Only a day after a “blowout” jobs report was launched, mortgage charges are falling once more.

I famous yesterday that mortgage charges did an excellent job navigating what might have been a nasty day.

As an alternative, they held agency and didn’t see a giant pop as could be anticipated when jobs numbers vastly exceed expectations.

And at this time issues acquired even higher for charges because the 10-year bond yield slid practically six foundation factors.

Meaning 30-year fastened mortgage charges stay very shut to six% and might nonetheless slip into the 5s quickly if situations warrant it.

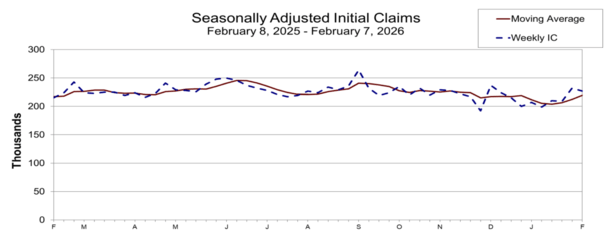

Jobless Claims Are available Increased Than Anticipated, Pushing Mortgage Charges Decrease

We acquired extra jobs information at this time courtesy of the weekly jobless claims from the U.S. Division of Labor.

They reported that seasonally adjusted preliminary jobless claims totaled 227,000, above the 225,000 anticipated however beneath the earlier week’s revised stage of 232,000.

That was apparently sufficient for bond yields to enhance, although different elements could possibly be at play, such because the CPI report coming tomorrow.

Bear in mind, mortgage rates can move lower when inflation is less of a threat.

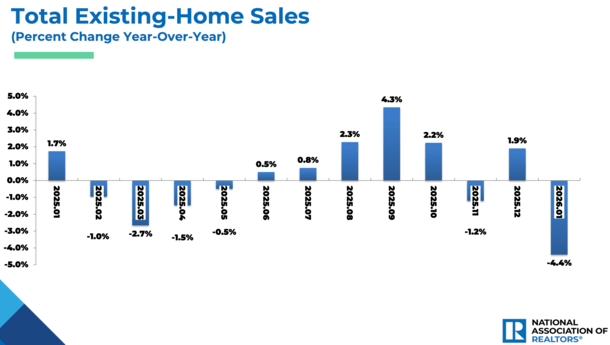

Or the truth that present dwelling gross sales got here in ice chilly for January, with a gross sales tempo of simply 3.91 million versus a forecast of 4.15 million.

Dwelling gross sales had been additionally down 4.4% in comparison with a yr earlier, one of many worst prints in current historical past.

Be aware that present dwelling gross sales are based mostly on precise closings from A number of Itemizing Companies (MLSs) and sure went beneath contract in November and December.

Mortgage charges improved fairly a bit since then and January noticed mortgage charges within the sub-6% class for the primary time in a number of years.

So it’s attainable we see a bump in February as these transactions shut…

CPI Might Additional Assist Mortgage Charges Tomorrow

It’s been a busy week for information due to the federal government shutdown. And it culminates with the January CPI report on Friday.

The forecasts are calling for comparatively steady inflation numbers, together with a 0.3% month over month enhance, which might be the identical because the December studying, together with a 2.5% year-over-year enhance.

One factor to control is tariff-related inflation. The Fed will usually be okay with that because it’s considered as a one-time pass-through occasion.

We simply don’t need to see a reacceleration of inflation, particularly if job development is questionable as effectively.

But when we get a good CPI studying, that coupled with the roles “victory” might push 30-year fastened charges ever nearer to the 5s.

I acquired to pondering that the best way mortgage lenders absorbed the new jobs report tells me they’re extra comfy with rates of interest at these ranges.

Had it been 2024 and even final yr, mortgage charges could have skyrocketed on a giant jobs beat.

That tells me it’ll be simpler to face up to sizzling studies and maybe simpler to maintain inching decrease into the 5s if studies are available in cooler-than-expected.

That is very true as a result of 10-year bond yields are increased at this time to compensate for present situations and mortgage spreads are tighter.

Meaning there’s room for bond yields to ease if financial information is cooperative, and brought along with tighter spreads, might get us that lengthy sought-after 5% mortgage charge!

Learn on: Do mortgage rates change daily?