Non-affiliate disclosure: all details about the this card have been collected independently by US Credit score Card Information and has not been reviewed by the issuer.

2025.7 Replace: This card is in a wierd state now: in this Freedom cards official webpage, this card has no software button; in this Chase all credit cards list official webpage, this card disappeared. Nonetheless, referral hyperlinks nonetheless work superb. The appliance hyperlink beneath on our web site is the referral hyperlinks which can be working superb. Some buyer consultant stated that this card is pulled for the month of Jul, and might be out there once more in Aug. We don’t know whether or not this card might be refreshed or discontinued within the close to future.

2024.4 Replace: The $200+5% on grocery&gasoline provide is expired. The present provide is $200.

2023.7 Replace: There’s a new $200+5% on grocery&gasoline provide. Screenshot. [2023.9 Update] Expired. The present provide is $200.

Provide Hyperlink

Advantages

- $200 provide: earn $200 money again after spending $500 within the first 3 months.The current greatest provide is $200+5% on grocery&gasoline.

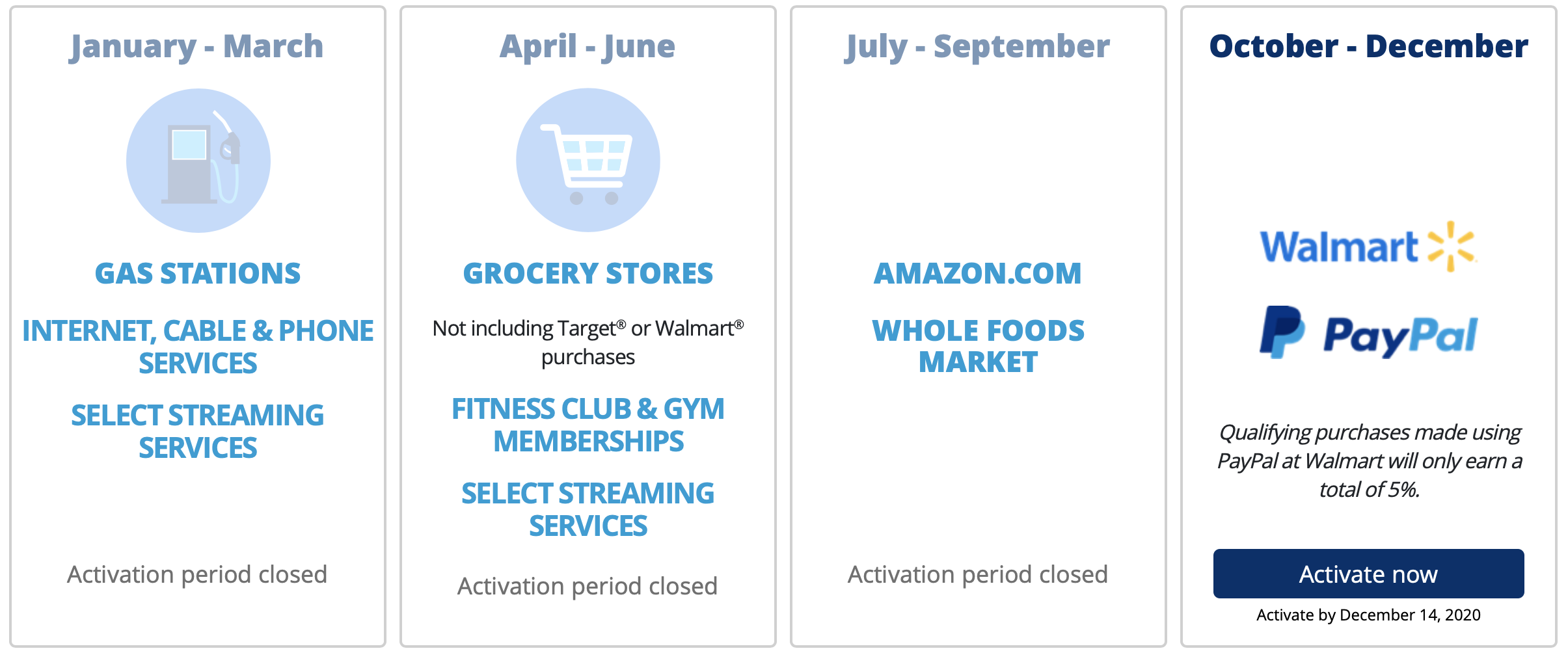

- Earn 5% money again in every quarter’s bonus classes, 1% money again on all different purchases. It’s good to activate beforehand, and the deadline is the 14th of the final month of every quarter, it received’t be activated robotically for a brand new card. For instance, right here is the bonus category calendar for 2020:

- Earn 5% money again on journey bought via Chase Final Rewards, earn 3% money again on eating (eating places & supply) and drugstore, and earn 1% money again on all different purchases.

- Though this card is marketed as a money again card, it really earns Final Rewards (UR) factors: i.e. the $200 sign-up bonus is definitely 20k UR factors sign-up bonus, and the 5% money again charge is definitely 5x UR factors incomes charge. We estimate that UR factors are price about 1.6 cents/level, see beneath for a short introduction. So the 20k sign-up bonus could possibly be price about $320, and the 5x UR factors incomes charge on bonus classes could possibly be price about 8%!

- Cellphone safety: stand up to $800 per declare and $1,000 per yr in cellphone safety in opposition to lined theft or harm for telephones listed in your month-to-month cellphone invoice if you pay it together with your eligible bank card. Deductible $50.

- Refer a friend: You’ll be able to earn 10,000 bonus UR factors for each accepted account you refer, as much as a most of 5 accepted referrals (50,000 UR factors) per calendar yr.

- No annual price.

Disadvantages

- You may have a $1,500 cap in 5% bonus classes per quarter, which suggests you possibly can earn as much as 7.5k factors per bonus class every quarter. After that, you earn 1 level per greenback spent.

- It has international transaction price, so it isn’t a sensible choice exterior the US.

Introduction to UR Factors

- You’ll be able to earn UR factors with Chase Freedom Student, Chase Freedom, Chase Freedom Unlimited (CFU), Chase Sapphire Preferred (CSP), Chase Sapphire Reserve (CSR), Chase Ink Cash (Business), Chase Ink Unlimited (Business), Chase Ink Preferred (Business), and so forth.

- You’ll be able to transfer your UR factors from one UR card to a different at any time.

- UR factors by no means expire. You’ll lose the UR factors on one card when you shut the account, however you possibly can stop shedding your UR factors by shifting the factors to a different UR card beforehand.

- When you have Chase Sapphire Preferred (CSP), Chase Sapphire Reserve (CSR), or Chase Ink Preferred (Business), UR factors could be transferred to some resort factors. Among the finest manner to make use of UR factors is to 1:1 switch to Hyatt factors. UR factors may also be transferred to some airline miles. One of the widespread and greatest manner to make use of UR factors is to 1:1 switch them to United Airways (UA) miles (Star Alliance), and mix them with the UA miles earned from the UA card. Different good choices are: Southwest (WN) (Non-alliance), British Airways (BA) (Oneworld), Virgin Atlantic (VS) (Non-alliance), and so forth. In case you use UR factors on this manner, the worth is about 1.6 cents/level.

- When you have Chase Sapphire Reserve (CSR), you possibly can redeem your UR factors for as much as 2.0 cents/level in direction of air tickets or resorts on Chase Travel with the “Factors Increase” function; when you’ve got Chase Sapphire Preferred (CSP) or Chase Ink Preferred (Business), the worth is as much as 1.5 cpp (or 1.75 cpp for premium cabin).

- When you have any of the UR playing cards, you possibly can redeem your UR factors at a hard and fast charge 1 cent/level in direction of money.

- In abstract, we estimate that UR factors are price about 1.6 cents/level.

- For extra details about UR factors, see Maximize the Credit Card Points Values (overview), and Introduction to UR: How to Earn and Introduction to UR: How to Use (very detailed).

Advisable Software Time

- [5/24 Rule] When you have 5 or extra new accounts opened previously 24 months, Chase is not going to approve your software on this card, irrespective of how excessive your credit score rating is. The variety of new accounts consists of all bank card accounts, not solely Chase accounts. See this post for particulars about methods to probably bypass this rule.

- This product is obtainable to you when you shouldn’t have this card and haven’t obtained a brand new cardmember bonus for this card previously 24 months. Notice that what issues right here is the time you bought the sign-up bonus, not the time you open the account or shut the account.

- Don’t apply for greater than 2 Chase bank cards inside 30 days, or it’s extremely seemingly that you’ll get rejected.

When you have greater than $10,000 deposits in Chase checking, you may get this card even with no credit score historical past in any respect. You’ll be able to go to a department and discover a banker to use for this bank card instantly via Particular Consideration.Particular Consideration is now not out there.- We advocate you to use for this card after you have got a credit score historical past for greater than 8~9 months.

Notice which you can not have multiple Freedom Flex card on the similar time, subsequently you cannot improve its 5% bonus classes spending restrict by holding a number of playing cards.[Update] Precise information factors present which you can nonetheless get a number of of this card by product change.

Abstract

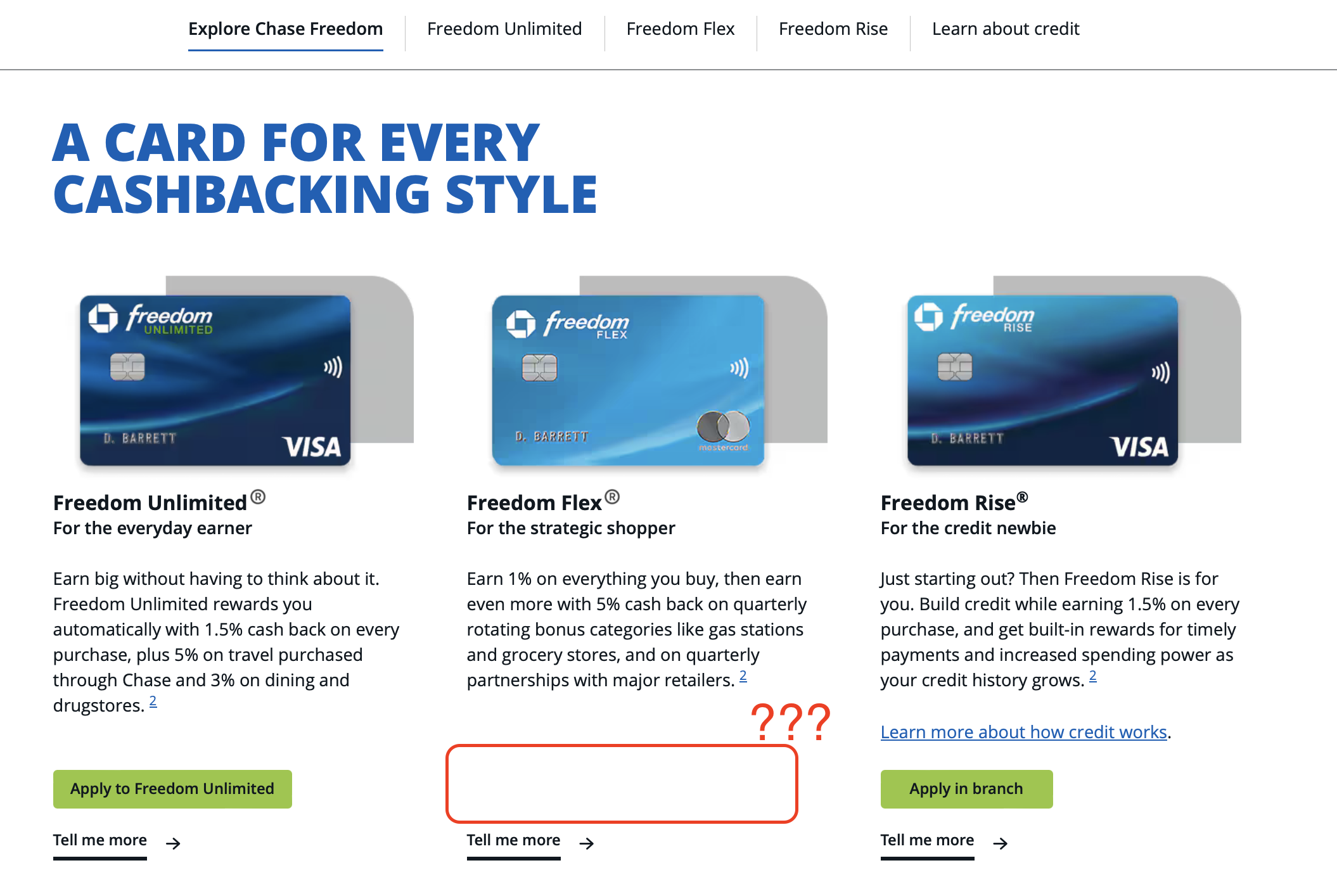

This Chase Freedom Flex (CFF) card is an improve from the old Chase Freedom card. Fairly just like the outdated Freedom card, you possibly can primarily apply it to the 3x (~4.8%) and 5x (~8%) bonus classes. After you accumulate sufficient UR factors, you possibly can apply for a CSP/CSR after which switch these UR factors to airline miles/resort factors to get most worth out of your factors. The outdated Freedom card is already a implausible card, and this upgraded CFF card is even higher! This card makes a variety of different eating bank cards much less engaging. Everybody ought to have one!

You’ll be able to apply instantly for this card if underneath 5/24, in any other case you are able to do a product change (from different Freedom playing cards or Sapphire playing cards) to acquire it.

Associated Credit score Playing cards

After Making use of

- Name 800-436-7927 to verify Chase software standing. That is an automatic phone line, and the knowledge has the next meanings: Obtain choice in 2 weeks means your software might be accepted; Obtain choice in 7-10 days means your software might be rejected; Obtain choice in 30 days merely means your software requires additional assessment and there’s nothing to inform you for now.

- Chase reconsideration backdoor quantity: 888-270-2127 or 888-609-7805. Name it when you didn’t get approve instantly. Your private info might be acquired and they’ll then assessment it. You seldom reply questions, as an alternative, simply benefit from the music and then you definately get accepted or rejected, or additional info is required to be hand in to the department or faxed.

Historic Gives Chart

Notice that typically there’s a $200 + 5% on grocery within the first yr provide, and the latter half is just not proven within the plot.

Provide Hyperlink

Editorial disclosure: Opinions categorical listed here are creator’s alone, not these of any financial institution, bank card issuer, resort, airline, or different entity. This content material has not been reviewed, accepted or in any other case endorsed by any of the entities included throughout the put up.