SBICard not too long ago launched a miles-focused bank card lineup to faucet into the rising demand amongst frequent travellers, pushed by the Axis Magnus impact. Among the many three variants, the top-tier providing is the SBI Miles Elite Credit score Card.

Right here’s every part that you must learn about SBICard’s first vary of bank cards that permit level transfers to a large community of airline and resort companions.

Overview

| Kind | Journey Credit score Card |

| Reward Price | 1% to 4.7% |

| Foreign exchange Markup Price | 1.99%+GST |

| Greatest for | Journey spends |

| USP | Lounge entry based mostly on spends |

To use, You’ll have to open the hyperlink on desktop (not cell), click on on “begin apply journey” and click on on “change card” and select “SBI Card Miles Elite”.

Charges

| Becoming a member of Price | 4,999 INR+GST |

| Welcome Profit | 5,000 Journey Credit (on 1L spend in 60 days) |

| Renewal Price | 4,999 INR+GST |

| Renewal Profit | – |

| Renewal Price waiver | Spend 15L INR |

Asking cardholders to spend ₹1L in simply 60 days for a ₹5K charge card feels fairly excessive for the phase, particularly contemplating the truth that it takes over every week to obtain the cardboard in hand.

Even after assembly the spend requirement, the welcome profit barely justifies the ₹5,900 becoming a member of charge.

It might be extra affordable if SBI provided 6,000 Journey Credit as an alternative of 5,000 to make the signup extra interesting.

design“>design

Whereas there’s nothing a lot to complain or reward, I believe the colors could possibly be little extra vibrant even with the prevailing design, because it appears to be like bit uninteresting each indoors and outdoor.

Rewards

| SPEND TYPE | EDGE MILES | REWARD RATE (Miles at 1:1) |

|---|---|---|

| Common Spends | 2 / 200 INR | 1% |

| Journey Spends | 6 / 200 INR | 3% |

A 1% reward charge on common spends is extraordinarily underwhelming, particularly when the competing Axis Bank Atlas Credit Card gives 4% returns, even increased with choose redemptions like Accor, which isn’t the case with SBI Miles Elite Credit score Card.

Nevertheless, the reward charge on journey spends is comparatively respectable. Not solely that, it additionally covers extensive number of MCC’s used for journey, together with OTA’s, Tolls and public transports like taxis.

Exclusions for rewards:

- Utility, Insurance coverage, Training

- Hire, Pockets, EMI

Redemption

There are a number of choices to redeem these factors, as beneath:

- 1 Journey Credit score = Upto 1 for Air Mile / Resort Level (partners list)

- 1 Journey Credit score = ₹0.50 for Journey Bookings

- 1 Journey Credit score = ₹0.25 for Store & Smile Product Catalogue

Redeeming for airline/resort companions is the one approach to get a good worth, different choices give extraordinarily poor worth. To not point out that not all redemption companions are at 1:1 ratio.

Talking of redemption companions, the record is sort of good however the switch ratio is sort of poor with many of the companions.

Some worthy & well-liked companions with good switch ratio are as beneath:

- Airways: Air Canada, Air France-KLM, Cathay Pacific, British Airways (all at 1:1)

- Resorts: Accor (2:1), Shangri La (6:1)

The SBI Miles Elite Credit score Card gives a stable record of resort companions. Nevertheless, the conversion ratios for factors could possibly be improved to make it extra aggressive.

That mentioned, it’s good to see that SBI Miles Elite Credit score Card is a part of the current 10% Bonus miles Promo on Cathay Pacific. So if extra such switch gives kicks in, the cardboard would possibly get some traction.

Milestone Profit

| SPEND REQUIREMENT | MILESTONE BENEFIT | Reward Price |

|---|---|---|

| 12 Lakhs | 20,000 Journey Credit | ~1.7% |

Milestone profit on SBI Miles Elite Credit score Card is actually fairly good as you get virtually 1.7% return on 12L spend.

So the efficient reward charge on 12L spend is 2.7% on common spends or 4.7% on journey spends which appears to be like good.

However a single milestone feels limiting, virtually like flying all the best way to Europe solely to go to one nation. The place’s the journey in that?

Lounge Entry

| MEMBERSHIP TIER | Major | Major + Company (Spend based mostly) |

|---|---|---|

| Home | 2/Qtr | Upto 15 |

| Worldwide | 2/Qtr | – |

- Get 1 additional home lounge entry vouchers for every 1L spend, upto 15

- A Voucher Code can be despatched through SMS and E-Mail inside 120 days of buyer turning into eligible. To redeem, buyer wants to use the Voucher and replace journey particulars on Lounge Key.

The worldwide airport lounge entry restricted to 2 per quarter is inferior for a 5K charge card. I want extra playing cards comes with no quarterly restrict, like HDFC Regalia Gold.

Whereas the spend linked lounge entry vouchers are new and noteworthy, it is mindless to attend for 4 months to make use of it, therefore making it virtually ineffective for many cardholders.

And to not point out, the given hyperlink to redeem these lounge vouchers doesn’t work for a lot of months now.

Options and Advantages

- Lack of check-in baggage as much as ₹ 72,000

- Delay of check-in baggage ₹ 7,500

- Lack of journey paperwork as much as ₹12,500

- Baggage harm cowl as much as ₹5,000

Arms on Expertise

I utilized for the SBI Miles Elite Credit score Card few months in the past to expertise the cardboard and to see some recent design after a very long time.

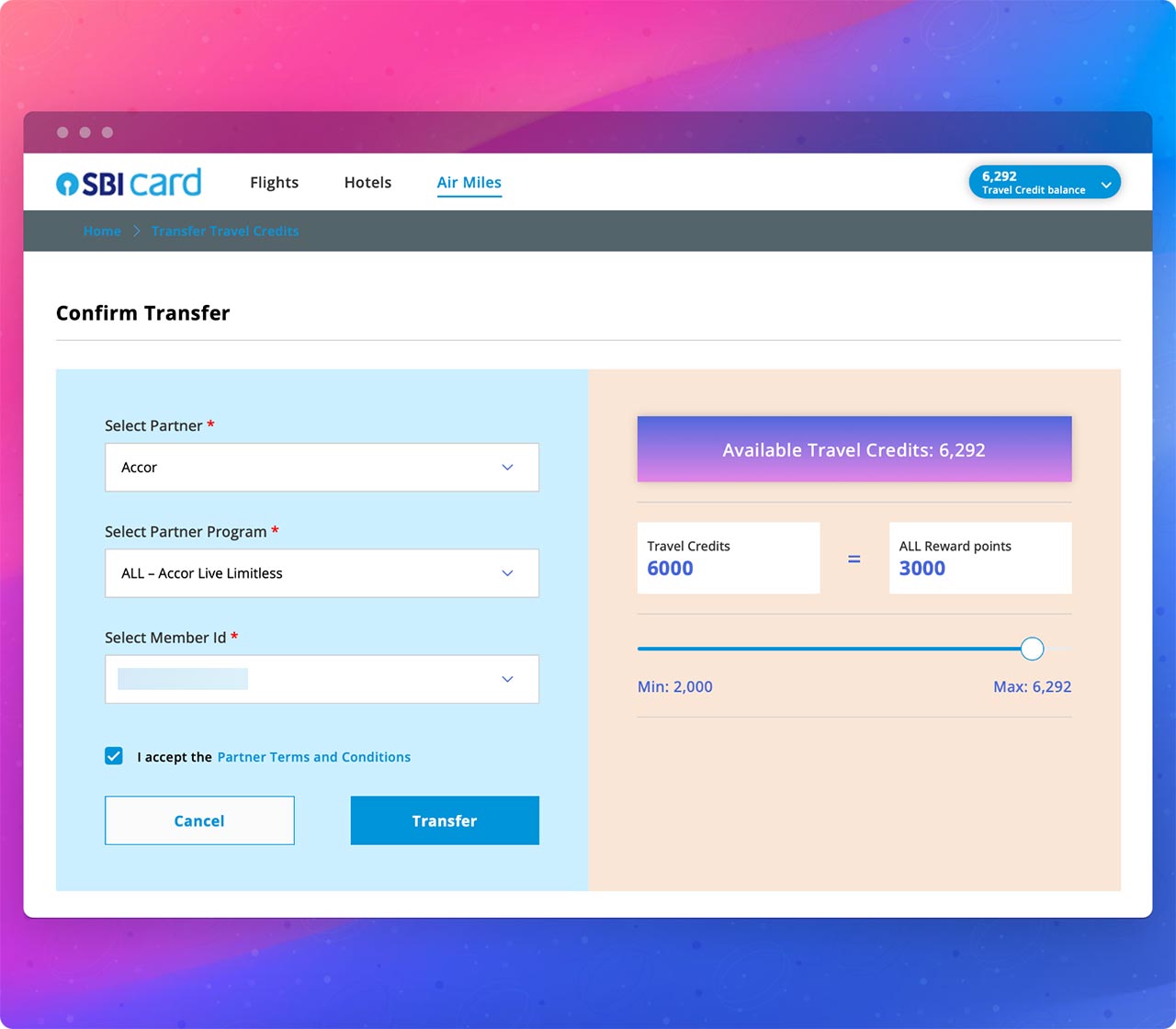

The 5,000 Journey Credit arrived inside a couple of weeks of finishing the ₹1L spend. Nevertheless, the factors switch portal was initially buggy, requiring a day to perform correctly.

As soon as fastened, I transferred factors to Accor, and the factors mirrored inside two days—much like how Axis Financial institution processes transfers.

Must you Apply?

I took the SBI Miles Elite Credit score Card assuming that there can be some backup card to earn Aeroplan/Accor factors past the cap on Axis Magnus Burgundy.

However now that HSBC TravelOne card is there to serve that objective with higher advantages, I believe SBI Miles Elite doesn’t do any justice going ahead.

However in the event you discover HSBC Playing cards restricted by serviceable areas or in the event you’re within the milestone profit to earn rewards on big selection of classes, SBI Miles Elite Card could come useful.

To use, You’ll have to open the hyperlink on desktop (not cell), click on on “begin apply journey” and click on on “change card” and select “SBI Card Miles Elite”.

Bottomline

SBI Miles Elite Credit score Card, the primary miles-focused providing from SBICard fails to face out for many cardholders on this phase except they’ve already maxed out rewards on the extra profitable Axis Atlas Credit Card.

In consequence, it stays not often seen in circulation and is prone to keep that manner except SBICard enhances its worth proposition or Axis Atlas undergoes devaluation.