Borrower fairness within the U.S. noticed a third-quarter pullback, whereas a corresponding enhance in underwater mortgages is elevating issues in regards to the monetary well being and debt ranges of some householders, in accordance with Cotality.

Processing Content material

Residence fairness ranges declined by $373.8 billion 12 months over 12 months within the third quarter, representing a drop of two.1% to roughly $17.1 trillion, the actual property information supplier stated in its newest report. By comparability, house fairness stood at $17.5 trillion on the

Home-owner fairness hit its highest level ever in 2024’s second quarter at $17.7 trillion, Cotality stated.

Whereas the most recent numbers present many U.S. householders are sitting on comfy ranges of accessible fairness, 2025 developments level to weak pockets that should not be ignored, in accordance with Cotality Chief Economist Selma Hepp.

“Because the tempo of house worth development slows and markets recalibrate from pandemic peaks, we’re seeing a transparent shift in fairness developments,” Hepp stated in a press launch.

After seeing a $25,000 enhance in fairness in 2023, accrual slowed to $4,900 final 12 months. This 12 months, positive factors have stalled with U.S. householders dropping a median of $13,400, the corporate’s information confirmed. The common mortgage borrower nonetheless has roughly $299,000 in collected fairness.

The current falloff is an indication of each house worth corrections in some markets alongside rising

A corresponding rise in underwater householders

As house values have declined, the share of debtors falling into adverse fairness, or going underwater, has additionally risen. Owners are outlined as underwater when the excellent mortgage steadiness on their property exceeds its worth.

“Adverse fairness is on the rise, pushed partly by affordability challenges which have led many first-time and lower-income consumers to overleverage

Roughly 1.2 million householders, equal to 2.2% total, sat in adverse fairness on the shut of the latest quarter. The quantity elevated by 216,000 from 12 months in the past. As

Market by market comparisons

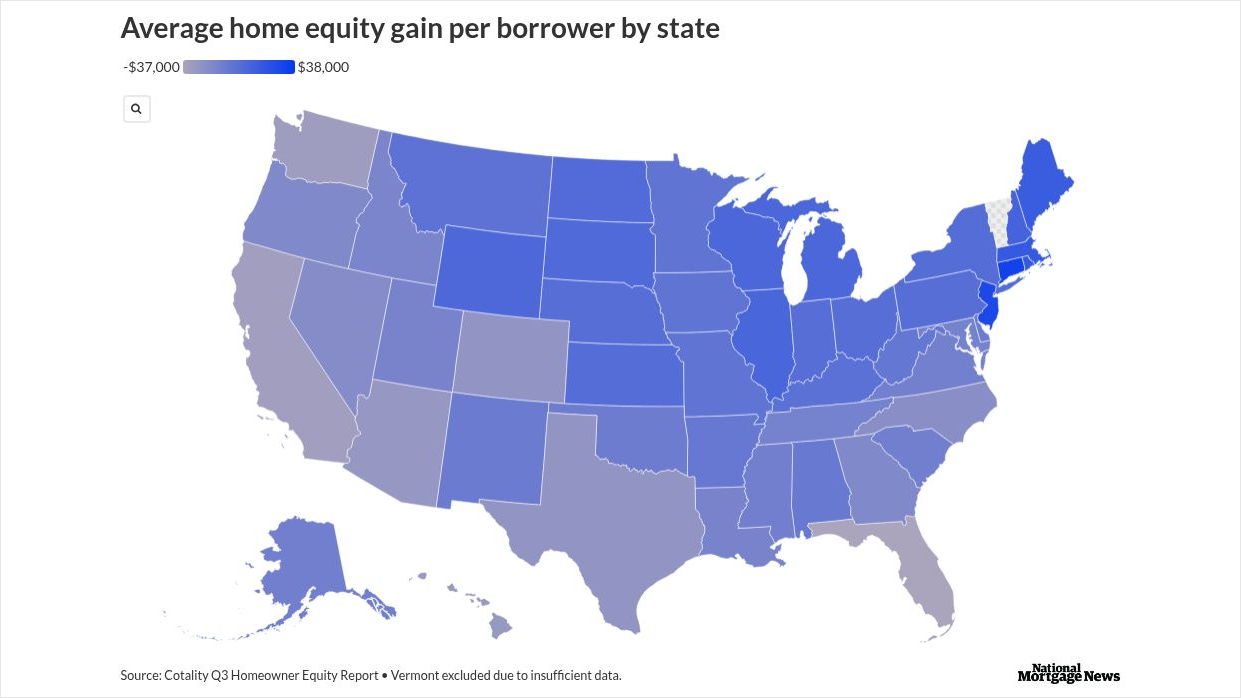

Thirty-two states recorded yearly declines in house fairness, however broad variations within the tempo of each constructive and adverse development may very well be seen in Cotality’s information.

The three jurisdictions experiencing the biggest fairness losses have been Florida, with an approximate common of $37,400. The Sunshine State was adopted by the District of Columbia at $35,500, and California with a $32,500 common loss.

On the constructive finish, the Northeast noticed the most important positive factors, led by Connecticut, the place householders noticed common fairness enhance by $31,500 12 months over 12 months. New Jersey and Rhode Island adopted with will increase of $27,500 and $16,200.