Guild Mortgage will likely be utilizing Loanlogics’ LoanBeam NQM to help in underwriting its non-qualified mortgage manufacturing by automating the earnings evaluation course of.

Processing Content material

“Non-QM mortgages create higher potential for lender error because of the unconventional monetary profiles of debtors who do not usually meet commonplace earnings, employment or credit score standards,” mentioned

It’s in any other case a labor intensive guide job, he continued. The product combines synthetic intelligence-powered doc processing with human verification and clever earnings calculation.

Guild originated $7.4 billion of mortgages

Development in non-QM throughout 2025

Business-wide nevertheless,

The nonconforming share of fee locks, which Optimum Blue contains non-QM in, made up 17% of the month’s exercise, up 210 foundation factors from 12 months prior.

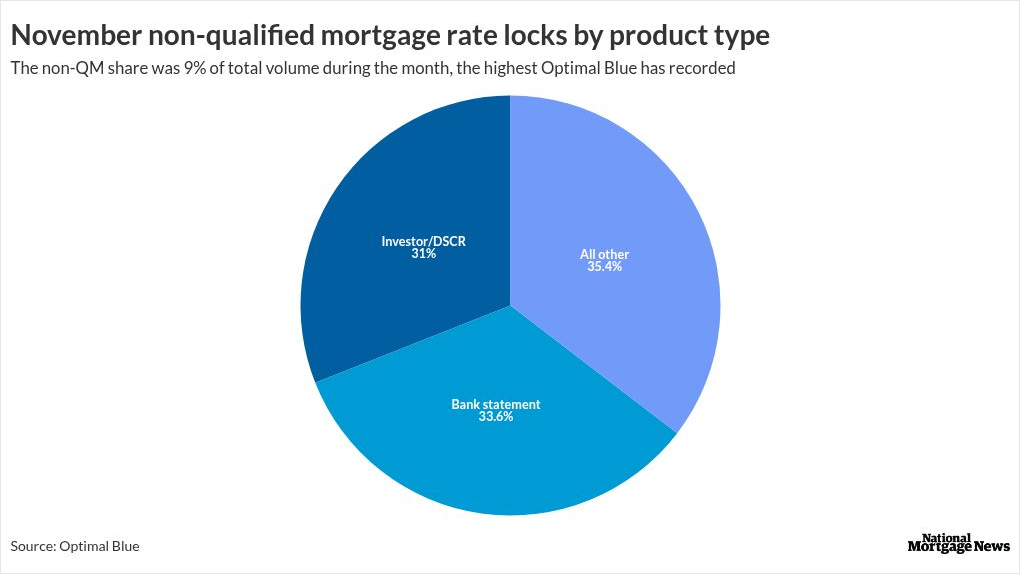

A lot of the expansion has been within the investor/debt service protection ratio class. These made up 31% of November’s non-QM fee locks, up 186 foundation factors over October, and 181 foundation factors from November 2024.

Financial institution assertion loans had been 33.6% of the overall, however this shrunk 120 foundation factors from the prior month and by 391 foundation factors versus the earlier November.

The broad all different non-QM class had a 35.4% share, simply 0.65% decrease than October, however up by 2.1% versus the prior 12 months.

Loanlogics rolled out LoanBeam NQM final October. Among the many preliminary customers was Pennymac.

This know-how will

Guide earnings evaluation can create bottlenecks which restrict non-QM mortgage quantity, decelerate underwriting and delay closings, Parker mentioned on the time.

“Guide processing can also be extra weak to information transcription errors, lacking documentation, inconsistent guideline functions and compliance points that may injury borrower relationships and investor confidence,” he defined.

LoanBeam NQM has 4 energetic customers together with Pennymac and Guild, with extra to be introduced quickly, a Loanlogics spokesperson mentioned.