On this weblog, we’ll cowl and focus on the top-rated five-star Washington DC lenders for conventional and non-QM mortgages who’ve the most effective mortgage charges. Washington, DC has one of many highest house costs within the nation. Whether or not you might have nice credit score, low credit score, or are looking for distinctive non-QM and different financing loans with multiple mortgage options, and competitive rates, you’ll discover the knowledge on this information.

We’ll clarify how to buy the most effective Washington DC lenders for conventional and non-QM mortgages. As Gustan Cho Associates continues to develop our staff, we’re additionally increasing our record of states we’re licensed in.

One of many principal the reason why Gustan Cho Associates, empowered by NEXA Mortgage, LLC has a nationwide five-star popularity is as a result of we’ve got the states (licensed in 48 states), we’ve got the most effective and extensive number of mortgage mortgage choices (lending community with 280 wholesale lending companions), and we’ve got the bottom mortgage charges (We now have our compensation on a dealer comp platform which limits the max compensation for the entire firm at 2.75% the place mortgage bankers must cost over 5% to 9% compensation on the back-end).

Washington DC Housing Market within the Information

With lots of consideration on nationwide politics today, D.C. is on the radar of most Individuals. Lots of our readers dwell within the District of Columbia. The Nationwide Multistate Licensing System (NMLS) requires a mortgage firm to have a particular license. The housing market in Washington, DC has been booming for a few years. Lastly, within the fourth quarter of 2024, the housing market in Washington, DC has stabilized and looks as if there’s a correction.

Median house costs from $575,500 in June of 2023 to $535,000 in November 2023. Housing stock has elevated 17.8% since June 2024.

Houses in Washington, DC sat out there thrice longer from November 2023 till November 2024 than it did the identical time interval the earlier yr. Gustan Cho Associates have been simply granted this license. On this weblog, we’ll element some information concerning the District of Columbia, pattern just a few mortgage merchandise provided by Gustan Cho Associates, and methods to apply for a mortgage with our staff.

The Greatest Washington DC Lenders For Excessive-Steadiness Conforming Loans

Our staff may be very excited to supply our mortgage providers in our nation’s capital. As we discovered in elementary college, Washington D.C. shouldn’t be a metropolis or a state however is a federal district that has been in existence since 1790. The federal district has a population of nearly 700,000 people. The historical past of Washington D.C. runs very deep.

FHA and Conforming Excessive-balance mortgage loans are mortgage loans which are greater than the utmost mortgage restrict in low-cost median priced areas. For instance, the utmost FHA mortgage restrict for Washington, DC for 2025 is $524,225.

Any FHA mortgage that’s greater than the low-cost median priced space mortgage restrict of $524,225 and as much as $1,209,750 known as FHA jumbo loans or high-balance FHA mortgage loans. Similar with standard loans. Any standard loans in high-cost areas greater than $806,500 as much as the ceiling of $1,209,750 is known as Jumbo standard loans or Jumbo conforming loans. Many refer it to high-balance conforming loans.

How Washington D.C. Was Based

Again in 1774, our nation’s first continental Congress or group of representatives from our colonies wanted a spot to fulfill. Our 13 states wished a capital that might characterize them equally which was not too far north or not too far south.

Many individuals dwell in surrounding states of Washington, DC. They dwell in Virginia, and Maryland however work in Washington DC.

So, in 1970 George Washington selected a spot proper between the states of Maryland and Virginia. America’s founding fathers have been aware of the truth that folks dwelling on this space might unfairly affect Congress and to at the present time, the District of Columbia residents wouldn’t have voting illustration in Congress.

Greatest Washington DC Non-QM Lenders For Unhealthy Credit score

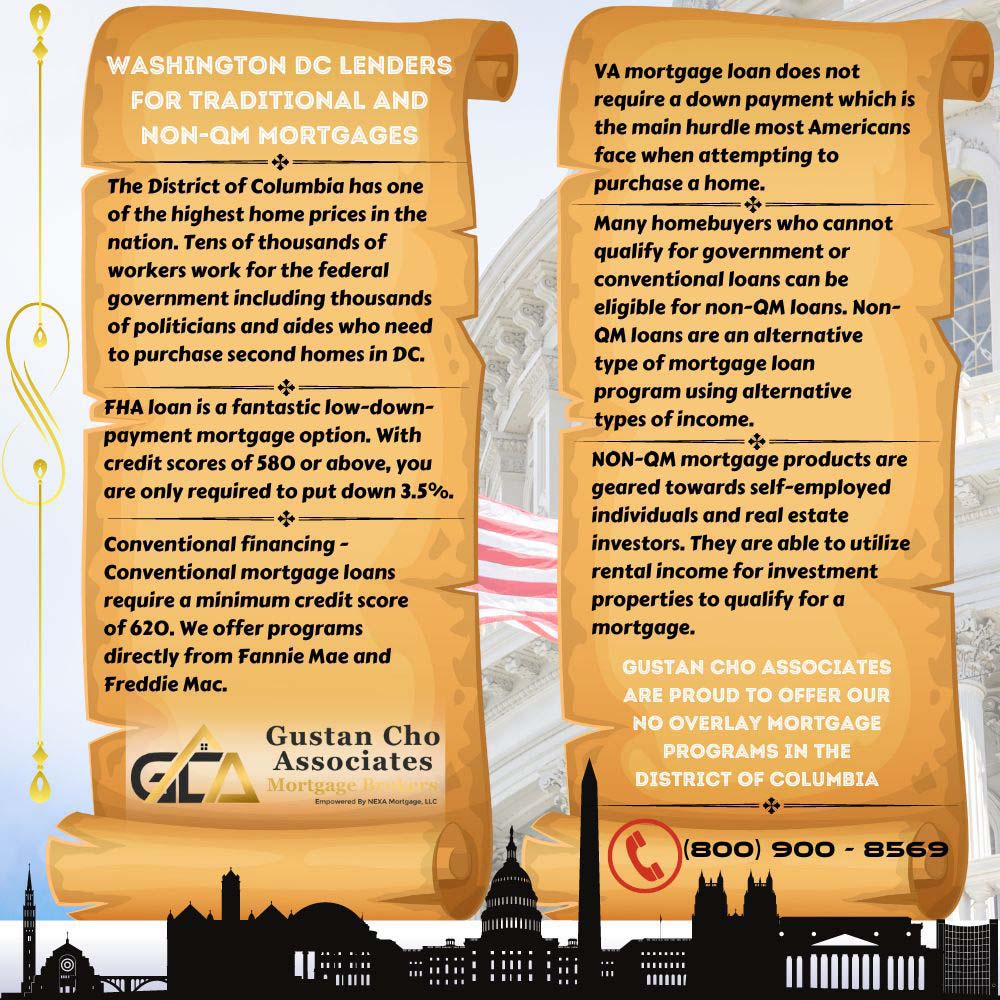

The District of Columbia has one of many highest house costs within the nation. Tens of 1000’s of employees work for the federal authorities together with 1000’s of politicians and aides who must buy second houses in DC. Many homebuyers who can not qualify for presidency or standard loans could be eligible for non-QM loans.

For apparent causes, residents of D.C. can vote in federal elections. Through the conflict of 1812 towards Nice Britain, the town was practically destroyed. There’s a ton of historical past on this space and after Abraham Lincoln gave his well-known Emancipation Proclamation in 1863, the inhabitants of the D.C. space grew. Many freed slaves got here to dwell within the space.

Washington DC lenders providing non-QM and different lending mortgage choices supply dozens of various kind of non-QM mortgages in Washington, DC. In style non-QM mortgage packages for Washington, DC homebuyers embody the 12-month financial institution assertion mortgage loans, No-Doc Mortgages, DSCR Mortgage Loans, Asset-Depletion Mortgages, ITIN Mortgage Loans, Expatriate Mortgage Loans, Overseas Nationwide Mortgages, Revenue and Loss Assertion Solely Mortgages, and lots of of different non-QM mortgage mortgage choices.

Measurement of Washington DC

Washington D.C. could also be small in space, solely about 68 sq. miles, however this space has a number of the most historic buildings within the nation. The USA Capitol constructing, the White Home, Supreme Court docket constructing are just some of those buildings.

Landmarks in Washington DC

There are additionally quite a few monuments and landmarks together with the Washington Monument, Lincoln Memorial, and The D.C. conflict memorial. Many college students have a big college journey to go to these historic websites.

We’re extraordinarily excited to announce we at the moment are licensed within the territory of the District of Columbia. As many Individuals know, the District of Columbia is the capital of our nation.

When visiting D.C., chances are you’ll be taught many enjoyable information together with the identify Washington D.C. is called after George Washington and Christopher Columbus. D.C. stands for District of Columbia. We’re one of many prime Washington DC lenders with no overlays on authorities and conforming loans.

Washington DC Dwelling of the President of america

The White Home was formally referred to as the president’s palace and Andrew Jackson was the primary president to dwell there. In 1901, Theodore Roosevelt formally modified the identify to the White Home. There have been many pets who’ve lived within the White Home, however an alligator would be the craziest one.

Washington DC has one of many highest house costs within the nation. Gustan Cho Associates can get you certified and authorized for high-balance FHA and conforming loans in Washington DC.

President Theodore Roosevelt let his children deliver many unusual pets into the White Home together with a small bear, a lizard, a guinea pig, a badger, and even a one-legged rooster. In case you have not visited the D.C. space earlier than, it’s a nice time to find out about our nation’s historical past and have some nice meals throughout your journey.

The Greatest Washington DC Mortgage Lenders with Lax Lending Pointers

Gustan Cho Associates are proud to supply our no overlay mortgage packages within the District of Columbia. Many lenders add extra qualifying necessities to their mortgage packages above and past the company pointers. That is referred to as a lender overlay.

Fortunately, our staff doesn’t have lender overlays to get in our means. That is why the Gustan Cho Associates are in a position to assist extra households than most lenders throughout the nation.

Over 80% of our debtors are people who couldn’t qualify at different mortgage corporations both as a result of lender having overlays or as a result of the mortgage firm didn’t have the mortgage possibility finest suited to the mortgage borrower. Our extremely expert staff gives standard, FHA, and VA mortgage loans within the District of Columbia.

Washington DC Lenders With No Lender Overlays

Typical financing – Typical mortgage loans require a minimal credit score rating of 620. These packages are sometimes capped with a most debt to earnings of 49.99%, ideally decrease. We provide packages instantly from Fannie Mae and Freddie Mac.

Advantages to a traditional mortgage embody cancelable private mortgage insurance when placing lower than 20% down and are used for purchasing second homes and investment properties.

Every company has its personal set of pointers that may be strict in comparison with FHA or VA financing. Many actual property brokers favor purchasers using standard financing as their appraisal necessities are barely lax in comparison with government-backed financing.

HUD-Permitted Washington DC Lenders For Unhealthy Credit score

FHA mortgage financing – In case you are on the lookout for Washington DC lenders who’re specialists on FHA loans, Gustan Cho Associates would be the lender for you.

The Federal Housing Finance Authority overseen by the U.S. Division of Housing and City Growth gives aggressive mortgage financing on main residences.

FHA financing is a superb mortgage program that lots of our purchasers benefit from. An FHA mortgage is a implausible low-down-payment mortgage possibility. With credit score scores of 580 or above, you’re solely required to place down 3.5%.

Washington DC Lenders For Debtors with 500 Credit score Scores

FHA financing can also be accessible for decrease credit score scores people. On FHA loans, you possibly can go all the best way down to a 500 credit score with a ten% down fee. As soon as once more, any credit score rating above 580 will solely require a 3.5% down fee. FHA financing additionally has favorable fee necessities for people with scholar mortgage debt.

We don’t suggest debtors stretch their funds additional than a snug month-to-month fee, however FHA does enable a better debt-to-income requirement in comparison with standard financing.

Not too many Washington DC Lenders can do FHA loans with credit score scores right down to 500 FICO. One of many prime Washington DC Lenders for low credit score and decrease credit score scores is Gustan Cho Associates. A bigger share of our debtors are people with credit score scores right down to 500 FICO and wish manual underwriting.

The Greatest Washington DC Lenders For Debtors With Decrease Credit score Scores

An FHA mortgage can also be an awesome monetary device that may will let you construct wealth even you probably have had a chapter up to now. The ready interval after a chapter 7 chapter is just two years, half the time in comparison with standard financing. And you probably have a chapter 13 chapter, you possibly can truly buy or refinance a property whereas nonetheless within the lively chapter 13 chapter.

Washington DC Lenders With Low Charges

Typical mortgage charges require a full two-year ready interval after you’re discharged from a chapter 13 mortgage. Since many chapter 13 compensation plans are 5 years in size, it could possibly be as much as seven full years earlier than you qualify for a traditional mortgage mortgage.

Non-QM loans are an alternate kind of mortgage mortgage program utilizing different kinds of earnings. Non-QM mortgage loans will not be arduous cash loans. Arduous cash loans on owner-occupant and second houses is illegitimate.

In case you are already discharged out of your chapter 13 chapter, there isn’t any ready interval to use for an FHA mortgage. For extra data on FHA chapter lending, please name Gustan at (800) 900-8569 or e mail us instantly at gcho@gustancho.com.

Washington DC Lenders for Excessive-Steadiness VA Loans With No Overlays

VA mortgage loans – When you have been courageous sufficient to serve our nation, you might have the flexibility to make the most of top-of-the-line mortgage packages accessible, a VA mortgage mortgage. A VA mortgage mortgage doesn’t require a down fee which is the principle hurdle most Individuals face when trying to buy a house. The most effective Washington DC lenders for VA loans are mortgage lenders with no overlays on VA loans.

The staff at Gustan Cho Associates are specialists in serving to our veterans with credit score scores right down to 500 FICO and excessive debt-to-income ratio get authorized for a VA mortgage in Washington, DC.

With the loopy fee of inflation seen all through the worldwide financial system, saving cash is more durable now than it has been up to now. Veterans of our nation don’t want a down fee and are in a position to qualify for a mortgage program that additionally doesn’t have non-public mortgage insurance coverage. Saving you 1000’s of {dollars} over the lifetime of the mortgage.

Washington DC Lenders For VA Loans with Credit score Scores All the way down to 500 FICO

A VA mortgage doesn’t have a minimal qualifying credit score rating. We concentrate on decrease credit score rating VA mortgage lending and likewise supply guide underwriting. The VA does have a fee historical past requirement. The essential {qualifications} for a VA mortgage mortgage embody clear 12-month fee historical past and all objects that report back to your credit score.

The staff at Gustan Cho Associates has a nationwide popularity of having the ability to approve and shut mortgage loans different lenders can not.

A late fee or derogatory objects akin to a set up to now 12 months might hinder your VA {qualifications}. An underwriter would additionally confirm your means to make your housing fee. They will view the final 24 months of hire or mortgage funds through the underwriting course of.

Professional Washington DC Lenders For VA Loans Whereas in Chapter 13 Chapter

Our extremely expert VA staff is right here to help you. We’ll full a radical credit score evaluation with you to find out your {qualifications}. Even you probably have late funds reporting within the earlier 12 months, our staff will level you in the suitable path to qualify for a VA mortgage as rapidly as potential. Many veterans even have bankruptcies reported on their credit score experiences.

Tourism is without doubt one of the main industries within the space. The D.C. Amtrak station is the second busiest station within the nation solely second to New York Metropolis!

There’s a two-year ready interval after a chapter 7 chapter, similar to FHA financing. There may be additionally no ready interval throughout a chapter 13 chapter identical to FHA financing. So long as you’re at the least 12 funds into your chapter with none mist funds, please attain out to our staff in the present day.

Washington DC Lenders Who Are Consultants on Non-QM Jumbo Mortgage Loans

NON-QM mortgage merchandise – The District of Columbia space has many self-employed people. Self-employed debtors might face problem when qualifying for a mortgage on account of how they filed their federal tax returns.

Most self-employed people benefit from write-offs to restrict their federal earnings tax legal responsibility. For the reason that company pointers require mortgage corporations to confirm a borrower’s means to repay, there are very black-and-white pointers surrounding self-employed earnings. These pointers are put in place to keep away from a market crash as we noticed in 2008.

Washington DC Lenders For Self-Employed Debtors

Many NON-QM mortgage merchandise are geared in the direction of self-employed people and actual property traders. They’re able to make the most of rental earnings for funding properties to qualify for a mortgage. They’re additionally in a position to make the most of your self-employed earnings proven in your financial institution statements versus your tax returns.

We additionally supply a full slate of NON-QM mortgage packages. Under are some fundamental {qualifications} for the packages we provide.

The business-related deposits into your financial institution statements are used to calculate your qualifying earnings. Actually, tax returns will not be required to qualify for these mortgage loans. The down fee necessities fluctuate primarily based on credit score rating and we suggest you attain out to Gustan at (800) 900-8569 to debate your NON-QM choices within the D.C. space. Our staff has entry to quite a few NON-QM shops, giving us a aggressive edge.

Washington DC Lenders For Conventional and Non-QM Mortgages

Uncover the most effective Washington, DC lenders for conventional and Non-QM mortgages. Find out about mortgage choices, pointers, and the way Gustan Cho Associates can assist you qualify.

Why Debtors in Washington DC Want Versatile Mortgage Choices

Shopping for or refinancing a house in Washington, DC, can really feel overwhelming, particularly given the town’s aggressive actual property market and excessive property values. Conventional mortgage packages akin to Typical, FHA, VA, and USDA loans serve many debtors.

At Gustan Cho Associates, we concentrate on serving to debtors throughout Washington, DC, qualify for each conventional mortgage packages and different non—QM mortgage choices with out lender overlays.

Not everybody matches neatly into these pointers. That’s the place non-QM (non-qualified mortgage) loans are available. Whether or not you’re a first-time homebuyer, a self-employed skilled, or somebody with credit score challenges, we offer mortgage options tailor-made to your state of affairs.

What Are Conventional Mortgage Loans?

Conventional loans are commonplace mortgage packages backed by authorities companies or standard traders akin to Fannie Mae and Freddie Mac. They embody:

Typical Mortgages in Washington DC

- Backed by Fannie Mae and Freddie Mac

- The minimal credit score rating is often 620

- Aggressive charges with sturdy credit score and earnings

- Out there for main, second houses, and funding properties

FHA Loans in Washington DC

- Low down fee of three.5%

- Versatile credit score rating necessities (as little as 500 with 10% down)

- Splendid for first-time homebuyers or debtors with credit score challenges

VA Loans in Washington DC

- For eligible veterans and active-duty service members

- 100% financing with no down fee

- No mortgage insurance coverage required

USDA Loans in Washington DC

- Designed for rural and suburban areas exterior the principle metropolis

- Zero down fee accessible

- Revenue limits apply

What Are Non-QM Mortgages?

Non-QM (Non-Certified Mortgages) are loans that don’t observe commonplace company pointers however are nonetheless secure, totally documented, and designed to assist debtors with distinctive conditions.

In style Varieties of Non-QM Loans in Washington DC

- Financial institution Assertion Loans – Good for self-employed debtors who need to qualify utilizing private or enterprise financial institution deposits as an alternative of tax returns.

- DSCR Loans (Debt Service Protection Ratio) – That is for actual property traders who qualify primarily based on rental earnings moderately than private earnings.

- No-Doc/Alt-Doc Loans – Restricted documentation packages for entrepreneurs and freelancers.

- Asset-Depletion Loans – Qualify primarily based on liquid property as an alternative of earnings.

- ITIN Loans – For debtors and not using a Social Safety Quantity however with an Particular person Taxpayer Identification Quantity.

Why Work With Gustan Cho Associates in Washington DC?

No Overlays: Extra Approvals

Most lenders add strict pointers, also referred to as overlays, that make qualifying more durable. At Gustan Cho Associates, we observe company pointers solely for FHA, VA, USDA, and Typical loans.

Large Vary of Non-QM Applications

We provide one of many largest alternatives of Non-QM mortgage packages in Washington, DC, permitting debtors with complicated monetary conditions to safe financing.

Quick Closings and Nationwide Licensing

- Licensed in 48 states, together with Washington, DC.

- In-house staff skilled with conventional and Non-QM underwriting

- Identified for closing loans that different lenders can not

Key Advantages of Non-QM Loans in Washington DC

- Versatile earnings verification

- Credit score rating flexibility (generally right down to 500)

- Applications accessible for latest chapter, foreclosures, or late funds

- Choices for jumbo loans above standard limits

- Nice answer for high-cost housing markets like Washington, DC.

The way to Select the Greatest Washington DC Mortgage Lender

Examine Conventional vs. Non-QM Choices

Perceive whether or not you match into company pointers or want different financing.

Deal with Expertise

Select a lender with confirmed success in closing loans with distinctive borrower profiles.

Have a look at Velocity and Service

Fast pre-approvals and clean closings are important in a fast-moving market like Washington, DC.

FAQs About Washington DC Lenders for Conventional and Non-QM Mortgages

What Credit score Rating Do I Want For a Conventional Mortgage in Washington, DC?

Most standard lenders require at the least a 620 rating, whereas FHA loans might enable scores as little as 500 with a bigger down fee.

Can I Get Permitted if I’m Self-Employed With No W-2 Revenue?

Sure. Non-QM financial institution assertion loans will let you qualify utilizing financial institution deposits as an alternative of tax returns.

Are Non-QM Mortgages Riskier Than Conventional Loans?

Not essentially. They use different documentation. Funds, rates of interest, and phrases are designed to suit your monetary profile.

Can Traders Purchase Washington DC Rental Properties With a Non-QM mortgage?

Sure. DSCR loans are perfect for actual property traders since they qualify primarily based on property earnings.

Do Non-QM Loans Require Greater Down Funds?

Relying in your credit score and mortgage kind, some packages might require 10–20% down.

Are Non-QM Loans Solely For Folks With Unhealthy Credit score?

No. Many creditworthy debtors use Non-QM loans as a result of they don’t match company documentation guidelines.

Can I Refinance My Present Washington, DC Dwelling With a Non-QM Mortgage?

Sure. Each rate-and-term and cash-out refinance choices can be found.

How Quick Can I Shut a Non-QM Mortgage in DC?

Many packages shut inside 30 days, relying on documentation and appraisal.

Do Washington DC, Non-QM Lenders Report back to Credit score Bureaus?

Sure, most Non-QM lenders report your mortgage funds to credit score bureaus.

Why Ought to I Select Gustan Cho Associates Over a Native Financial institution?

We provide conventional and Non-QM loans with no overlays, sooner approvals, and extra versatile options than most banks.

Last Ideas

Suppose you’re looking for Washington, DC, lenders for conventional and Non-QM mortgages. In that case, Gustan Cho Associates is your one-stop mortgage dealer. With no overlays, versatile Non-QM packages, and expertise serving to debtors that different lenders flip away, we will discover the suitable mortgage in your distinctive wants.

👉 Name Gustan Cho Associates in the present day at 800-900-8569 or go to gustancho.com to begin your mortgage journey.

Get Pre-Permitted With Washington DC Lenders with Lax Necessities and Low Charges

Our staff is happy to develop and is right here to help you together with your mortgage wants. We’ll proceed to replace our readers as we broaden into extra states through the calendar yr of 2023. Even you probably have been turned down for a mortgage up to now, we suggest you attain out to our staff as chances are you’ll be operating right into a lender overlay.

Uncover the most effective Washington DC lenders for conventional and Non-QM mortgages. Find out about mortgage choices, pointers, and the way Gustan Cho Associates can assist you qualify.

We attempt on making our staff accessible to suit your schedule and can be found on nights and weekends. The applying course of is straightforward and accomplished on-line to streamline the method. Be at liberty to offer us a telephone name in the present day with any mortgage-related questions.