The objective for synthetic intelligence in mortgage is not whole automation, however misunderstandings surrounding the aim of the know-how can lead some to consider it’s, leading to a sure degree of apprehension and distrust as we speak.

If something, the know-how business’s efforts to market AI, notably its means to automate, is perhaps too profitable, unintentionally creating apprehensions and misconceptions in extremely regulated segments like mortgage over what agentic instruments are literally doing, business leaders recommend.

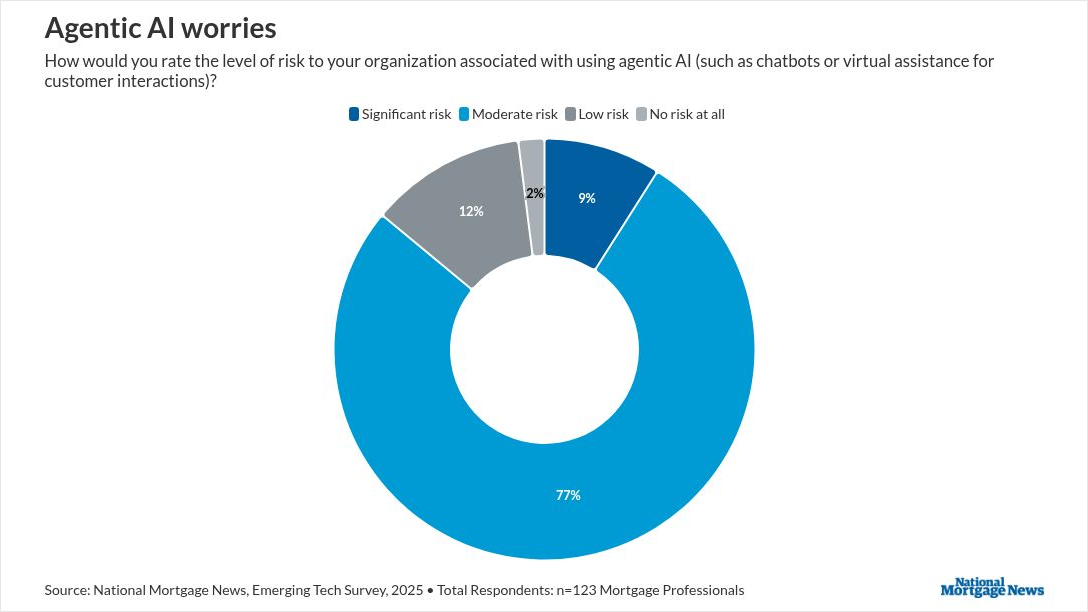

The

A part of the issue could also be that AI is making the work look too simple, in line with Diane Yu, CEO of point-of-sale software program platform Tidalwave.

“Quite a lot of know-how corporations try to promote it that approach: ‘I’ll automate all the pieces,'” she defined.

Whereas the

“Lots of people do not perceive that, although,” Yu added, referring to the patron inhabitants. as a result of what AI automation can accomplish is ” story.”

Extra than simply ChatGPT

Many individuals as we speak equate synthetic intelligence output to ChatGPT manufacturing, however agentic AI expands that definition, ranging in type from automated voice service know-how to instruments that function within the background studying, extracting and analyzing information and paperwork.

The accelerated enchancment of synthetic intelligence over the previous yr signifies that, regardless of business hesitance, many mortgage professionals need to discover the potential profit it is going to carry, no matter their establishment sort. Giant

“They’re asking, ‘The place is it protected to make use of? The place will regulators be comfy with us utilizing it? And what can we automate with out making a threat for, say, a repurchase?'” Geertsema mentioned.

“Quite a lot of what we have been speaking about was giant language fashions for the final couple years. The distinction now could be that with agentic AI, it goes past simply being conversational and now the brokers are literally executing multistep duties,” he added.

Guaranteeing people are within the loop

Whereas its aptitude at engaging in duties and evaluation in a fraction of the time it would take a dwell worker to do them, agentic AI will not be capable to present optimum outcomes by itself, consultants warned, emphasizing long-standing business sentiment that people will stay important to its enlargement.

They raised warning in regards to the perils of handing an excessive amount of duty to agentic AI packages and its

In an evaluation of the efficiency of end-to-end agentic AI workflows performed by attorneys at Debevoise & Plimpton, they decided the know-how was efficient when automating points of a fancy mission however struggled to keep up that degree persistently throughout a mission.

“Many of those AAW initiatives fail as a result of, as numerous duties are stitched collectively with none human evaluate in between them, the danger of errors compound, and any time saved within the course of is misplaced by needing human intervention to repair the tip product,” the attorneys wrote within the legislation agency’s information weblog.

The advantages agentic AI provides is just pretty much as good as the info it has out there to research, which means necessary variables could also be overlooked when it considers all potential outcomes.

“The principles that we arrange for agentic AI programs normally can not seize the nuanced social and cultural contexts that skilled workers depend on when deciding that not following a coverage is definitely the precise plan of action as a result of the coverage was drafted with out this explicit state of affairs in thoughts,” the weblog acknowledged.

Within the case of mortgage, any incomplete or outdated supply information might end in a buyer being deemed ineligible for sure loans just because incorrect tips have been utilized. Whereas the AI could technically nonetheless be working inside the guidelines, the usage of defective information in such circumstances brings the identical sort of final result a denial would — misplaced enterprise.

The findings add credence to know-how consultants’ emphasis to maintain people within the course of, not simply to evaluate distinctive findings, but additionally override AI when needed.

“You desire a human within the loop on a number of these selections which can be occurring,” Geertsema mentioned. Reaching the precise steadiness means discovering the precise system “to make issues extra environment friendly and extra correct, however nonetheless maintaining that human contact and reasoning in there.”

Agentic AI’s scrutinization of supply information and the velocity at which it may well to spell out its findings after accomplished duties are serving to to offer lenders some peace of thoughts, Yu mentioned. Understanding how autonomous determinations have been made, together with any flaws AI could have uncovered, and seeing strategies for future motion objects goes a great distance in serving to them get to the lightbulb second.

“Mortgage officers, processors, underwriters — they do not should chase down all these information factors.They do not should run calculations. They’ll see them within the evaluate,” Yu mentioned.

Because of this, “they will make an extended choice a lot quicker, and I feel that is the important thing right here. They’re making the mortgage choice,” she mentioned.

tech-marketing-might-inadvertently-cause-ai-hesitancy”>Supply hyperlink