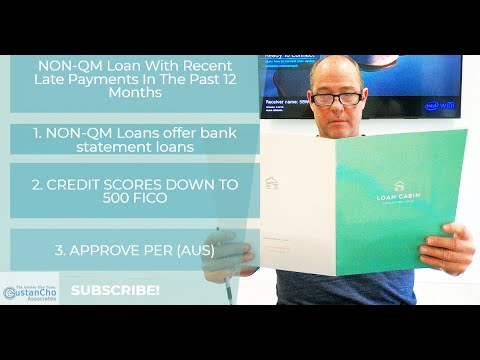

Non-QM Mortgage with Current Late Funds: Your Information to Homeownership in 2024

For those who’ve had latest late funds in your credit score report, you may assume shopping for a house or refinancing is out of attain. However there’s excellent news—non-QM loans with latest late funds are right here to assist. Within the present housing market with rising residence costs, non-QM loans present alternatives for people who don’t qualify for conventional loans to purchase a home or refinance. Let’s stroll by how these loans work and the way they will help you obtain your homeownership desires.

Qualify For A Non-QM Loan With Recent Late Payments. Click Here

What’s a Non-QM Mortgage?

Earlier than diving into the small print, let’s first clarify a non-QM mortgage. Non-QM stands for “non-qualified mortgage.” Not like conventional loans (like FHA or typical mortgages), non-QM loans don’t observe the identical strict pointers. They’re designed for debtors with distinctive monetary conditions or credit score challenges—like latest late funds.

These loans are nice for:

- Self-employed people who can’t present tax returns

- Debtors with low credit score scores or latest credit score points

- Buyers seeking to purchase rental properties

- Homebuyers with excessive debt-to-income ratios

You don’t want to fulfill conventional lending requirements with a non-QM mortgage. Lenders have a look at the larger image, contemplating your revenue, property, and general monetary stability—even in the event you’ve had late funds within the final 12 months.

Can You Qualify for a Non-QM Mortgage with Current Late Funds?

Completely! For those who’ve had latest late funds in your credit score report, you may really feel discouraged. Nevertheless, non-QM loans are particularly designed to assist debtors such as you. Not like government-backed or conventional loans, non-QM loans assist you to qualify even in the event you’ve missed funds on different loans previously 12 months.

Right here’s the way it works:

- Versatile Pointers: Whereas conventional lenders require a clear cost historical past, non-QM lenders are extra versatile. They perceive that life occurs—whether or not it’s job loss, medical payments, or monetary hardships. Non-QM lenders will work with you even in case you have late funds in your mortgage, bank cards, or different loans.

- Down Fee Choices: Based mostly in your credit score rating and monetary circumstances, non-QM loans usually necessitate a down cost starting from 10% to 30%. A bigger down cost will increase your chance of qualifying, even in the event you’ve skilled latest late funds.

- No Ready Durations: With conventional loans, you might need to attend months—and even years—after missed funds or main monetary occasions like foreclosures or chapter. However with a non-QM mortgage, you’ll be able to apply for financing instantly, providing you with the possibility to purchase a house now quite than ready till your credit score improves.

Why Non-QM Loans Are a Nice Possibility in 2024

The actual property market is hard, with property values growing in quite a few areas nationwide. If you wish to purchase a house or refinance, ready too lengthy may imply paying much more later. That’s why a non-QM mortgage with latest late funds may very well be the right resolution.

Listed below are some advantages of non-QM loans in 2024:

- No Personal Mortgage Insurance coverage (PMI): Non-QM loans don’t require PMI, leading to diminished month-to-month funds for you.

- No Mortgage Limits: Whereas typical loans have limits, non-QM loans don’t. This offers you the pliability to purchase a house at your required value.

- Self-Employed? No Drawback: For those who’re self-employed and don’t have conventional proof of revenue, non-QM loans are nonetheless accessible. You’ll be able to qualify based mostly on financial institution statements as an alternative of tax returns.

- Out there for Buyers: Wish to purchase an funding property? Non-QM loans can be found for each main residences and funding properties.

Qualify For A Non-QM Loan, Click Here

Steps to Qualify for a Non-QM Mortgage with Current Late Funds

Questioning how one can get began? Qualifying for a non-QM mortgage is easier than you may assume. Right here’s a step-by-step information that will help you alongside the way in which:

1. Evaluate Your Monetary State of affairs

First, take a very good have a look at your present monetary scenario. Are you self-employed? Have you ever had late funds within the final 12 months? Realizing the place you stand financially will assist decide which non-QM mortgage product is best for you.

2. Get in Contact with a Non-QM Lender

Not all lenders supply non-QM loans, so discovering a lender specializing in them is important. Gustan Cho Associates is a superb place to begin. Our workforce is right here to information you at each step and show you how to perceive your choices, particularly in the event you’ve just lately confronted late funds.

3. Collect Your Paperwork

Despite the fact that non-QM loans have versatile pointers, you’ll nonetheless want to collect some paperwork. Typical paperwork embody:

- Current financial institution statements

- Proof of employment (or self-employment)

- Data of any property you could have

- Particulars of your latest late funds

4. Talk about Your Down Fee Choices

Down funds for non-QM loans usually fall between 10% and 30%. The bigger your down cost, the higher your possibilities of qualifying for a mortgage,you’veif you will have had credit score challenges. Your lender will collaborate with you to establish the optimum down cost alternative based mostly in your credit score profile and monetary goal.

5. Submit Your Utility

When you’ve gathered your paperwork and mentioned your choices, it’s time to submit your mortgage utility. A non-QM lender will overview your general monetary image—not simply your credit score rating—and decide one of the simplest ways to proceed along with your mortgage approval.

Who Advantages Most from Non-QM Loans?

Non-QM loans are extremely versatile and work properly for a lot of various kinds of debtors. Right here’s a breakdown of who advantages most:

Non-QM loans are extremely versatile and work properly for a lot of various kinds of debtors. Right here’s a breakdown of who advantages most:

- Homebuyers with Current Late Funds: If in case you have just lately missed funds in your credit score report, a non-QM mortgage could also be your most fitted alternative for acquiring financing. Lenders will take into account facets past your credit score rating and focus in your monetary scenario.

- Self-Employed People: Self-employed debtors can use financial institution statements as an alternative of conventional revenue verification. This makes it simpler so that you can get authorised for a mortgage with out displaying tax returns.

- Buyers: Non-QM loans may also be used to buy funding properties. Whether or not shopping for a rental or fixing a property to flip, non-QM loans present versatile financing choices.

- Debtors with Excessive Debt-to-Earnings Ratios: Standard loans sometimes restrict your debt-to-income (DTI) ratio to 43%. Non-QM loans permit larger debt-to-income (DTI) ratios, which helps extra folks qualify. That is particularly useful in case you have bank card debt, scholar loans, or different monetary commitments.

Speak With Our Loan Officer About Non-QM Loans Today

What Are the Drawbacks of Non-QM Loans?

Whereas non-QM loans supply flexibility and advantages, additionally they include a number of drawbacks it is best to take into account:

- Larger Curiosity Charges: Non-QM loans are inclined to have larger rates of interest than typical ones. Lenders understand these loans as extra dangerous due to your credit score background or monetary circumstances.

- Bigger Down Funds: You’ll must make a bigger down cost—sometimes between 10% and 30%. For those who’ve been battling latest late funds, you’ll should be ready to place extra money down upfront.

- Stricter Phrases for Funding Properties: For those who’re buying an funding property, non-QM loans could include prepayment penalties and different charges, so overview the mortgage phrases rigorously along with your lender.

Refinancing Non-QM Loans to Standard Mortgages

Among the best facets of non-QM loans is that they will function a bridge mortgage. After bettering your credit score rating or fixing your monetary scenario, you’ll be able to refinance from a non-QM mortgage to a conventional mortgage.

Right here’s the way it works:

- Shut on Your Non-QM Mortgage: Use a non-QM mortgage to purchase your own home or refinance, even in the event you’ve had latest late funds.

- Enhance Your Credit score: Over the following six months to a 12 months, enhance your credit score rating by making well timed funds and decreasing your general debt.

- Refinance to a Standard Mortgage: As soon as your credit score rating improves, you might be eligible to refinance into a conventional mortgage with decrease rates of interest and higher phrases.

The right way to Get Began with a Non-QM Mortgage

For those who’re able to discover non-QM loans and learn the way to qualify regardless of latest late funds, we’re right here to assist! Gustan Cho Associates is a trusted chief in non-QM lending, and our workforce is offered 7 days per week to reply your questions and information you thru the method.

Contact us as we speak at 800-900-8569 or electronic mail us at alex@gustancho.com to find out how a non-QM mortgage with latest late funds will help you purchase a house or refinance. We’re right here to make your homeownership desires a actuality, irrespective of your credit score historical past.

Contact Us Today To Learn More About How Non-QM Loans Can Work For You

Often Requested Questions About Non-QM Loans with Current Late Funds:

Q: Can I get a Non-QM Mortgage with Current Late Funds on my Credit score Report?

A: Sure! A non-QM mortgage with latest late funds is designed for individuals who have missed funds within the final 12 months. These loans have extra versatile pointers than conventional loans, making it simpler so that you can qualify even in the event you’ve had late funds.

Q: How A lot Down Fee do I Want for a Non-QM Mortgage with Current Late Funds?

A: You’ll sometimes want a down cost between 10% and 30% for a non-QM mortgage with latest late funds. The extra you’ll be able to put down, the higher your possibilities of approval.

Q: Will Late Funds on my Credit score Report Cease me From Getting a Mortgage?

A: Not essentially. For those who’ve had late funds previously 12 months, a non-QM mortgage with latest late funds might nonetheless show you how to get authorised for a mortgage. Non-QM loans have a look at extra than simply your credit score rating, like your revenue and property.

Q: Do Non-QM loans have Larger Curiosity Charges if I’ve had Late Funds?

A: Sure, non-QM loans usually have larger rates of interest, particularly in the event you’ve had latest late funds. Lenders see these loans as larger danger, however they’re nonetheless an awesome choice if conventional loans aren’t accessible.

Q: Can I Refinance a Non-QM Mortgage to a Standard Mortgage Later?

A: Completely! Many individuals use a non-QM mortgage with latest late funds as a brief resolution. As soon as your credit score improves, you’ll be able to refinance into a standard mortgage with higher phrases and decrease rates of interest.

Q: How Lengthy do I Must Wait After Late Funds to Purchase a Dwelling?

A: With a non-QM mortgage, there isn’t any ready interval after late funds. You’ll be able to apply for a non-QM mortgage immediately, even in the event you’ve had missed funds within the final 12 months.

Q: Can Self-Employed Debtors get a Non-QM Mortgage with Current Late Funds?

A: Sure! Non-QM loans are nice for self-employed debtors. You don’t want tax returns to qualify. As a substitute, you need to use financial institution statements to indicate your revenue, making qualifying even in the event you’ve had late funds simpler.

Q: What Properties Can I Purchase with a Non-QM Mortgage with Current Late Funds?

A: A non-QM mortgage with latest late funds can be utilized to buy main houses and funding properties. Whether or not you’re shopping for a residence or a rental property, a non-QM mortgage could be an acceptable alternative.

Q: Do Non-QM Loans have Prepayment Penalties if I’ve Late Funds?

A: For owner-occupied houses, non-QM loans sometimes don’t have prepayment penalties. Nevertheless, in the event you’re shopping for an funding property, you may face prepayment penalties, so talk about this along with your lender.

Q: How Can I Improve my Possibilities of Qualifying for a Non-QM Mortgage with Current Late Funds?

A: To enhance your possibilities of getting authorised for a non-QM mortgage with latest late funds, give attention to making a bigger down cost and offering documentation of your monetary stability, reminiscent of financial institution statements and proof of property.

This weblog about “NON-QM Mortgage With Current Late Funds In The Previous 12 Months” was up to date on October seventeenth, 2024.