On this weblog, we’ll cowl and focus on FHA 203k mortgage course of and eligibility necessities. The staff at Gustan Cho Associates are specialists in originating and funding FHA 203k loans. FHA 203k loans permits house patrons to buy fixer-uppers and can lend on the acquisition and renovation multi function mortgage program. Dwelling patrons want 3.5% of the after-improved worth.

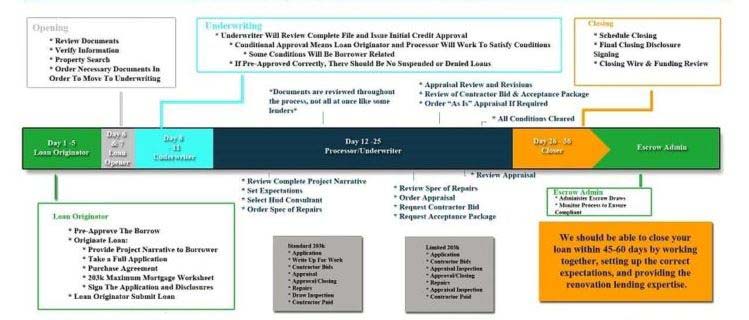

Here’s a chart on how the FHA 203k Mortgage Course of Works:

Within the following paragraphs, we’ll focus on FHA 203k mortgage course of for house patrons who’re shopping for fixer-uppers and the eligibility necessities.

How Does The FHA 203k Mortgage Course of Work

Many of us are below the idea there’s a whole lot of pink tape within the FHA 203k mortgage course of. That’s not the case. Understanding the FHA 203k mortgage course of previous to making use of for a mortgage will keep away from stress through the mortgage course of and make the FHA 203k mortgage course of go a lot smoother. To make the mortgage course of go smoother, house patrons, sellers, mortgage officers, realtors, and contractors have to work as a staff. The FHA 203k mortgage course of is barely longer than a conventional FHA mortgage course of. It usually takes 45 days to 60 days from pre-approval to closing.

Pre-Approval Stage Of FHA 203k Mortgage Course of

The pre-approval stage of the mortgage course of is a very powerful step. The mortgage officer ought to totally qualify the borrower, the property, the scope of labor of the renovations, and different essential components previous to beginning the processing and underwriting of the FHA 203k mortgage course of. The primary purpose for a last-minute mortgage denial and/or stress through the mortgage course of is that the mortgage officer didn’t correctly qualify the borrower. All paperwork ought to be rigorously reviewed, analyzed, and made positive is full.

Steps Of FHA 203k Mortgage Course of

The next steps must be processed previous to issuing a pre-approval. Be certain debtors meet all HUD Tips. If the lender has lender overlays, make sure that debtors meet the lender overlays of the corporate. All mortgage docs corresponding to revenue docs, credit score report, property and liabilities, tax returns, financial institution statements, and different paperwork ought to be totally reviewed. Run automated underwriting system and guarantee that debtors can meet all circumstances of AUS.

Advantages Of FHA 203k Renovation Loans

203k renovation loans are the subsequent factor to having a customized house. Dwelling patrons should purchase fixer-uppers and customise the renovations to their liking. Homebuyers can do room additions and second-story additions. They’ll do full intestine/rehab renovations. Inside repairs corresponding to flooring, millwork, basement and attic, HVAC, new home equipment, kitchens, loos, and numerous of different repairs. Exterior repairs corresponding to driveways, roof, home windows, soffits/fascia/gutters, foundations., nicely/septic, and numerous different repairs/renovations. Luxurious transforming/renovation tasks corresponding to swimming swimming pools, out of doors kitchens, and tennis courts aren’t allowed.

Processing Stage Of FHA 203k Mortgage Course of

As soon as a house purchaser indicators a contract, the executed buy contract must be submitted to the mortgage officer together with up to date mortgage paperwork. The file will probably be assigned to a mortgage processor. The processor will totally assessment the docs supplied. If any objects are lacking, the processor will request them from the borrower, mortgage officer, realtor, or different events. The processor won’t submit the file to a mortgage underwriter till it’s absolutely full. The mortgage processors principal aim is to get conditional mortgage approval with as little circumstances as doable by the underwriter. As soon as the file is full, the file is assigned to a mortgage underwriter.

Underwriting Stage Of FHA 203k Mortgage Course of

As soon as the mortgage underwriter has totally reviewed the file, the underwriter will problem conditional mortgage approval. The conditional approval is shipped to the processor. The mortgage processor then will get again to work and begins gathering circumstances requested by the underwriter. Examples of circumstances may be the next:

- Up to date financial institution statements

- Up to date verification of employment

- Letters of explanations on tradelines listed on the buyer credit score report

- Letters of explanations on debtors’ credit score, revenue, asset, legal responsibility, employment, residence, and/or different components that want clarification

- Request info and/or particulars concerning the HUD consultant

- Clarification and/or extra particulars on the scope of labor

- Request the as is as full FHA 203k Appraisal

- Request contractor’s bid

Clearing Situations And Clear To Shut

As soon as all circumstances are submitted again to the mortgage underwriter, the underwriter will totally assessment the circumstances and if all have been met, the underwriter will problem a transparent to shut. A transparent to shut signifies that the lender is able to put together the closing docs and fund the mortgage. The lender’s closing division will contact the title firm and make preparations for the closing time and date. The ultimate Closing Disclosure will probably be disclosed and despatched out to all events. The closing docs will probably be despatched to the title firm. The ultimate assessment previous to funding will probably be performed by the lender whereas all of that is and do a QC compliance Assessment agency guidelines have been met.

Sorts Of FHA 203k Renovation Loans

There are two sorts of FHA 203k Loans: Normal and Streamline 203k loans. FHA 203k streamlines are for beauty repairs solely. Normal 203k Loans are for any sorts of house renovations together with structural adjustments and room additions. Each sorts of 203k Loans have the identical guideline necessities and are processed and underwritten the identical means. The utmost acquisition and development prices are capped on the FHA county limit. Most of 1 basic contractor. Most of 5 attracts allowed to the overall contractor on full FHA 203k Loans. Structural adjustments and room additions are allowed on Normal 203k loans.

FHA 203k Streamline Renovation Loans

FHA 203k Streamline Renovation Loans are for beauty repairs.

- Rehab price capped at $35,000.

- No HUD advisor required

- No structural work allowed

- Most of two funds per contractor

For extra info on this matter and/or different mortgage associated matters, please contact us at Gustan Cho Associates at 800-900-8569 or textual content us for a sooner response. Or electronic mail us at gcho@gustancho.com.