The Scapia Credit score Card is a co-branded card issued by Federal Financial institution in partnership with Scapia, who markets and distributes the cardboard.

Scapia Credit score Card is designed for the new-age travellers preferring to have journey experiences as rewards over the same old cashback sort rewards.

The Scapia app is fashionable, simple to make use of, and presents one of many smoothest software processes within the nation. Right here’s all the pieces that you must know concerning the Federal Financial institution Scapia Credit score Card in it’s present type:

Overview

| Kind | Journey Credit score Card |

| Reward Price | Upto 4% |

| Eligibility | 750+ CIBIL Rating helps |

| Becoming a member of / Renewal Payment | Nil [Lifetime Free] |

| Greatest for | Journey Spends & redemptions |

| USP | 0% Foreign exchange |

When you look nearer, Scapia is an attention-grabbing card: it’s an entry-level card, but presents advantages like a journey card with a reward fee pretty much as good as premium playing cards and a person expertise matching super-premium ones.

So no matter which section you belong, you would possibly nonetheless love this card.

*** Greatest Free Journey Card of 2025 ***

Earn Scapia Cash

| SPEND TYPE | Scapia Cash | Reward Price |

|---|---|---|

| Common Spends | 10% | 2% |

| Journey Spends (on Scapia App) |

20% | 4% |

- Excluded class for rewards: Lease, Training, Present Playing cards, Gasoline, Authorities Spends & Pockets High-Ups

- Scapia Cash worth: 0.20 INR/coin

The Scapia Credit score Card offers 2% base reward fee, which is nice for a lifetime free card, nonetheless the reward fee on journey spends may have been larger, because it’s restricted to spends performed on the app.

When you’re searching for higher rewards, you would possibly just like the 5% cashback on online spends with SBI Cashback Credit score Card.

Be aware: The 10% or 20% Scapia cash talked about on the app as earn fee is about cash, not precise proportion.

Further Phrases:

- Utility and telecom invoice funds earn 2% reward fee on spends as much as ₹20,000 per billing cycle

- Utility (or) Gasoline spends over 50,000 INR will entice 1% charge (upto 3K INR)

- Lease & Pockets Load will entice 1% charge (max. upto 3K INR)

- 1% Gasoline surcharge waiver as much as ₹5000/txn

Redeem Scapia Cash

Scapia cash can be utilized not only for flights and inns, but additionally for buses, trains and even Visa, a novel function. Nevertheless, Visa redemptions are bit dear from what I see.

The excellent news is you possibly can redeem 100% of your Scapia cash for journey.

Foreign exchange Markup Payment

- Foreign exchange Markup Payment: 0%

- Reward fee on Intl. Spends: 0%

- Internet achieve: 0%

0% foreign exchange markup is often seen solely on choose premium playing cards, however the Scapia Credit score Card brings it to everybody, serving to particularly freshmen save rather a lot on worldwide spends.

Lounge Entry

| ACCESS TYPE | VIA | LIMIT |

|---|---|---|

| Home Lounge Entry | Visa | Limitless |

- Spend Requirement: 10,000 INR per 30 days on Visa (or 15K INR on Rupay)

It’s certainly a shock to see limitless lounge entry on the cardboard with spend requirement as little as 10,000 INR, which is honest sufficient.

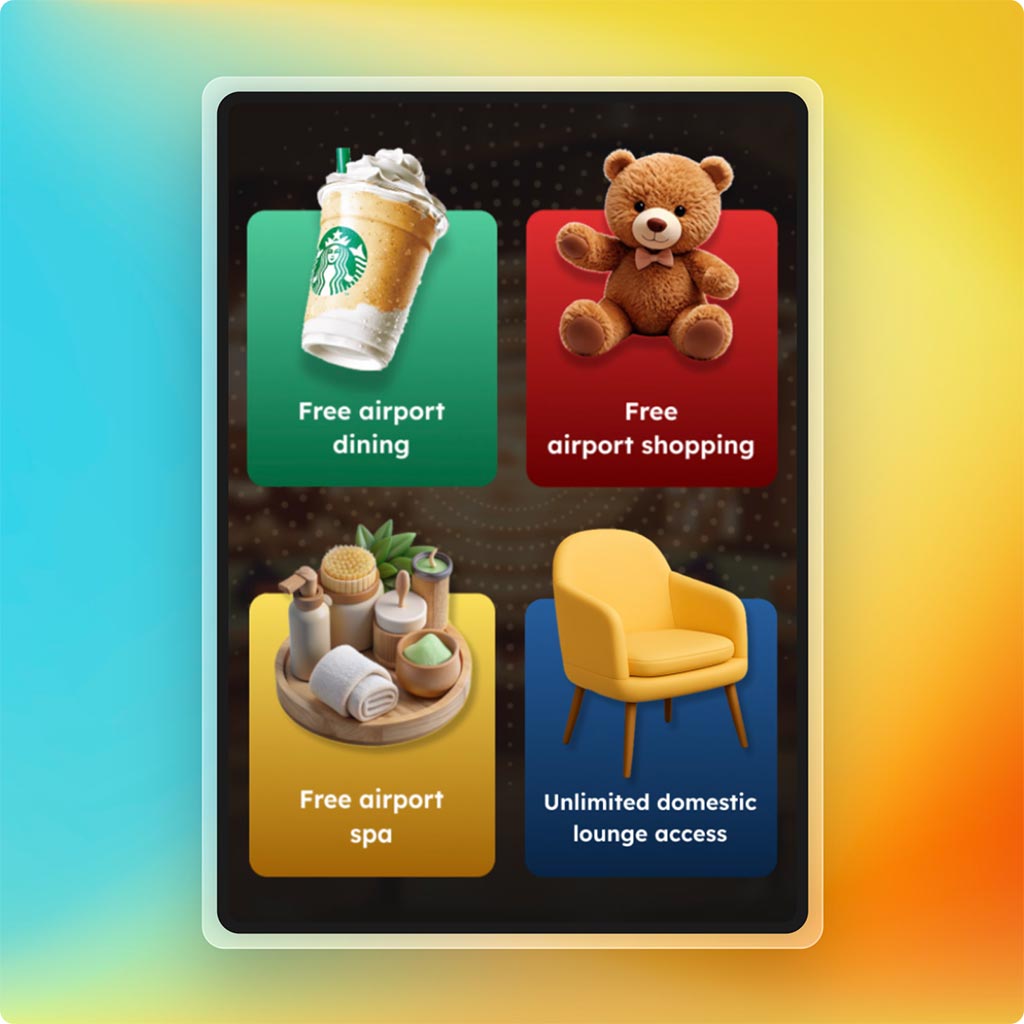

Talking of lounge entry, it’s one of many 4 choices you possibly can select underneath the airport privileges profit on this card. Let’s take a look at them intimately:

Airport Privileges

- Choices: Store, Dine, Spa, Lounge.

- What you get? 100% again as factors on airport store/dine spends

- Max Cap: Upto 1,000 INR per go to

- Restrict: 1 entry (both of above) for each departure.

This can be a distinctive profit that the majority different playing cards don’t provide, and it’s a superb thought. Assuming you get lounge entry on different playing cards, you should utilize this profit to buy one thing on the airport.

It could be good to see extra playing cards providing a profit like this in future, maybe with 100% cashback as an alternative of factors.

On this case, as an alternative of paying the lounges in your entry, they pay that quantity to you, however in factors, which works out even higher for them.

Right here’s the way it works:

- Meet the spend requirement. (10K INR on Visa; 15K INR on Rupay)

- Open the app, choose the choice: Store, Dine, Lounge, Spa

- Activate the outlet the place you wish to spend.

- Spend utilizing the cardboard.

You’ll get Scapia cash price as much as ₹1,000 at metro airports (Mumbai, Delhi, Bangalore, Chennai, Kolkata, Hyderabad) and ₹500 at different airports.

The profit applies to each “Departure” (not arrival) and there’s no restrict on what number of instances you possibly can avail this, so it’s an excellent profit in case you fly typically.

The app is nicely designed to grasp the entire course of, so that you gained’t go clueless.

Basically, each time you go to the airport, you will have an choice to go for some free purchasing if lounge is just not your factor.

Palms-on Expertise

I utilized for the Scapia Credit score Card through the app, and it was one of many smoothest bank card software experiences I’ve had in current instances.

It took me lower than 10 minutes to use, and the KYC was scheduled instantly, taking one other 10 minutes or so.

The cardboard was permitted inside a day, with the digital card prepared for immediate use. The bodily card arrived in about three days.

Whereas the onboarding was nice, the app was even higher.

The UI isn’t just lovely but additionally extremely practical. Each element is thoughtfully designed, delivering a buttery-smooth expertise I’ve in any other case solely seen in prototypes.

Must you get it?

Sure, Completely!

The Scapia Federal Credit score Card comes with varied advantages like: 0% Foreign exchange, 2% Base Rewards, Lounge Entry (or) Airport Buying price 1,000 INR on each journey.

And all of that given on a Lifetime Free Card. When you’re into journey, it is a should have bank card in your pockets.

*** Greatest Lifetime Free Credit score Card ***

Backside line

Scapia Federal Financial institution Credit score Card is a splendidly rewarding lifetime free bank card for contemporary travellers searching for journey experiences as rewards.

Aside from the cardboard advantages, the app is nicely built-in with the financial institution, permitting us to carry out all key actions seamlessly inside the app.

General, it’s vital bank card for any traveler, and I hope they provide you with a premium or super-premium variant sooner or later.

Do you maintain Scapia Federal Credit score Card? Be at liberty to share your expertise within the feedback beneath.