This submit could include affiliate hyperlinks that pay us whenever you click on on them.

The Citi Strata Elite Card is the brand new child on the block relating to premium bank cards. Though it has a $595 annual charge, the fee is on the decrease finish of premium journey bank cards, after so many playing cards have not too long ago elevated their annual charges. Launched in the summertime, I discover the Strata Elite to be a stable premium card: nice worth with out annoyance.

I haven’t had a premium bank card in a number of years. However when the Strata Elite was launched, I knew it was alternative to get again in. With a 100,000-point sign-up bonus and a curated checklist of easy-to-track advantages, I believe this card delivers effectively on its worth proposition. The truth is, since getting the cardboard in late July, I’ve been in a position to extract over $2,300 in worth from the cardboard. And there’s much more to come back when the calendar flips to 2026.

Right here’s how I’ve been in a position to maximize the Citi Strata Elite Card’s worth even after paying its hefty annual charge.

The Worth I’ve Earned From The Citi Strata Elite Card

Premium bank cards have become pseudo-coupon booklets (I’m you, Amex Platinum). For a lot of, monitoring the laundry checklist of spending advantages turns into a part-time job. And many people both lose out on these perks or discover ourselves making purchases we usually wouldn’t make as a way to redeem them.

The Citi Strata Elite strips away these complications. It provides cardholders a small handful of advantages which might be simply usable.

Right here’s how I’ve used them, and the worth I earned again.

Incomes Citi ThankYou Factors

I’ve been in a position to earn a big quantity of Citi ThankYou Factors through the use of this card as my on a regular basis card. The cardboard earns:

- 12x per greenback spent on resorts, automobile leases, and points of interest when booked by the Citi Journey portal

- 6x per greenback spent on airfare when booked by the Citi Journey portal

- 6x per greenback spent throughout Citi Nights: eating out on Friday and Saturday night time from 6 pm to six am EST

- 3x per greenback on all different restaurant spending outdoors Citi Nights

- 1.5x per greenback on all different purchases

Combining factors earned from spending and the 100,000 factors from the welcome bonus, I’ve earned roughly 150,000 Citi ThankYou factors in just some months. Many individuals worth Citi ThankYou Factors at 1.9 cents per level. Even when deliberately undervaluing Citi ThankYou factors at 1 cent per level, I’ve earned at the very least $1,500 in worth.

With 150,000 factors in my pockets, that’s sufficient factors for me to redeem for an excellent enterprise class redemption on Turkish Airways in April 2026. Benefiting from the current 50% switch bonus from Citi to Turkish Airways gave me sufficient factors to e-book my flight and canopy the taxes.

$300 Lodge Credit score

The Citi Strata Elite Card comes with a $300 lodge credit score whenever you keep two or extra nights on rooms booked by CitiTravel.com. I used this credit score to e-book a weekend keep within the Bahamas on the Hyatt Baha Mar.

Although I saved $300 on the keep, I nonetheless earned 12x factors per greenback on my invoice. It’s a tremendous property, and I can’t wait to e-book one other go to.

$200 Splurge Credit score

I discovered the splurge credit score to be probably the most distinctive advantages of the Citi Strata Elite Card. After opening your account, you get a $200 Splurge credit score every year to spend at certainly one of 4 manufacturers: American Airways, Finest Purchase, Future Private Coaching, and Stay Nation.

Initially, I deliberate on reserving a flight on American Airways since I stay near Miami Worldwide Airport.

However then I remembered that Finest Purchase sells retail reward playing cards for quite a few eating places and different family names, together with Amazon. As a substitute of reserving a money flight, I’ll use AAdvantage miles for my subsequent journey. This allowed me to go to my native Finest Purchase to purchase a $200 Amazon reward card. I offered it to my Mother for a small low cost since she recurrently retailers there. Win-win for each of us. She will get deal, and I get money that I can use anyplace for something.

American Airways AAdmirals Membership Passes and Precedence Cross Lounge Entry

The cardboard comes with 4 single-use American Airways lounge passes. These value $79 if you happen to purchase them on the lounge. For the sake of this text, I’m valuing them close to retail, however I wouldn’t ever pay $79 to go to a lounge.

The Strata Elite Card additionally contains Precedence Cross lounge entry, which provides me free entry into greater than 1,300 lounges globally.

I’m going to make use of two of the AAdmirals Membership lounge passes on my subsequent journey from Miami to Phoenix. For spherical numbers, I’ll worth these lounge perks at $150.

Safety Enrollment Credit score

Many premium bank cards include an software credit score for both Global Entry® or TSA PreCheck®, and this one isn’t any completely different. My World Entry membership doesn’t expire till 2028, so I usually give my credit away to family and friends.

This time, I gave it away as a marriage current to a buddy. Since I’m not personally utilizing this profit and I’ve different playing cards that additionally supply reimbursement, I’m assigning a $0 worth to this perk.

Blacklane

I had by no means heard of Blacklane till making use of for the Citi Strata Elite card. It’s a premium chauffeur service that’s principally a elaborate Uber experience. The cardboard provides you a $200 annual credit score, which is split into two credit – $100 in January-June, and $100 in July-December.

I performed round with the app to get an thought of how a lot rides value on the platform. I stay roughly 9 miles from Fort Lauderdale Worldwide Airport, and a experience there on their lowest automobile service was $120. After accounting for the $100 credit score, I paid $20 out of pocket for my experience. The $20 I paid is concerning the regular value I spend on an Uber or Lyft, so it was a pleasant deal with to have an upscale expertise with out costing something further.

This one is hard to worth as a result of I wouldn’t usually use this service. However for this text, I’m giving it a $100 worth since that’s what I’ve spent up to now.

Citi Service provider Presents

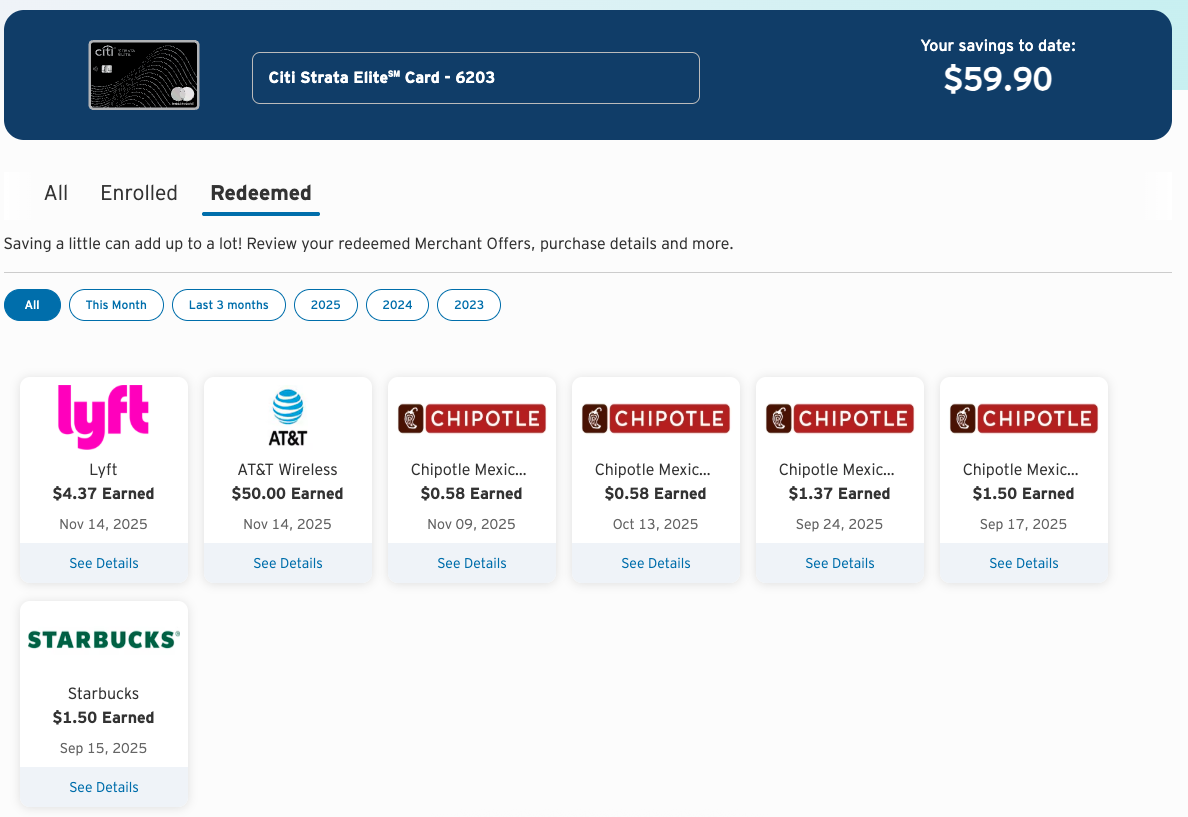

Citi Service provider Presents are a straightforward option to earn rebates on purchases you ordinarily make. The large one not too long ago was a $50 off a $65 buy with ATT. I’ve ATT Fiber Web at house and pay as you go my account with $65. The acquisition triggered the $50 credit score and it appeared on my assertion quickly after.

My web invoice is about $50 per 30 days, so this supply basically gave me one free month of web. I’ve earned $60 up to now utilizing numerous Citi Service provider Presents, so I’ll worth it at that.

The Bald Ideas About This Citi Strata Elite Evaluate

I determine I’ve earned about $2,310 in worth from the cardboard in 4 months. After deducting the $595 annual charge, that places me at $1,715 in web worth. The worth I’ll obtain within the first yr shall be a lot increased since most of the most precious credit reset in January. Since these perks are based mostly on the calendar yr, I’ll get one other $300 lodge credit score, $200 Splurge credit score, and the opposite half of the Blacklane credit score to offer much more worth. With this extra $600 in worth, that ought to cowl my annual charge to justify maintaining the cardboard one other yr when the annual charge hits.

Have you ever utilized for the Citi Strata Elite Card? In that case, have you ever discovered it straightforward or arduous to make use of the cardboard’s annual credit and different advantages? Tell us within the feedback.