A consortium of mortgage and banking commerce teams is voicing help for adjustments to a capital danger framework governing depository establishments, which if enacted may increase their participation in dwelling lending.

Processing Content material

In a letter addressed to federal officers, the teams referred to as for additional reexamination and a reproposal of the Basel III rule that units acceptable capital-risk ranges for banking actions. The letter comes days after remarks made by Federal Reserve Gov. Michelle Bowman this week which pushed for

Listed among the many addressees was Bowman, alongside the leaders of banking regulators Workplace of the Comptroller of the Foreign money and Federal Deposit Insurance coverage Corp.

“Enough capital reduces the probability of financial institution failures that threaten broader monetary stability, which might show pricey for households, monetary establishments and taxpayers. Nevertheless, extreme capital necessities which might be misaligned with empirically derived danger assessments can negatively have an effect on the price of and entry to credit score,” the letter mentioned.

It was signed by eight commerce teams, together with the Mortgage Bankers Affiliation and Housing Coverage Council. Additionally included among the many signatories had been U.S. Mortgage Insurers and teams representing the banking business.

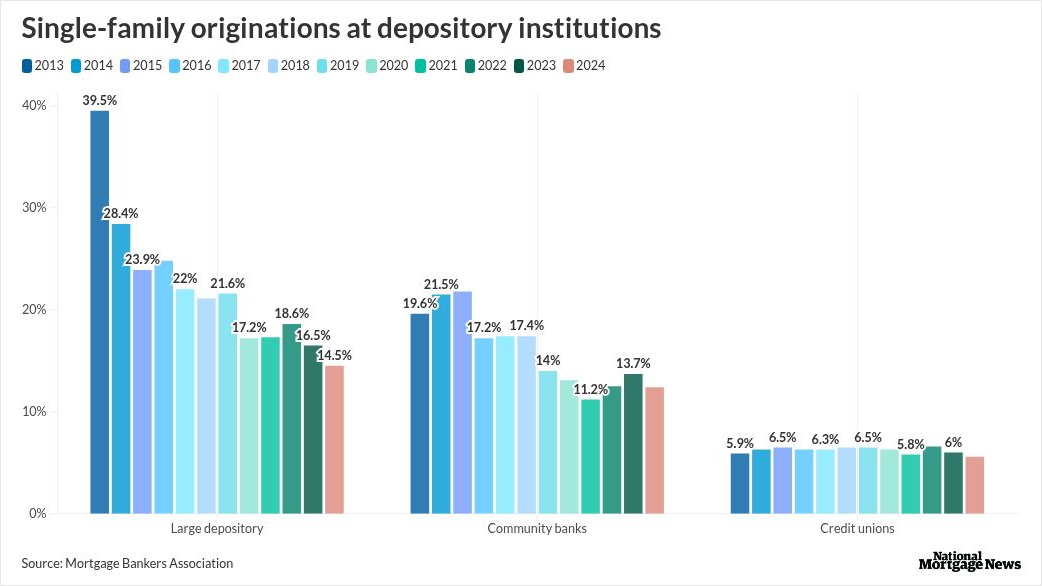

In keeping with MBA information, the share of mortgages originated by depository establishments shrank from 65% in 2013 instantly following the Nice Recession to 32.5% in 2024, with many citing regulatory overreach as a driver of financial institution exits lately. On the similar time, the nonbank lender share has expanded from 35% to 67.5% over the identical time interval.

All through the letter, the teams requested for extra granular consideration of assorted standards that may encourage banking exercise in the end benefiting all kinds of lenders at minimal danger, they claimed. Their ideas coated coverage subjects starting from danger weighting of

- Threat weights must “precisely replicate real-world credit score efficiency.” The letter requested for adoption of granular danger ranges by loan-to-value ratio that takes under consideration personal mortgage insurance coverage commensurate with its safety of the mortgage. “All banking organizations ought to be capable of elect the extra granular credit score danger framework,” it mentioned.

- Capital danger weight assigned to mortgage servicing rights needs to be slashed from a “punitive” 250% to 100% for all banks. The teams additionally beneficial recalibration of limits or deductions tied to MSR-related property when contemplating what counts as core capital in figuring out danger ranges. Alternatively, the present widespread fairness tier cap might be considerably raised, they proposed.

- The group beneficial decreasing depository warehouse lending danger weights from its present ranges of 100% to 50%, liberating up liquidity out there to impartial mortgage bankers. It mentioned warehouse lending enterprise strains introduced “extraordinarily low-risk credit score publicity” for banks.

The letter additionally referred to as for extra granular remedy of mortgage credit score danger publicity, recognizing the worth of personal mortgage insurance coverage, and coordination throughout federal banking regulators.