Medical insurance and the claims course of typically stay a gray space for a lot of – not simply in India, however throughout the globe. Regardless of its significance, most individuals I’ve spoken to, like mates & household don’t appears to have sufficient belief on insurance coverage firms.

There’s a widespread notion that claims are sophisticated, troublesome to navigate or are sometimes rejected with out clear causes.

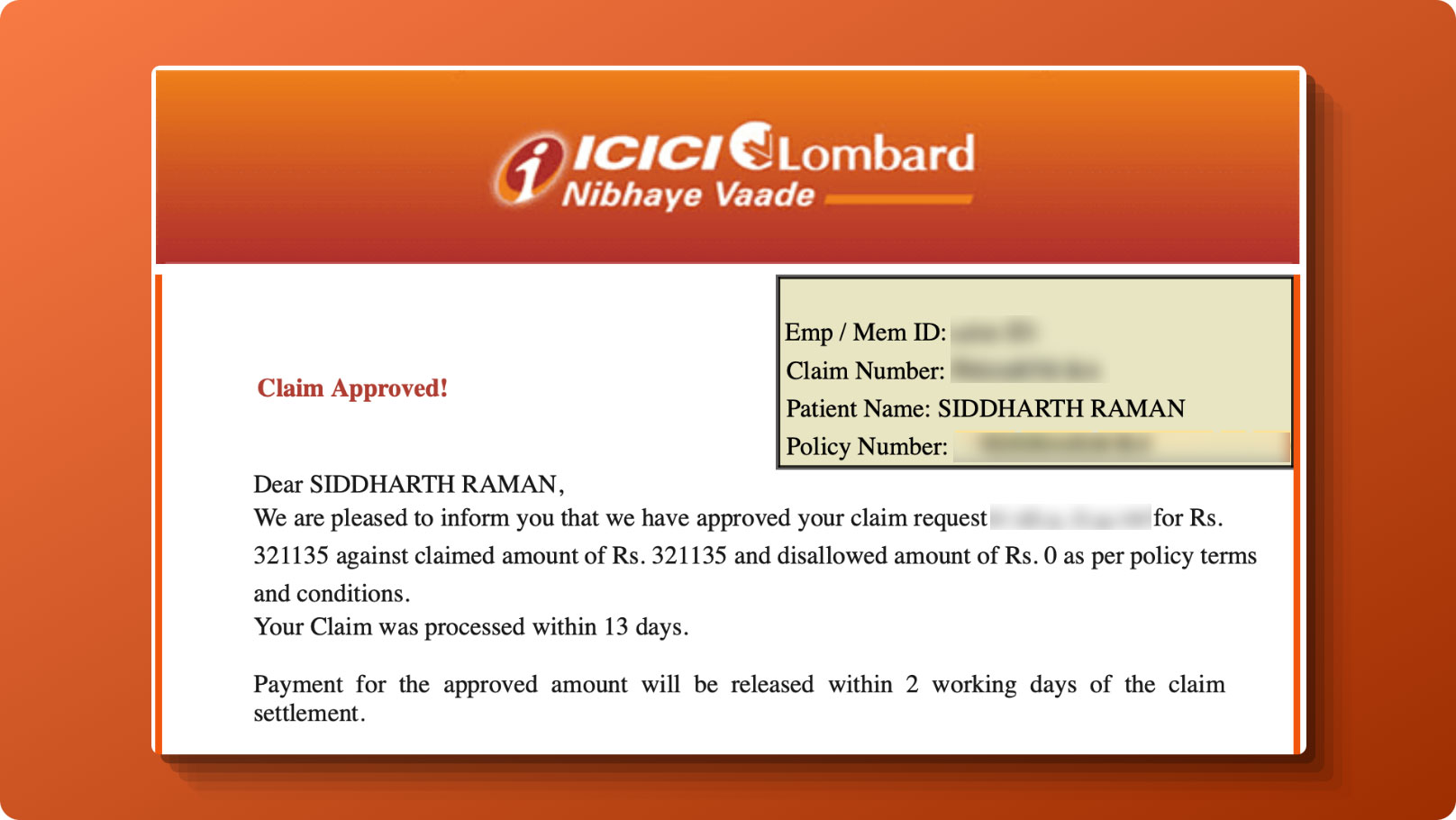

Lately, I needed to undergo the method myself – a medical health insurance reimbursement declare and I’m blissful to share that your complete declare was settled for 100% of the billed quantity.

On this article, I’ll stroll you thru my end-to-end expertise with ICICI Lombard Well being Insurance coverage, particularly below a policy issued through American Express India.

Whether or not you’re making ready to make a declare, or just wish to perceive how the system works, this could provide you with a transparent image of what to anticipate and tips on how to enhance your probabilities of a clean, profitable final result.

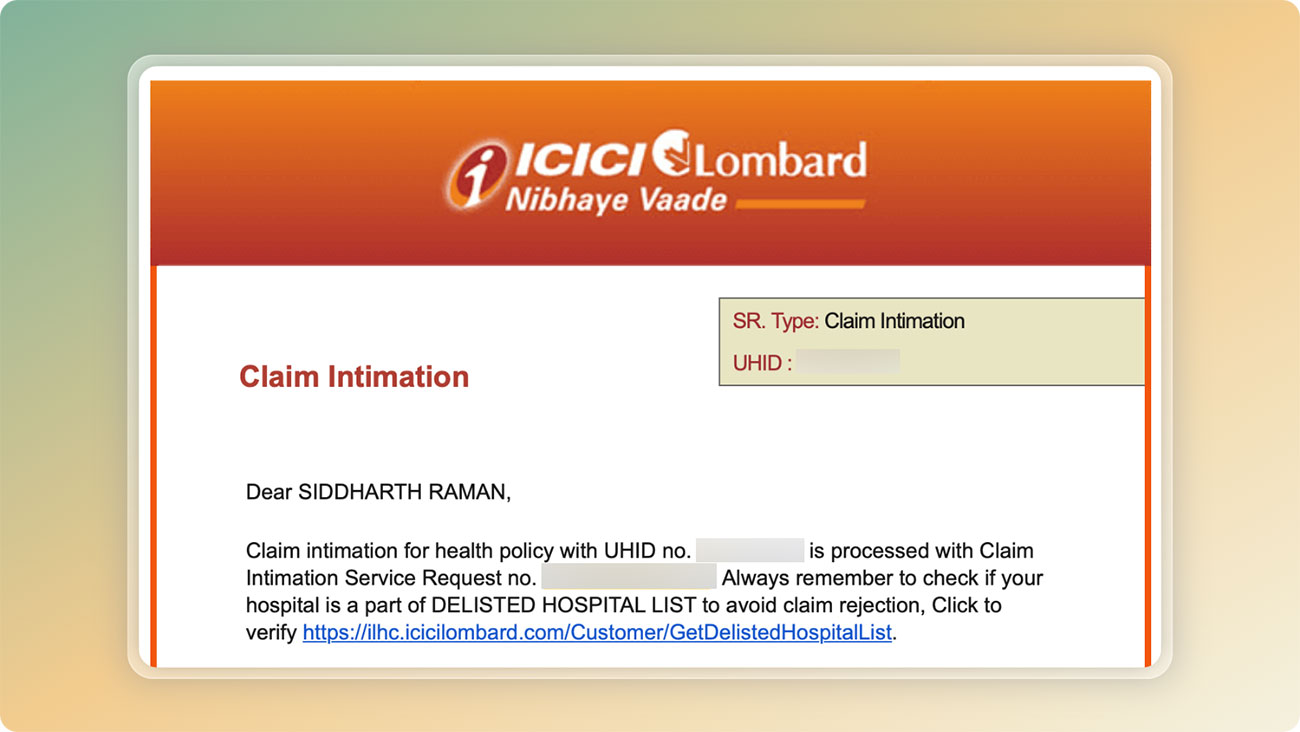

Step 1: Intimation

I referred to as the devoted ICICI Lombard helpline for American Categorical cardholders and knowledgeable them of my deliberate hospital admission, together with the admission date. This triggered an e mail affirmation as above.

I additionally requested for additional written affirmation, because the remedy falls below the AYUSH class. The affirmation e mail was then acquired accordingly.

Step 2: Admission & Papers

I then bought admitted for the remedy and picked up all of the papers that may be required.

Because it’s going to be a re-imbursement declare, I made positive I’ve all crucial paperwork so as. This included invoices, fee receipts, proof of funds, session papers, check stories, and associated paperwork.

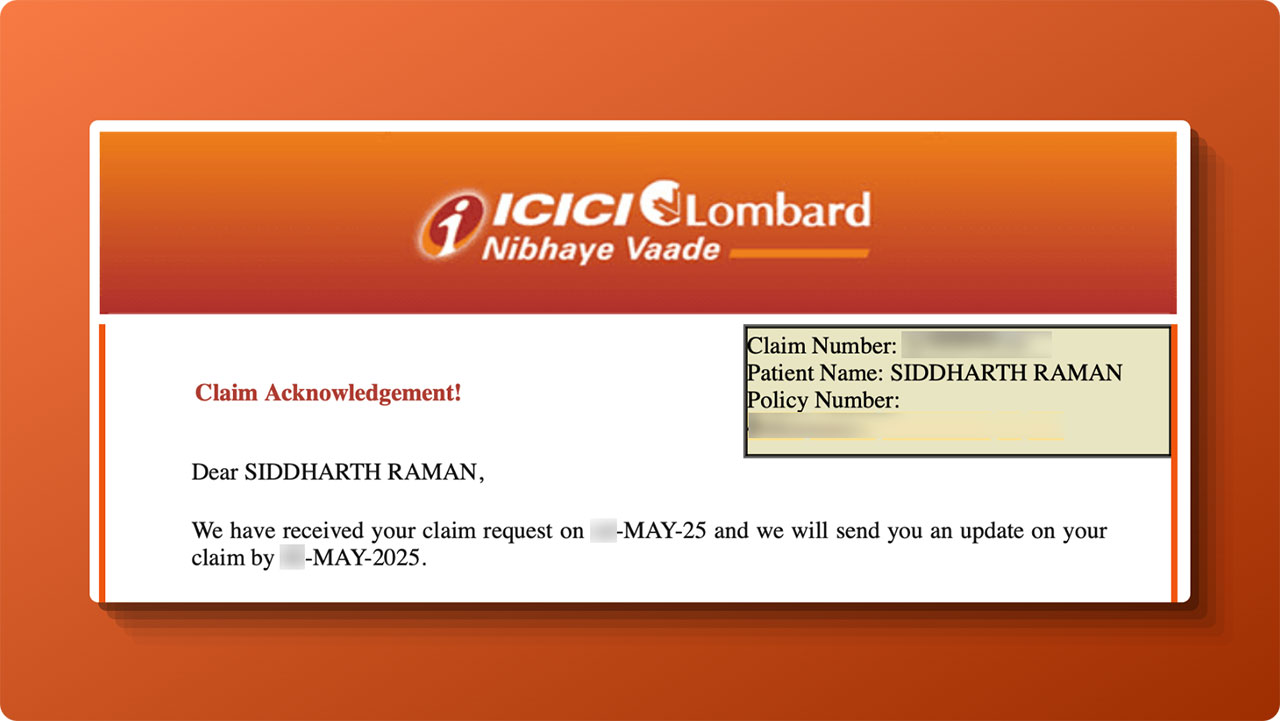

Step 3: Declare Submission

Fortuitously, ICICI Lombard has a wonderful system in place to provoke claims digitally via its cellular app, ILTakeCare.

Day 1: I crammed within the required particulars and uploaded each related doc I may consider, due to thorough prior analysis.

The general submission course of was clean, and I acquired a brief declare quantity. A day later, the declare was accepted for additional processing, and I used to be issued a ultimate declare quantity.

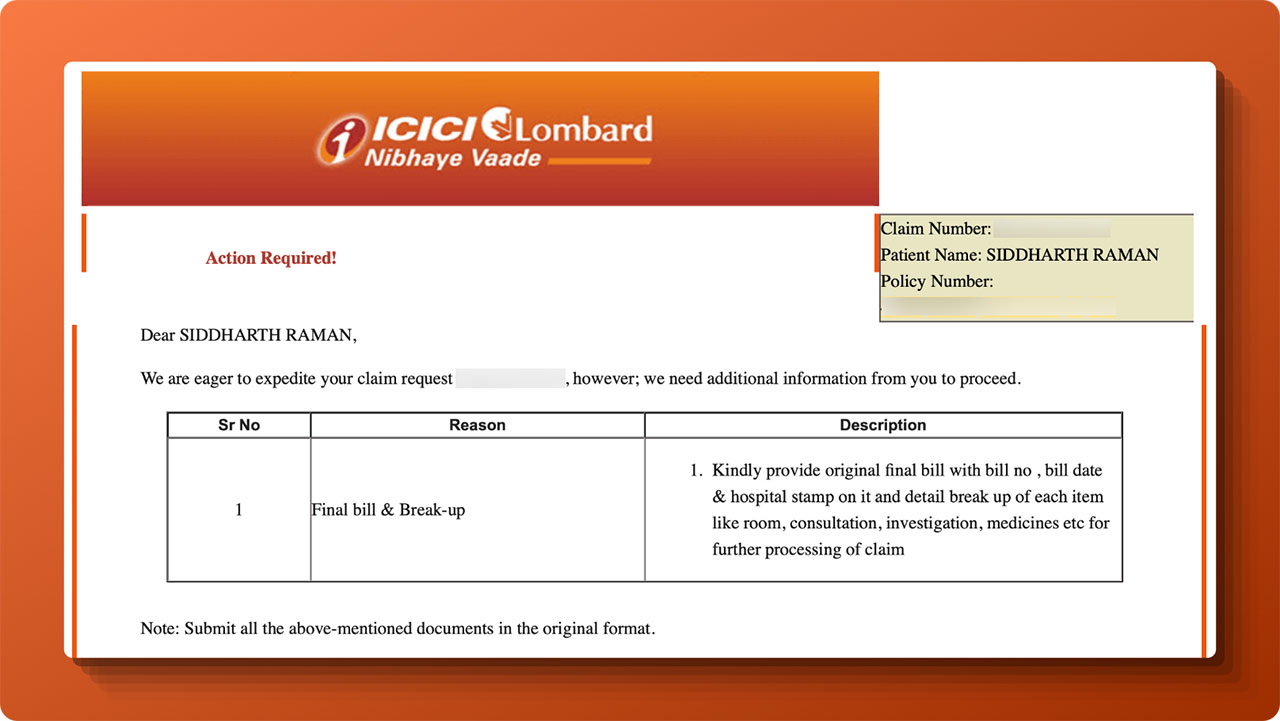

Step 4: Extra Docs Requested

Day 6: I acquired an e mail from ICICI Lombard requesting further paperwork together with a signed consent letter. This was bizarre, as a result of the required paperwork had been already uploaded.

Day 11: One other request got here in for extra paperwork. I needed to contact the hospital once more to acquire the required paperwork, which I then uploaded.

At this level, the method began to really feel irritating, so I escalated the problem to each the Amex Insurance coverage crew and the ICICI Lombard Grievance crew.

The Amex crew merely suggested me to observe the usual course of: so the expectation of assist from their finish didn’t materialize.

Alternatively, the ICICI Lombard grievance crew referred to as again inside a day, assuring me that they had been wanting into the matter.

Step 5: Area Verification

Just a few days after submitting all paperwork and escalating the case, I acquired a name from somebody claiming to be from ICICI Lombard’s area verification crew.

He talked about that he wanted bodily copies of the paperwork and required a crammed questionnaire kind.

Sadly, I used to be in Switzerland by then, so I defined my state of affairs.

He checked together with his superior and confirmed that digital copies would suffice, however the kind needed to be crammed in individual. He steered {that a} member of the family may do it on my behalf, together with their ID proof.

I requested my dad to finish the prolonged questionnaire, which requested for detailed data on my medical historical past, earlier associated OPD consultations (with supporting paperwork), my work profile, and extra.

Fortunately, I had all my paperwork saved on the cloud, so dealing with these requests didn’t take any further time.

The subsequent day, he referred to as once more to ask about my mode of transport to the hospital and requested proof. I had my flight tickets prepared and promptly shared them.

Initially, I had questioned how a declare could possibly be assessed with such restricted enter throughout submission, so it made sense that they’d observe up with these queries later.

Whereas that’s high-quality, I want they requested for every thing upfront as an alternative of initiating a separate area verification course of. However that’s simply the way it works!

That mentioned, the sector govt was extraordinarily well mannered all through, and I used to be relieved that they didn’t insist me to fly again to India simply to show I exist, lol.

Day 22: Inside a day of submitting the flight tickets, the declare was accepted for 100% of the billed quantity, and I acquired an e mail affirmation the very subsequent day.

The e-mail talked about that the fee could be initiated inside two days and actually, it was credited inside simply someday.

It’s value noting that the 100% approval was seemingly as a result of “Declare Protector” add-on cowl. With out it, a partial deduction may need been utilized. This add-on is sort of necessary, but many individuals are likely to skip it, and that may be an costly mistake.

For instance, a pal of mine lately wanted to make use of his medical health insurance however ended up not submitting a reimbursement declare as a result of the deductibles had been so excessive that he felt it doesn’t make sense to undergo the entire course of anyway.

In-fact I even have an extra add-on referred to as “convalescence profit” (10K INR) which I simply realised a day again that I’m but to say. I used to be advised prior that these further add-on advantages together with pre/submit hospitalisation bills could be claimed as soon as the primary declare goes via.

And aside from that, I do have an extra OPD cowl and for those who had been studying the weblog for someday, you may need gone via my OPD claim experience prior to now.

Therefore, investing a bit further in the correct add-ons could make a giant distinction when it really issues.

So total it took about 22 days for the whole reimbursement declare course of, end-to-end.

Key Takeaway

Throughout the entire course of, I spent a great period of time researching on the very best practices to ensure the declare doesn’t get delayed or rejected. So listed here are some key factors value understanding:

- Purchase insurance policies via premium channels corresponding to Amex or premium banking companies, as these are typically seen as lower-risk by insurers.

- Claims made after the moratorium interval, sometimes after 5 consecutive years are often thought-about safer and extra easy.

- Preserve a whole and accessible medical historical past as having previous OPD information and lab stories prepared could make a giant distinction.

- Keep alert to emails and SMS notifications so you possibly can reply promptly to any doc or clarification requests.

- Be obtainable in individual every time doable as greater declare quantities might set off area verification, which frequently requires in-person involvement.

This a lot ought to suffice for reimbursement claims. The method is, after all, a lot simpler if the declare is cashless.

Whereas my expertise is with ICICI Lombard, the general declare course of ought to be broadly comparable throughout most main insurers.

That mentioned, this doesn’t essentially imply ICICI Lombard is the most suitable choice — medical health insurance is a posh product, and what’s appropriate is dependent upon components like the kind of protection you want, age, and medical historical past.

For instance, I’ve insured my dad and mom below Niva Bupa since ICICI Lombard by way of Amex doesn’t assist coverage porting. Porting would have meant shedding their present insurance coverage no-claim historical past (because it helps moratorium interval), which wasn’t a danger value taking.

In a nutshell

Medical insurance reimbursement claims could seem complicated, however with the correct preparation and consciousness, the method could be smoother than anticipated. My expertise with ICICI Lombard below a coverage issued by way of AmEx India was largely optimistic, ending with a 100% settlement.

Whereas the sector verification course of added a number of further steps, being proactive and having digital backups helped pace issues up.

Though the declare course of could possibly be extra clear, particularly with upfront documentation necessities, it’s reassuring to know {that a} well-documented and eligible declare does get honoured.

Have you ever made any medical health insurance declare for you or your loved ones? Be at liberty to share your experiences within the feedback beneath.