This information covers how the mortgage underwriting course of works. The mortgage processor will put together a debtors file and get it prepared for the mortgage underwriter to overview. As well as, your creditworthiness shall be assessed by contemplating your credit score rating, which is a numerical indication starting from 300 to 850. In case you are planning to purchase a home and want a mortgage, you could undergo the mortgage underwriting course of referred to as underwriting. Alex Carlucci, a senior loan officer at GCA Forums Mortgage Group, explains how the mortgage underwriting course of works as follows:

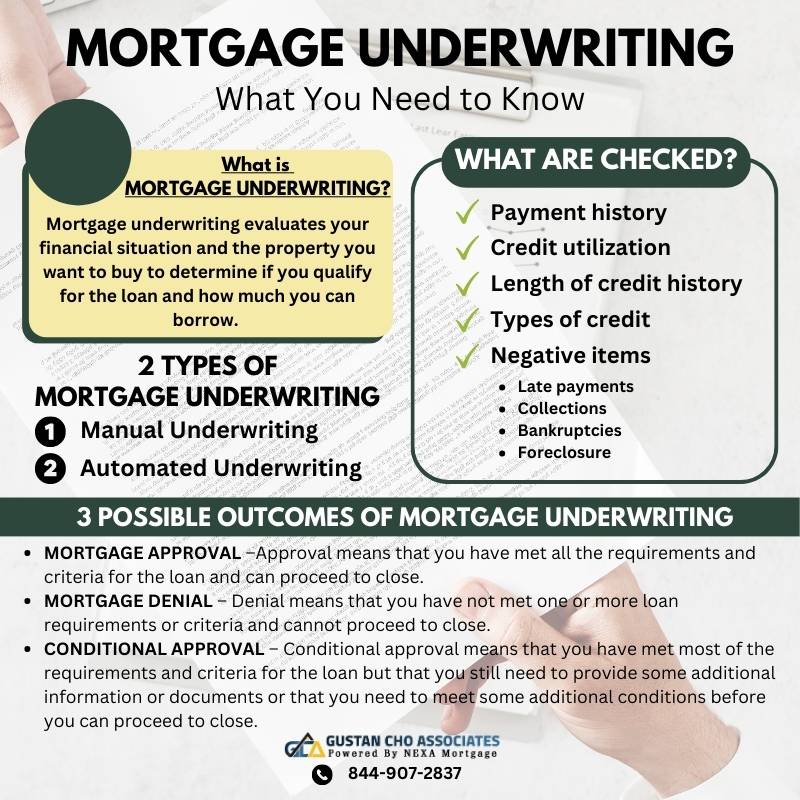

Mortgage underwriters will examine your credit score report from a number of of the foremost credit score bureaus (Equifax, Experian, or TransUnion) and take a look at your cost historical past, credit score utilization, size of credit score historical past, varieties of credit score, and any unfavourable gadgets, resembling late funds, collections, bankruptcies, foreclosures.

The mortgage underwriting course of evaluates your monetary state of affairs and the property you need to purchase to find out when you qualify for the mortgage and the way a lot you may borrow. The mortgage underwriting course of is a vital step within the home buying process, as it will possibly have an effect on your probabilities of getting accepted for the mortgage and the phrases and situations of the mortgage. Within the following paragraphs, we’ll cowl how the mortgage underwriting course of works.

What Are the Important Elements in The Mortgage Underwriting Course of

Mortgage underwriters take a look at three important components when assessing your mortgage software: credit score, earnings, and collateral. These components are also referred to as the three Cs of mortgage underwriting. Credit score, Capital, and Collateral: Your credit score historical past and rating present how nicely you might have managed your money owed up to now and the way seemingly you might be to repay your mortgage on time. Sometimes, the upper your credit score rating, the higher the chance of mortgage approval and acquiring a extra favorable rate of interest. Chad Bush, a dually licensed mortgage officer and actual property agent with GCA Forums Mortgage Group says the next in regards to the mortgage underwriting course of:

When assessing your mortgage software, underwriters will validate your earnings by inspecting your pay stubs, tax returns, W-2 varieties, financial institution statements, and different related paperwork that confirm your earnings.

Your earnings displays each the quantity you earn and the soundness and reliability of your earnings supply. Moreover, they’ll contemplate your debt-to-income ratio (DTI), the share of your month-to-month earnings allotted in direction of debt reimbursement. Sometimes, a decrease DTI enhances your approval prospects and will increase the potential for acquiring a bigger mortgage. Your collateral is the property you need to purchase with the mortgage. Click Here to start your mortgage underwriting process

What are The Totally different Kinds of Mortgage Underwriting Course of?

You should know some issues about mortgage underwriting course of and the way it works. We are going to focus on what’s the mortgage underwriting course of and the way it works. The mortgage underwriting course of varies relying on components resembling the kind of mortgage you’re making use of for and the particular lender you’re working with. Listed below are some widespread varieties of mortgage underwriting course of:

- Handbook underwriting: Handbook underwriting is when a human underwriter critiques your mortgage software and paperwork and decides based mostly on their judgment and expertise.

- Automated underwriting: Automated underwriting is when a pc program or software program analyzes your mortgage software and paperwork and decides based mostly on a predefined algorithm and tips.

- Automated underwriting may be quicker and cheaper than guide underwriting, as it will possibly course of extra functions in much less time and with fewer errors.

Handbook underwriting may be extra versatile and lenient than automated underwriting, as it will possibly contemplate extra components and circumstances which may not match into a typical formulation or standards. Handbook underwriting may be extra time-consuming and dear than automated underwriting, requiring extra human assets and experience.

What Are The Potential Outcomes of The Mortgage Underwriting Course of?

Automated underwriting may be extra constant and goal than guide underwriting, because it doesn’t contain human bias or emotion. Nonetheless, automated underwriting will also be extra inflexible and strict than guide underwriting, it won’t account for nuances or exceptions that have an effect on your eligibility or suitability for the mortgage. Mortgage underwriting can lead to one in all three doable outcomes: approval, denial, or conditional approval.

- Mortgage Approval –Approval means that you’ve met all the necessities and standards for the mortgage and may proceed to shut. Approval doesn’t essentially imply you’ll get the precise mortgage quantity or rate of interest you utilized for, as these may change relying on market situations or different components.

- Mortgage Denial – Denial signifies that you haven’t met a number of mortgage necessities or standards and can’t proceed to shut. Denial can occur for varied causes, resembling having a low credit score rating, a excessive DTI, a low LTV, a poor property appraisal, or inadequate earnings or belongings.

- In case you are denied the mortgage, you may attempt to enhance your state of affairs and reapply later, or you may search for different mortgage choices or lenders with totally different requirements or applications.

- Conditional approval – Conditional approval means that you’ve met a lot of the necessities and standards for the mortgage however that you simply nonetheless want to offer some extra info or paperwork or that you’ll want to meet some extra situations earlier than you may proceed to shut.

Conditional approval is quite common in mortgage underwriting, as some particulars or points may must be clarified or resolved earlier than the ultimate approval. Some widespread situations embody offering up to date pay stubs, financial institution statements, tax returns, and so forth., clearing up any discrepancies or errors in your credit score report, offering proof of house owners insurance coverage. If you happen to obtain conditional approval, you must fulfill the situations instantly and talk along with your lender and underwriter.

Abstract of The Mortgage Underwriting Course of

Mortgage underwriting is a crucial and complicated course of that determines whether or not you qualify for a mortgage mortgage and the way a lot you may borrow. Mortgage underwriting entails evaluating your credit score, earnings, and collateral based mostly on varied components and standards. Mortgage underwriters will appraise the worth and situation of the property by its options, location, market tendencies, comparable gross sales, and so forth.

Mortgage underwriters may even take a look at the loan-to-value ratio (LTV), the share of the property’s worth you need to borrow. Typically, the decrease your LTV, the higher your probabilities of getting accepted for the mortgage and a decrease rate of interest.

Mortgage underwriting may be performed manually or robotically, relying on the kind of mortgage and lender. Relying on the

analysis end result, mortgage underwriting can lead to approval, denial, or conditional approval. By understanding how mortgage underwriting works and what to anticipate from it, you may put together your self higher and improve your probabilities of getting accepted for the mortgage and shopping for your dream home. Click Here to connect with our expert loan officers

FAQ on How The Mortgage Underwriting Course of Works

The mortgage underwriting course of is critical as it’s one step towards approving a house mortgage.

So, What Are The Particulars of The Mortgage Underwriting Course of?

Right here is a proof: For step one, the mortgage software course of begins when a mortgage software is filed, and monetary info, employment standing, and credit score profile are offered. You’re required to offer any of your earlier job exercise facilities. Useful resource Documentation: The mortgage processor does the entire above documentation by means of a scientific assortment and compilation strategy. It comprises tax varieties, financial institution data, stubs of funds, and lots of others.

Credit score Verify

This consists of how the borrower’s credit score historical past and rating are seen to find out if the borrower may be trusted to repay the mortgage. Most lenders don’t look very kindly on missed installments or cost obligations the place installment borrowings are extreme.

Debt-to-Earnings Ratio

The DTI is the debt-to-income ratio, an estimated ratio that the underwriter’s statistical mortgage software will decide to make sure reimbursement.

Property

These figures are in contrast with the overall excellent liabilities to establish how way more the borrower shall be required to place down as safety.

Property Price

On this context, value determinations are key to assessing the worth of the property acquired as a part of the mortgage.

Title Insurance coverage

Title searches to ascertain whether or not the property has any present authorized points, after which the wanted title insurance policies are acquired.

Last Resolution

The underwriter is liable for making a remaining choice based mostly on the knowledge collected and their analytic expertise. If all the pieces checks out, you’ll have credit score amenities prolonged to you! In the very best case situation, the period of the entire course of is just restricted to some days, and within the worst case, it may be just a few weeks, based mostly on the paperwork requested from you and the tempo of labor of the particular lender.