It has been virtually a 12 months with the IDFC First Bank Mayura Credit Card and it’s time for renewal. Given a number of playing cards within the pockets, I’ve spent solely a few lakh on the cardboard, so paying the annual charge doesn’t really feel price it.

So earlier than the renewal charge was charged, I referred to as buyer care to verify if there was any retention profit. The manager raised a cancellation request and mentioned I’d get callback in just a few days.

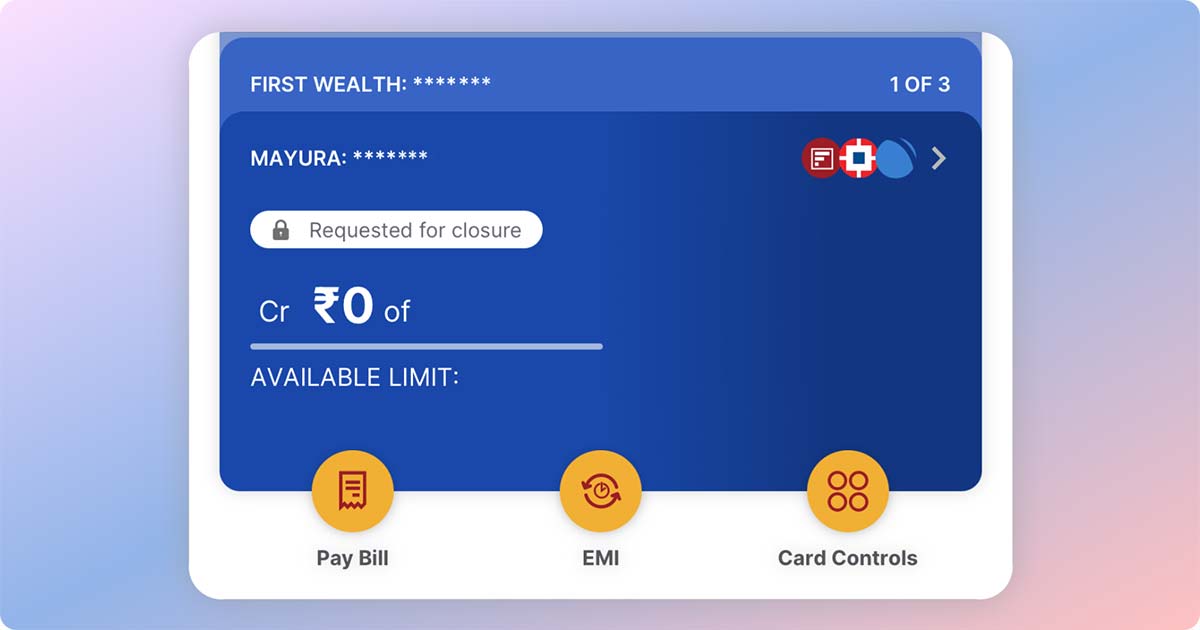

Shortly after, the app displays “requested for closure” towards Mayura. That’s a pleasant consideration to element.

I obtained a callback in three days and was supplied a retention bonus of: 1,500 reward factors.

I do not know why anybody would assume such a small provide is affordable for a premium card, virtually an excellent premium one.

A buddy with the IDFC First Ashva Credit score Card instructed me he obtained 2,000 factors as a retention profit a month in the past. So it feels unusual to see only one,500 factors on Mayura.

I perceive the worth distinction in journey redemption, but it surely nonetheless feels too low for the annual charge. It does make sense for these spending 15 lakh a 12 months, however not for others.

That mentioned, my spends weren’t excessive sufficient to count on extra, however even when I had accomplished increased spend I nonetheless doubt if they’ve a system for dynamic gives primarily based on spend.

Whereas a greater retention provide is crucial, it could be a lot better in the event that they introduce a focused spend requirement for waiver, like Amex used to do.

Have you ever acquired a greater retention provide in your IDFC First Financial institution paid bank cards? Be at liberty to share your expertise within the feedback under.