By now you’ve doubtless heard of mortgage fee lock-in.

It’s the speculation that owners received’t transfer if they’ve mortgage charges nicely beneath prevailing market charges.

For instance, a house owner with a sub-3% mortgage fee is much less prone to promote, all else equal, if charges are presently 6%.

And guess what? That’s precisely the present dynamic.

Nevertheless, over time this naturally eases as a result of regardless of lock-in, individuals nonetheless want/wish to promote their properties for X, Y, and Z causes.

Lock-In Easing However Nonetheless a Main Issue within the Housing Market

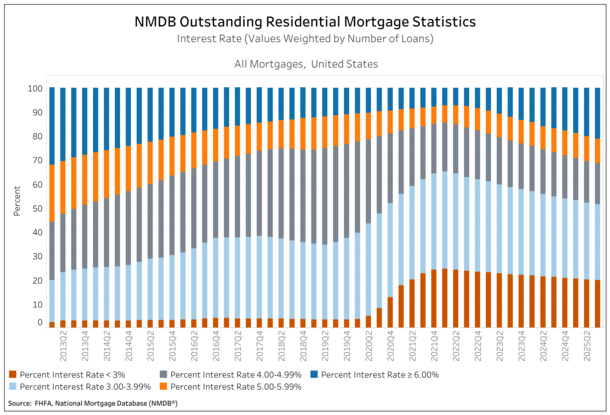

New knowledge from the third quarter of 2025 has revealed that the share of excellent mortgages with a fee above 6% exceeded these with a fee beneath 3% for the second straight quarter.

That is in accordance with the FHFA’s Nationwide Mortgage Database (NMDB). This hole has additionally widened fairly a bit since late 2022.

Solely 7.3% of debtors had a 6%+ mortgage fee within the second quarter of 2022 versus 21.2% as of the top of Q3 2025.

In the meantime, the share with a sub-3% mortgage has fallen from a peak of 24.6% within the first quarter of 2022 to twenty% as of Q3 2025.

So you’ll be able to see that progress is being made on this entrance, however that it stays fairly elevated.

Positive, we will have a good time the truth that the typical excellent mortgage fee is rising, thereby lowering the effect of mortgage rate lock-in.

However we will simply as simply say 20% of excellent mortgage loans are nonetheless priced at beneath 3%.

And likelihood is a whole lot of them don’t have any intention of transferring anytime quickly, both as a result of they will’t afford to or as a result of they don’t WANT to surrender their ultra-low fee mortgage.

Some critics of mortgage fee lock-in level to dwelling gross sales nonetheless totaling about 4 million yearly.

And certain, dwelling gross sales nonetheless occur and transactions nonetheless exist, however you surprise the place they’d be with out this mortgage fee disparity.

There’s a cause current properties gross sales have been hovering round a 30-year low these days…

Locked-In Owners = Much less For-Sale Stock, Greater Costs

It’s no secret housing affordability has been horrendous for years. Notably since mid-2022 when mortgage rates rapidly shot up from sub-3% ranges to 7%.

And one of many causes it’s been form of caught, with no main pullback in dwelling costs in response, has been on account of this lock-in.

In the end, if fewer current owners are prepared or in a position to transfer, they received’t record their properties.

This retains a lid on for-sale provide and the previous adage of provide and demand does its factor.

With fewer properties available on the market, costs can stay elevated and affordability poor, even when there are fewer dwelling consumers as nicely.

The consequence has been largely flat costs for a couple of years, which is usually excellent news as a result of it permits buying energy to catch up over time.

And now that mortgage charges have fallen to 3-year lows, affordability has certainly improved.

We’ve bought a mix of decrease charges and flat (and even down costs) over a interval of three years. That’s nice for the housing market!

As well as, with the hole between prevailing market charges and excellent mortgage charges shrinking as nicely, we should always see extra sellers come to market.

That may unlock extra of this stock that’s badly wanted in lots of markets nationwide and result in larger dwelling gross sales.

It may additionally result in decrease dwelling worth appreciation if there’s extra provide to select from, even when it’s cheaper.

I’m By no means Promoting This Home!

Whereas we’ve made some inroads on the lock-in impact these previous few years, it’s not going to vanish in a single day.

There are nonetheless numerous owners on the market who say, “I’m by no means promoting this home.”

They usually say that due to the low rate of interest. As famous, some 20% of excellent mortgage loans are nonetheless sub-3%.

To not point out one other 31.5% are within the 3.00% to three.99% vary, which collectively totals greater than half of the market.

There are additionally a whole lot of loans within the 4.00% to 4.99% cohort, so it’s not going to right itself as rapidly as some suppose.

Sure markets will unlock sooner than others too. I dug into the information some time again and located states like California had been unlocking extra slowly than different states.

So likelihood is for-sale stock will proceed to be constrained, even when extra sellers come to market this 12 months and past.

That’s most likely an excellent factor although as a result of it prevents a flood of stock and massive worth drops.

When it comes down it, gradual and regular enchancment in affordability is one of the simplest ways out of this mess. It’s simply going to take time!

Learn on: 2026 Mortgage Rate Predictions