Fannie Mae’s financial division has launched its first origination forecast for 2 years from now and it tasks a rebound to ranges that have not been seen because the 2021 by then, however at a gradual tempo.

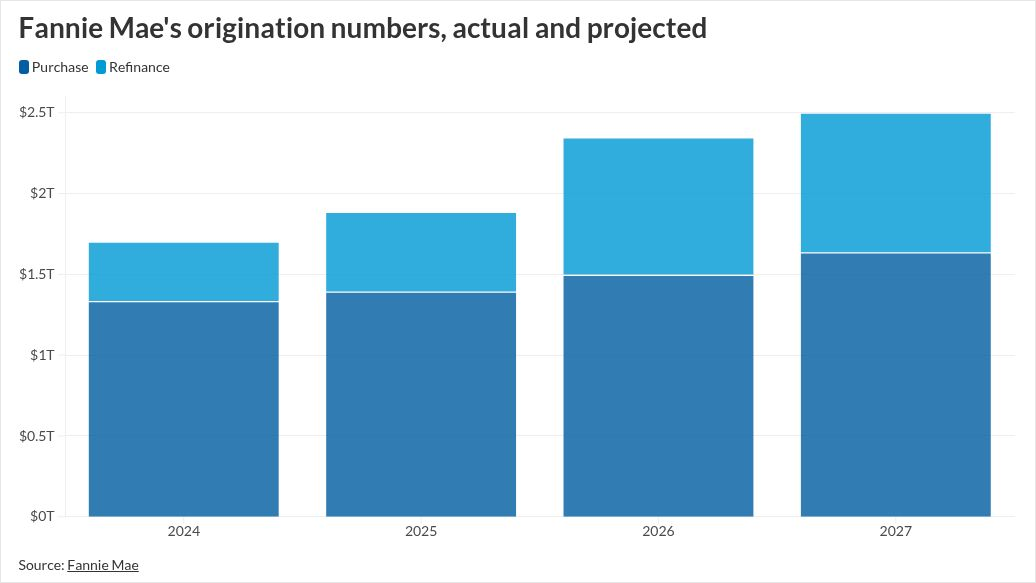

Following projected will increase of just about 11% this 12 months and almost 25% subsequent 12 months, originations might rise one other 6.5% by 2027 and cease simply shy of $2.5 trillion, a quantity final seen in 2021.

Whereas charges and different market situations will be unstable, making it doubtless the forecast might change over time, for now the government-sponsored enterprise’s 2027 projection suggests lenders could wish to put together to financial institution any 2026 good points forward of what may very well be a slower 2027.

Longer-term forecast stays targeted on buy

The brand new 2027 forecast tasks the majority or $1.63 trillion in originations will come from homebuyers with

Charges might decline by a steeper 60 foundation factors within the coming 12 months, however with many excellent loans from the pandemic a good distance from being uncovered to refinancing incentive, Fannie’s forecast additionally anticipates purchases loans will make up $1.49 billion of subsequent 12 months’s $2.3 trillion.

The administration additionally has been

Fannie has forecast that dwelling gross sales not too long ago pegged at round 4.7 million for 2025 might high 5 million by subsequent 12 months and develop extra incrementally to five.3 million in 2027.

Different current experiences have been extra pessimistic concerning the housing market’s energy, with Fitch reporting that it

Price politics additionally will play a task in what occurs in 2027

A lot might depend upon the diploma to which the Trump administration has affect over charges, that are ruled by unbiased policymakers however which it has strongly advocated reducing.

Some officers like

Mortgage Bankers Affiliation Chief Economist Mike Fratantoni mentioned not too long ago that

The administration is anticipated to have the ability to exert extra affect over the FOMC as time passes, which might change the forecast notably by then. The president nominates members of the rate-setting Federal Open Market Committee and the Senate confirms them.

Nonetheless, the Trump administration could also be considerably hesitant to exert an excessive amount of affect over the unbiased Fed board because the market has had a adverse response to it previously.