regulation follow administration platform MyCase rolled out three product updates as we speak that embody MyCaseIQ, an AI conversational interface; enhancements to its accounting module; and an immigration add-on. It additionally introduced the beta launch of Sensible Spend, a product that marries a enterprise bank card to expense monitoring inside MyCase.

Generative AI Enhancements

Final January, AffiniPay, the mother or father firm of MyCase, introduced AffiniPay IQ, its strategic initiative to embed generative synthetic intelligence throughout all of its merchandise and make AI a local element of authorized professionals’ day by day workflows, together with the beta variations of the primary two options of that initiative, doc summarization and textual content enhancing.

Now, these two options are popping out of beta beneath the identify MyCase IQ. The textual content enhancing function is already out of beta and out there inside MyCase, and doc summarization will launch inside a couple of weeks.

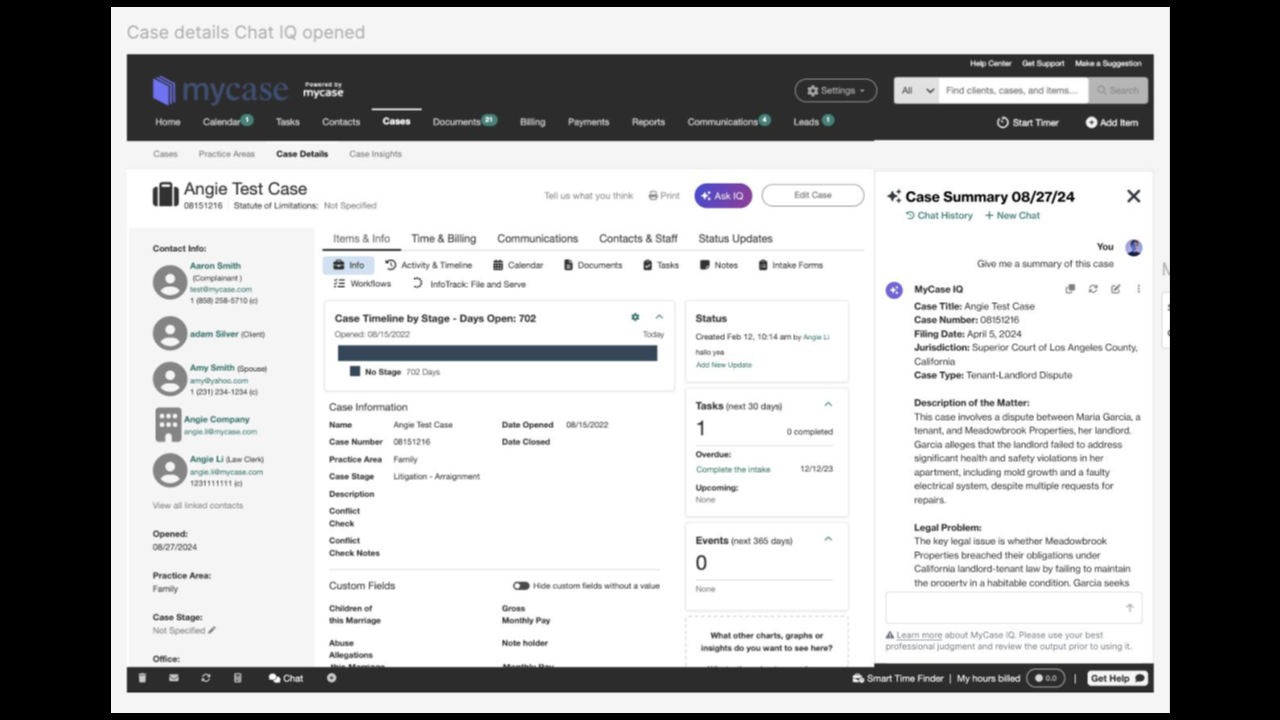

As well as, early subsequent yr, MyCase will launch an AI-driven conversational interface will enable customers to supply case info, timelines, and knowledge, all inside the case file itself, by asking questions in a conversational fashion.

The interface will likely be embedded immediately within the case element web page. It’ll have recommended prompts that customers can choose, equivalent to to request a abstract of the case or an in depth timeline.

“We’re on a mission to make our purchasers financially properly, and to make use of leading edge know-how to realize that aim in partnership with them,” Dru Armstrong, chief govt officer of AffiniPay, mother or father firm of MyCase, informed me throughout a briefing yesterday.

“So our entire thesis for generative AI is to not do it as a result of everybody’s doing it, however to do it as a result of it makes companies be capable of leverage automation and intelligence to offer them time again to allow them to serve their purchasers.”

From beta testing these generative AI options, Armstrong stated, one main takeaway has been that attorneys really want to belief the accuracy of the knowledge the AI is offering.

“So we’ve performed lots of work to be sure that all the things that goes full GA [general availability] meets these very excessive requirements that our attorneys have,” she stated.

Accounting Enhancements

MyCase additionally as we speak launched enhancements to its native accounting software program. Amongst these enhancements:

- 1099 vendor reporting: To assist simplify bookkeeping, MyCase Accounting will quickly supply 1099 vendor reporting immediately inside the platform.

- Computerized deposit slip creation: MyCase accounting now gives computerized deposit slip creation for distributors. When funds are deposited into the agency’s checking account, the slip is created routinely.

- Computerized financial institution reconciliation: As soon as the deposit slip is created, it’s matched to the corresponding financial institution feed transaction from LawPay, eliminating the generally time-consuming activity of reconciling deposit slips and transactions.

The deposit slip function is on the market now, and the opposite enhancements will likely be rolled out between now and the primary quarter of subsequent yr.

Armstrong stated the financial institution reconciliation is especially highly effective for its capacity to unravel a core follow administration problem of IOLTA compliance by combining invoicing inside MyCase, digital funds by way of LawPay, which can also be owned by AffiniPay, and computerized reconciliation inside the native accounting function.

“When you’ve got MyCase with the bill and billing engine mixed with LawPay, after which having the authorized accounting bundle constructed natively within the platform, it actually makes it a fairly automagical expertise to have the ability to reconcile the invoices with the transactions with the checking account,” she stated.

Immigration Add-On

The immigration add-on makes use of an software programming interface (API) to attach MyCase with its sibling firm Docketwise, a case administration platform for immigration attorneys.

The add-on integrates immigration case administration into the MyCase follow administration platform, enabling immigration attorneys to get the advantages of each case administration and follow administration with out having to modify between platforms.

Armstrong stated that many immigration prospects wished extra of a full follow administration platform, whereas preserving the immigration-specific case administration options of Docketwise, equivalent to its Sensible Varieties.

Ever since AffiniPay acquired MyCase, which already owned Docketwise, bringing collectively the capabilities of the 2 platforms “had been a core a part of our imaginative and prescient,” Armstrong stated.

To benefit from the combination, MyCase customers will required to buy a subscription for the Docketwise add-on. The month-to-month price of the add-on will likely be $79 per person or $69 if bought yearly.

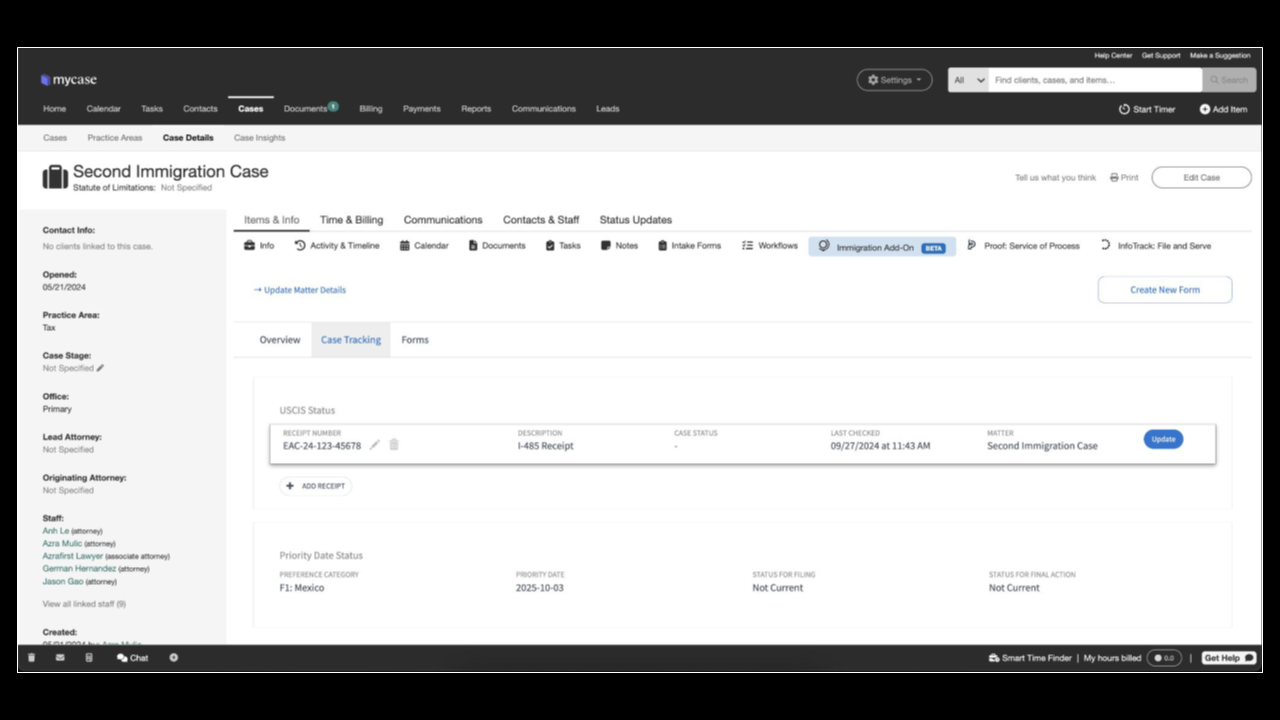

As soon as bought, all Docketwise options will likely be out there immediately inside MyCase, with out having to modify platforms and even ever use the Docketwise platform. Among the many options the add-on gives:

- Sensible Varieties: Customers can auto-populate immigration kinds with consumer knowledge, eliminating guide entry.

- USCIS case monitoring: Monitor the standing of immigration circumstances by computerized USCIS updates, preserving attorneys and purchasers knowledgeable, from inside MyCase.

- E-filing: Allows digital submission of immigration kinds on to authorities businesses (USCIS, DOL FLAG, DOS CEAC) from inside MyCase.

- Precedence date monitoring: Displays key dates to make sure well timed actions are taken on immigration circumstances, minimizing the danger of missed deadlines.

The immigration add-on is being soft-launched earlier than the top of the yr and will likely be made usually out there to all customers someday subsequent yr.

Sensible Spend Beta

MyCase additionally stated as we speak that the Sensible Spend function it announced last February will change into out there for beta testing by choose prospects staring Oct. 21. It will likely be launched for normal availability within the first quarter of subsequent yr.

MyCase had initially stated it could be launched in beta within the second quarter of this yr after which to normal launch within the third quarter.

The Sensible Spend function guarantees to supply a enterprise bank card for regulation companies that’s tied to software program that immediately channels client-related bills into the related issues and invoices inside the MyCase platform.

It gives regulation companies with a LawPay-branded Visa bank card for his or her attorneys and employees. All spending on the cardboard is tracked to a dashboard the place the agency can monitor all of its enterprise and consumer bills.

Spending can also be built-in inside MyCase, so consumer bills are immediately tracked to the matter, together with the character and class of the expense and any related receipts.

‘Huge Strikes’ Forward

In July, it was introduced that Genstar Capital had made a significant investment in AffiniPay, whereas TA Associates, which had been the corporate’s largest investor since 2020, would proceed to retain a “significant stake” within the firm.

Throughout our briefing yesterday, Armstrong stated that she was “tremendous excited” in regards to the new investor, which now owns the bigger share of the corporate.

“They’re an exceptional software program investor with simply an incredible observe report of serving to construct best-in-class, high-growth software program companies,” she stated.

She stated the driving drive behind the deal was to have the ability to make investments extra in product analysis and improvement so as to ship extra for the corporate’s prospects.

“It’s giving us a possibility to assume extra strategically about our place out there,” Armstrong stated.

“We had been tremendous profitable with our MyCase acquisition, and I feel you’re going to see us making some large strikes, whether or not it’s in merchandise that we’ve constructed or merchandise that we’ve partnered with or merchandise that we purchased.”