credit score scores are essential, however you could be questioning how they’re calculated and what the massive deal is. This all-important quantity could be checked out for a mess of causes: whenever you get a job, lease an house, open a brand new account, or apply for a loan—including a house mortgage.

Understanding credit score scores, credit score utilization ratios, scoring calculations, fee historical past, size of credit score historical past, and credit score scoring fashions will arm you with the data you have to evaluation—and even enhance—your credit score rating. And it will turn out to be useful whenever you’re able to buy or refinance a house.

Credit score Overview:

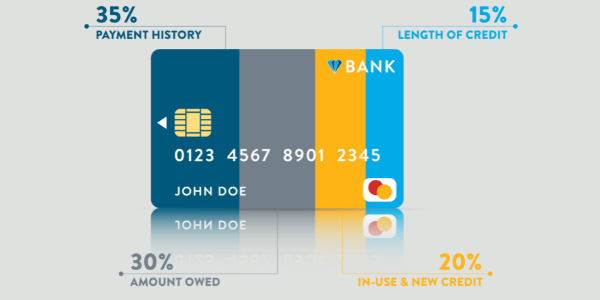

Credit score scores, mostly FICO scores (300 to 850), are calculated out of your credit score experiences by weighting fee historical past (35%), quantities owed/credit score utilization (30%), size of credit score historical past (15%), credit score combine (10%), and new credit score (10%).

Lenders use these scores to evaluate threat and set mortgage phrases, with rankings starting from Poor to Distinctive. You possibly can enhance your rating by making on-time funds, preserving utilization under 30%, prioritizing high-utilization balances, and correcting report errors—whereas avoiding frequent new accounts, shifting balances round, and shutting previous accounts. Even when your rating isn’t within the “good” vary, mortgage choices should be accessible, and APM gives sources and advisors that can assist you navigate financing.

How is My Credit score Rating Calculated?

The commonest credit score rating used known as your FICO rating, which stands for Fair Isaac Corporation, an information firm that tracks and measures credit score threat. The rating is calculated utilizing data out of your credit score experiences with every of the three fundamental reporting companies, then compiled and weighted to supply your rating, which in flip can have an effect on how a lot a lender will mortgage you and at what rate of interest.

Whereas the precise system is unknown, we do know that FICO scores are calculated by contemplating 5 distinct classes. The significance of every varies, as do the components inside every class.

Fee Historical past (Weight: 35%) Empty heading

Have you ever paid previous credit score accounts—including installment loans like auto loans, medical payments, and pupil loans—on time? What number of accounts have late or missed funds?

Quantities Owed (Weight: 30%) Empty heading

How a lot do you owe in your credit score accounts, and what number of accounts do you’ve? How a lot of your whole accessible credit—also often called your credit score utilization ratio—are you utilizing?

Size of Credit score Historical past (Weight: 15%) Empty heading

The longevity of your credit score historical past is essential. How lengthy have your credit score accounts been established? What’s the common age of those accounts, and the way lengthy has it been because you final used a few of these accounts?

Credit score Combine in Use (Weight: 10%) Empty heading

What sorts of credit score accounts do you’ve? What number of various kinds of credit score accounts are you utilizing?

New Credit score (Weight: 10%) Empty heading

What number of new accounts or current inquiries do you’ve in your credit score report? How lengthy has it been because you opened new credit score accounts or credit score limits?

Credit score Rating Ranges

Credit score scores vary from 300 to 850. These scores could be subjective, and all lenders are totally different, however basically, these credit score scores translate to:

- 800 or increased: Distinctive

- 740–799: Superb

- 670–739: Good

- 580–669: Truthful

- 579 or decrease: Poor

Even when your credit score rating is just not within the good or increased vary, there are nonetheless loads of mortgage packages which may be accessible to you.

Join with an APM Mortgage Advisor about what mortgage packages you qualify for, and what different choices may fit to your state of affairs. Naturally, you also needs to goal to enhance your credit score rating or, on the very least, make certain your conduct would not damage your credit score rating additional.

Enhance Your Credit score Rating

When you perceive the scoring calculations and credit score scoring fashions, there are issues you are able to do to enhance your credit score rating:

- Make on-time funds. Set reminders or have funds made routinely to make sure that you pay your payments on time.

- Create some steadiness in the way you scale back your debt. Whereas paying down installment loans (auto loans, mortgage loans, and so forth) will certainly enhance your credit score rating, paying your bank cards down or off may cause a fast leap in your credit score rating.

- Use the 30% credit score utilization threshold. Meaning it’s best to goal to maintain your operating bank card and revolving debt balances at or under 30% of every card’s accessible credit score restrict. For sooner outcomes, pay your payments with the best credit score utilization ratio first, somewhat than the playing cards with the best debt.

- Examine for errors and inaccuracies. Get a free copy of your credit report, evaluation it fastidiously, and phone the bureau in the event you discover any errors.

Do not Harm Your Credit score Rating

If you wish to enhance your credit score rating, it’s a must to first be sure you’re not participating in behaviors that damage it. These unfavourable impacts could possibly be an issue when it comes time to purchase a house. With that in thoughts, you wish to:

- Keep away from opening too many new accounts in a brief period of time. Let accounts have some growing old time; that approach, you may set up a constant fee historical past.

- Keep away from shifting debt round to a number of playing cards. Focus as a substitute on lowering the quantity by making on-time funds.

- Preserve your accounts open. Do NOT shut your credit score accounts. A sudden drop in your credit score spending energy doesn’t look good to the bureaus. Preserve your accounts energetic by utilizing them to pay your payments, together with your auto loans, installment loans, and different sorts of debt … with out accruing any frivolous new debt within the course of.

Further Assets

APM has you lined relating to understanding your credit score and navigating the house mortgage course of. Try the next for additional data:

Now you are able to hit the bottom operating as you enhance your credit score rating. Here is the factor, although: You do not have to attend till your credit score rating is phenomenal to buy a house.

APM’s trusted Loan Advisors can work with you now to discover a mortgage program that matches your wants, and we proceed working with you as your rating and state of affairs change.