Selecting between VA dwelling loans and standard mortgages generally is a pivotal determination for homebuyers. At My Good Mortgage, we perceive the significance of creating an knowledgeable alternative that aligns together with your monetary objectives and circumstances.

On this publish, we’ll examine VA dwelling loans vs standard mortgages, highlighting their key options, advantages, and potential drawbacks. By the top, you’ll have a clearer understanding of which possibility could be the very best match in your distinctive state of affairs.

- Lending in MI, OH, TN, FL, CO, MN, & PA

- Fast responses, so that you’re by no means left ready.

- Mortgage Choices designed to suit your monetary objectives.

- Easy Software Course of with Clear Communication

- Over 7,000 5 Star Critiques

- Accessible in CA, FL, GA, IL, MD, PA, and TX

- Experience & Steering

- Credit score Help

- Belief & Transparency

- Reasonably priced Lending Choices

- Lend in all 50 states

- Veteran lending specialist obtainable to you, regardless of the place you’re

- In-house processing and underwriting

- Categorical Mortgage Approval program, which lets you be achieved with the entire course of (minus the contract and appraisal), so you possibly can deal with discovering your private home.

- Price Defend (Lock & Store) lock in your charge earlier than you even discover a dwelling!

What Are VA Residence Loans?

VA dwelling loans supply a strong path to homeownership for veterans, active-duty service members, and eligible surviving spouses. These loans, backed by the U.S. Department of Veterans Affairs, present distinctive advantages that distinguish them from standard mortgages.

Eligibility Necessities

To qualify for a VA mortgage, you need to meet particular service necessities:

- At the least 24 steady months, or

- The total interval (at the least 90 days) for which you had been referred to as to lively responsibility

Surviving spouses of service members who died within the line of responsibility or on account of a service-connected incapacity can also qualify.

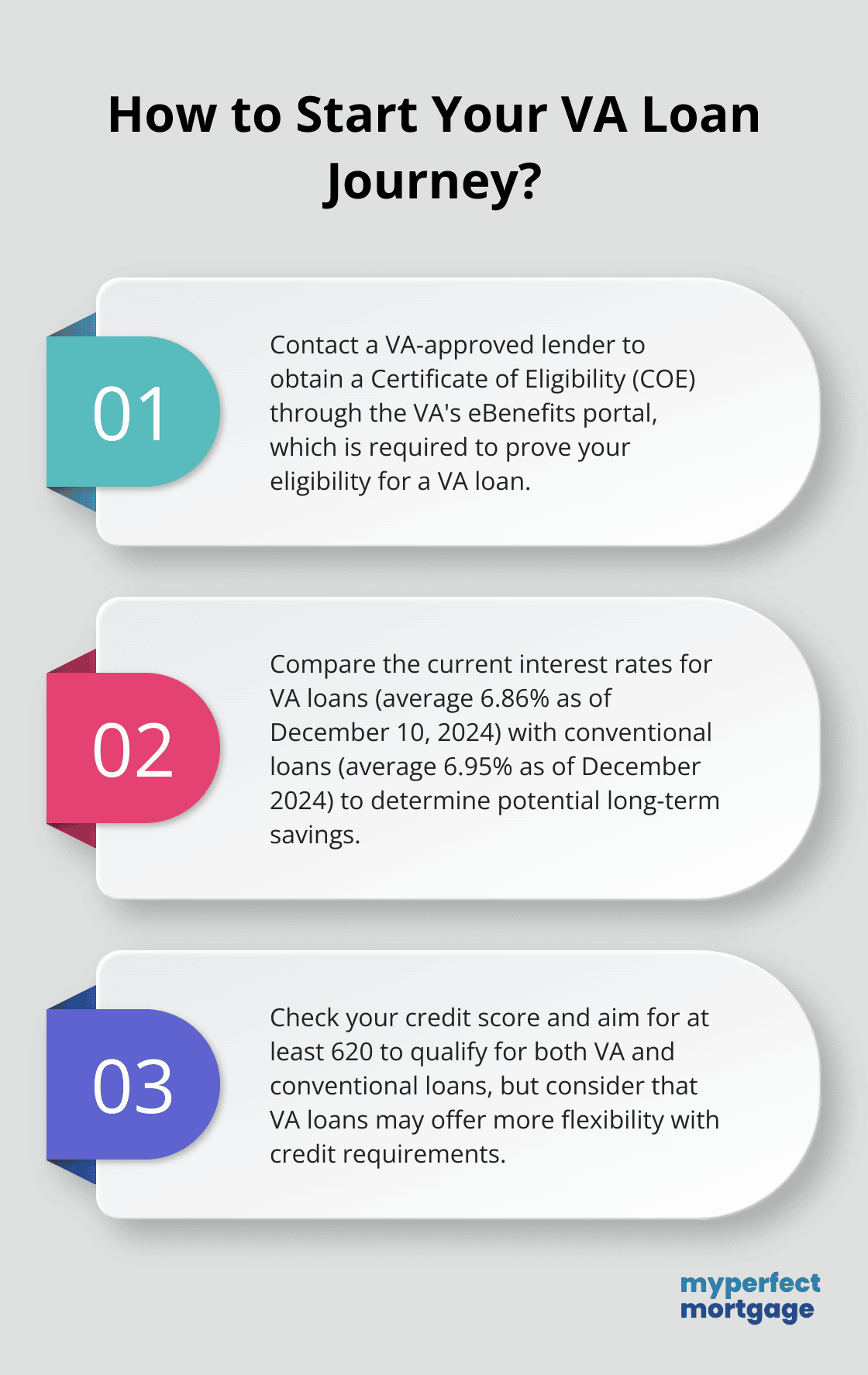

You have to receive a Certificates of Eligibility (COE) to show your eligibility to lenders. Request this doc via the VA’s eBenefits portal or a VA-approved lender.

Key Options

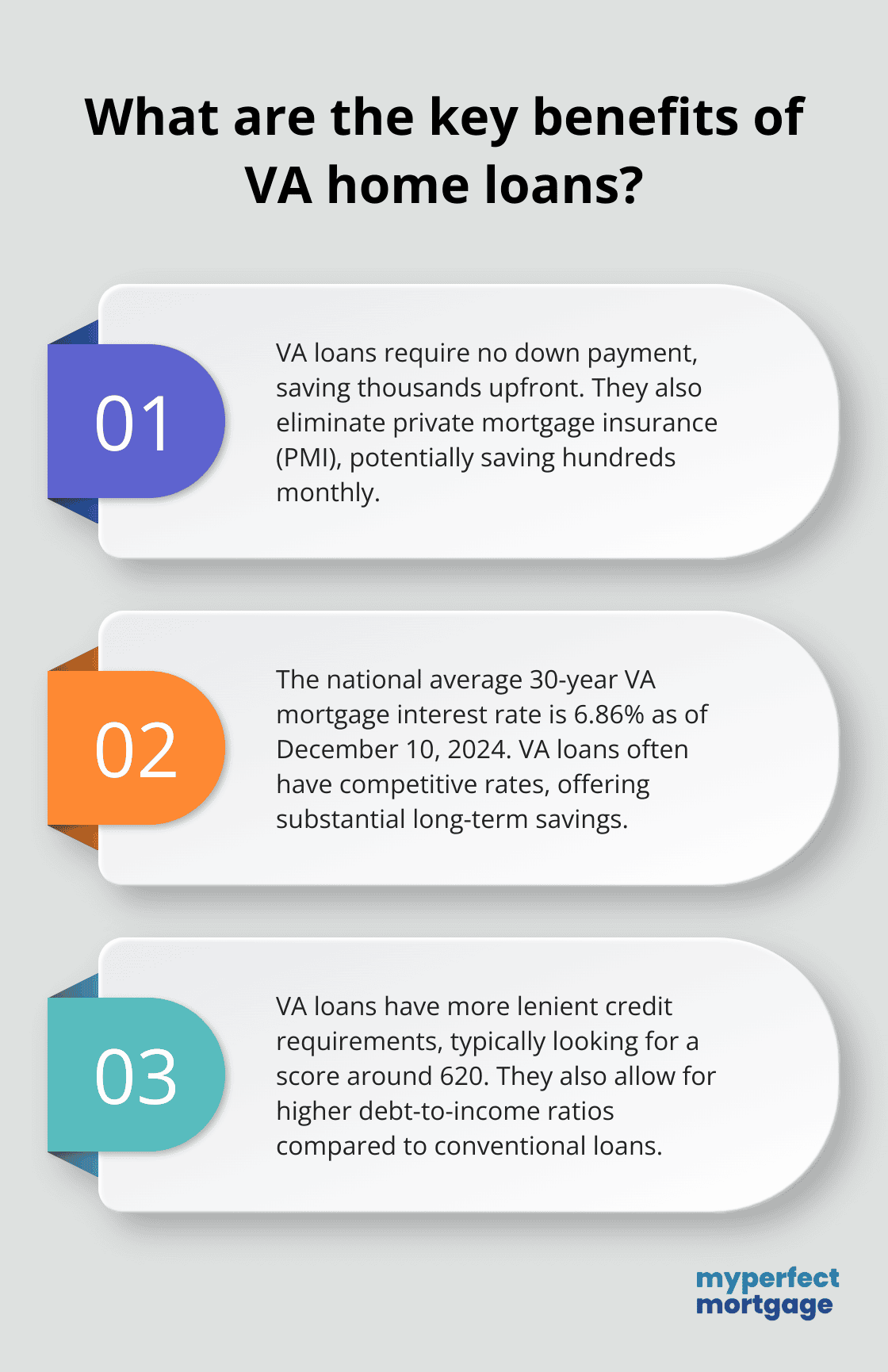

VA loans stand out for his or her favorable phrases. Probably the most important benefit is the power to buy a house with no down payment, which might prevent 1000’s of {dollars} upfront and make homeownership extra accessible.

One other standout function is the absence of personal mortgage insurance coverage (PMI). Standard loans usually require PMI for down funds lower than 20%, which might add a big quantity to your month-to-month funds. VA loans remove this further price, probably saving you lots of of {dollars} every month.

VA loans additionally typically include competitive interest rates. As of December 10, 2024, the nationwide common 30-year VA mortgage rate of interest is 6.86%. This charge can translate to substantial financial savings over the lifetime of your mortgage.

Advantages for Veterans and Service Members

VA loans prolong past monetary benefits. These loans supply extra forgiveness relating to credit score necessities. Whereas the VA doesn’t set an official minimal credit score rating, many lenders search for a rating of round 620. This flexibility can considerably assist veterans who’ve confronted credit score challenges.

VA loans additionally permit for extra lenient debt-to-income (DTI) ratio necessities. Standard loans typically cap DTI at round 43%, however VA loans might allow greater ratios (providing you with extra flexibility in qualifying for a mortgage).

Mortgage Limits and Property Varieties

VA loans don’t impose mortgage limits for debtors with full entitlement. This function permits eligible veterans to buy higher-priced properties while not having a down fee (so long as they qualify for the mortgage quantity).

These loans primarily serve for buying main residences. Nonetheless, you should use a VA mortgage to purchase a multi-unit property (as much as 4 items) so long as you occupy one of many items as your main residence.

As we transition to exploring standard mortgages, it’s vital to notice that whereas VA loans supply quite a few advantages, they’re not the one possibility obtainable. Understanding the options of standard loans will provide help to make an knowledgeable determination about which mortgage sort most closely fits your wants.

What Are Standard Mortgages?

Standard mortgages signify the commonest sort of dwelling loans in the USA. Non-public lenders supply these loans with out authorities insurance coverage, distinguishing them from government-backed choices like VA or FHA loans. Fannie Mae and Freddie Mac held or securitized a big proportion of residential mortgage debt excellent from 1990 to 2010.

Qualification Standards

Debtors usually want a credit score of at least 620 to qualify for a standard mortgage. Increased scores typically lead to higher rates of interest. Experian reviews that the common FICO rating for standard buy loans reached 757 in 2023.

Down funds for standard loans begin at 3% of the house’s buy worth. A down fee of 20% or extra eliminates the necessity for personal mortgage insurance coverage (PMI), which might considerably scale back month-to-month funds.

Lenders assess the debt-to-income (DTI) ratio of candidates. Most want a DTI of 43% or decrease, although some might settle for as much as 50% for well-qualified debtors.

Varieties of Standard Mortgages

Standard loans fall into two most important classes: conforming and non-conforming.

Conforming loans adhere to pointers set by Fannie Mae and Freddie Mac. In 2024, the conforming mortgage restrict for single-family properties in most areas stands at $766,550. Loans exceeding this quantity (generally known as jumbo loans) typically have stricter necessities.

Mounted-rate mortgages supply stability with constant month-to-month funds all through the mortgage time period. Adjustable-rate mortgages (ARMs) begin with decrease charges that may change over time, probably resulting in financial savings or greater prices relying on market circumstances.

Benefits for Debtors

Standard loans supply flexibility that government-backed loans can’t match. Debtors can use them for main residences, second properties, or funding properties (a versatility that draws a variety of candidates).

These loans typically lead to decrease total prices. Whereas upfront charges could be greater, standard loans don’t embody the funding charges related to government-backed loans. This distinction can translate to important financial savings over time.

Standard loans usually shut quicker than government-backed choices. In line with ValuePenguin, as of February 2019, closing occasions have maintained a decent vary of 42 to 48 days averaged throughout all mortgage varieties over the previous 18 months.

Debtors with robust credit score and monetary profiles typically obtain probably the most aggressive rates of interest with standard loans. As of December 2024, Freddie Mac reviews the common 30-year fastened standard mortgage charge at 6.95%.

The flexibleness and potential price financial savings of standard mortgages make them a beautiful possibility for a lot of debtors. Nonetheless, to make an knowledgeable determination, it’s important to compare these loans with other options like VA loans. The following part will discover the important thing variations between VA and standard loans, serving to you identify which possibility aligns greatest together with your monetary objectives and circumstances.

VA vs Standard Loans: Key Variations

VA and standard loans differ considerably in a number of points that may affect your private home shopping for journey. This comparability will provide help to make an knowledgeable determination about which mortgage sort fits your wants greatest.

Down Cost Necessities

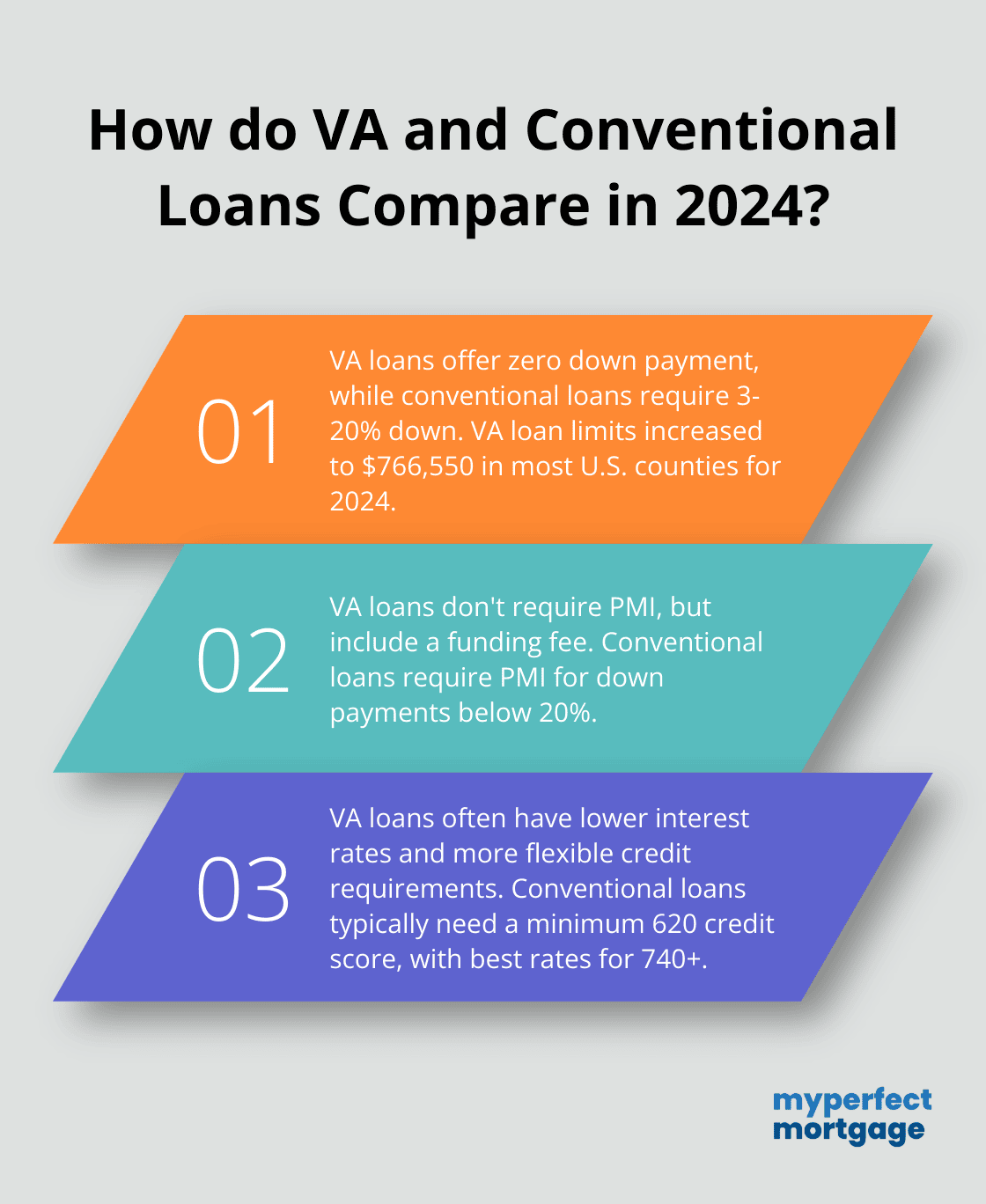

VA loans stand out with their zero down fee possibility for eligible debtors. This function could make homeownership extra accessible for veterans and repair members who lack substantial financial savings.

Standard loans, nevertheless, usually require a down fee between 3% and 20% of the house’s buy worth. This distinction can quantity to 1000’s of {dollars} in upfront prices.

Curiosity Charges and Charges

VA loans typically supply extra aggressive rates of interest. Nonetheless, VA loans embody a funding price. Whereas this price could be included within the mortgage, it represents an extra price. Standard loans don’t have this price however might incur greater closing prices.

Mortgage Insurance coverage Concerns

VA loans don’t require personal mortgage insurance coverage (PMI), which might save debtors in comparison with standard loans with lower than 20% down fee.

Standard loans usually require PMI when the down fee is under 20%. This extra price can considerably have an effect on your month-to-month funds.

Mortgage Limits and Flexibility

VA loans supply extra flexibility by way of mortgage limits. About VA Loan Limits. VA mortgage limits acquired an enormous improve in 2024. The usual VA mortgage restrict in 2024 is $766,550 for many U.S. counties.

Standard loans have conforming mortgage limits. In 2024, the restrict for single-family properties in most areas is $766,550. Loans exceeding this quantity turn out to be jumbo loans, which frequently include stricter necessities and better rates of interest.

Credit score Rating Necessities

Credit score rating necessities current one other key distinction. Whereas the VA doesn’t set a minimal credit score rating, many lenders search for a rating round 620 for VA loans. Some lenders might approve VA loans with scores as little as 580, relying on different components.

Conventional loans typically require higher credit scores. Most lenders want a minimal rating of 620, with the very best charges typically reserved for debtors with scores of 740 or greater.

Last Ideas

VA dwelling loans and standard mortgages every supply distinct benefits for homebuyers. VA loans present zero down fee choices and aggressive rates of interest for eligible veterans and repair members. Standard loans supply flexibility in property varieties and probably decrease total prices for debtors with robust credit score profiles and bigger down funds.

Your monetary state of affairs, long-term objectives, and eligibility standing ought to information your determination between VA dwelling loans vs standard choices. Credit score scores considerably affect this alternative, with VA loans typically having extra lenient necessities and standard loans rewarding greater scores with higher charges. Think about your plans for the property, as VA loans primarily serve main residences whereas standard loans permit for second properties or investments.

At My Good Mortgage, we simplify the mortgage course of and provide help to discover the very best mortgage in your distinctive state of affairs. We match you with perfect lenders based mostly in your monetary profile and supply instruments to assist your decision-making. My Perfect Mortgage can information you thru the method, making certain you make an knowledgeable alternative that aligns together with your homeownership objectives.

Our advise is predicated on expertise within the mortgage business and we’re devoted to serving to you obtain your purpose of proudly owning a house. We might obtain compensation from companion banks once you view mortgage charges listed on our web site.